BitQuick: why closed? 4 alternatives for bitquick.co (07.2024)

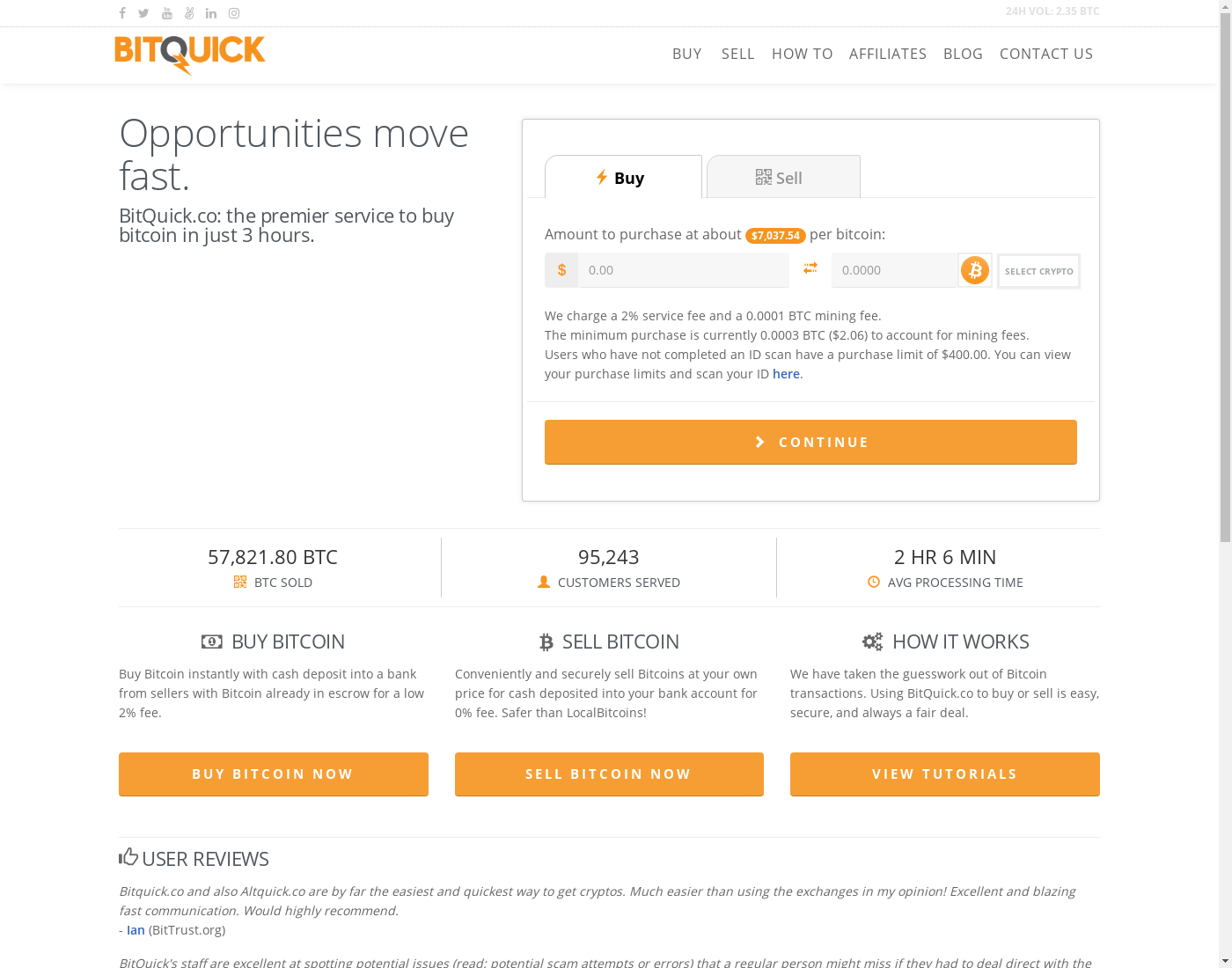

What was BitQuick (now defunct) in a nutshell? It was a trusted, well established, promising exchange service (p2p marketplace) working with 1 cryptocurrency: you could buy and sell coins using 1 fiat currency (1 banks & payment systems were supported). Exchange service started the business Oct 2013, it served the customers for a few years.

This P2P Marketplace served the clients from 255 countries (including your country: United States!). It was open for the US customers and allowed registrations from all the 56 states and territories. In the year 2022 BitQuick was closed. The reason why the p2p marketplace had to close the doors was the lack of profit.

Research: the best alternative to BitQuick

Since there is no way you can use the services of bitquick in 2024, we took the liberty to research the market and suggest a viable, well-known, 100% trusted alternative exchange platform. How we did it? Let's explain! Makes sense to start from figuring out what exactly we are looking for:

BitQuick was the P2P Marketplace; Athena Bitcoin, Inc (dba BitQuick) started the business in October 2013. The entity was operating for 10 years and 9 months and gained some popularity on the market. The company was based in the United States with the headquarters located in Chicago.

BitQuick was founded by Jad Mubaslat.

Athena Bitcoin, Inc. has several offices in the US: Chicago, Saint Louis, Dallas, Miami and branches in Latin America: Bogotá (Colombia), Buenos Aires (Argentina). Besides the exchange platform, the company also operates a network of Bitcoin ATMs.

Quote about BitQuick from the reviewer: «BitQuick was one of the first exchanges in the USA and worldwide. Although it suffered a hack in March, 2016, the customers' funds were never lost.» Our visitors had left 5 testimonials about their experience at bitquick.co, 80% of the testimonials were positive, 20% were neutral and there were 0 negative ones. The rating the bitquick.co earned at our platform was "4.5 stars" | 84 of 100. Website only assisted the users to exchange various electronic currencies, no extra services were provided.

Considering all the abovementioned, we were looking for another p2p marketplace allowing registrations from United States with a flawless reputation and the best rating and found a perfect match: Bitpapa! Let's explain what makes it the best choice for you:

BITPAPA is also a P2P Marketplace; Bitpapa IC FZC LLC. (dba Bitpapa) had started doing the business in May 2020. The legal entity is established in the United Arab Emirates and the principal office is located in the Ajman media City Free Economic Zone. Registration address of Bitpapa is A-0059-652 - Flamingo Villas. It is a maybe not the most recognized, but well established, exchange platform (p2p marketplace) that supports 5 cryptocurrencies and tokens: you can buy and sell crypto using 21 national currencies (89 payment systems and banks are supported) or exchange one digital currency into another here. Besides the crypto-exchange, bitpapa.com also provides other crypto-related services, for example, Mobile wallet. This is what we value the most about this great exchange service:

- Although the entity holds no special licenses, etc. it fully complies with the local regulation

- The exchange runs the business for a long time; project was started 4 years and 2 months ago

- The platform supports 5 cryptocurrencies and 21 fiat ones (totally 89 payment systems / banks are available). Apart from buying, selling and exchanging cryptocurrencies, there are other services available: Mobile wallet

- Bitpapa accepts the registrations from 255 countries; customers from United States can use the services

More alternatives to BitQuick

Of course, we can suggest some more alternative exchange services you can use instead of the "dead" bitquick.co. We picked a few similar exchanges that provides more or less the same service: other ones of p2p marketplace type mostly. Besides, we found platforms having similar rating that are popular in United States particularly and North America in general. If the only question that you want to ask is "what exchange has the best rates to buy and sell BTC and 50 cryptocurrencies?", our price comparison platform always finds the most beneficial exchange rates in United States!

BitQuick vs CEX

Let's compare the most important features and key facts about the CEX with what BitQuick (RIP) offered us in the past to make a conclusion if CEX will be the optimal choice for you:

- CEX is a trading platform BitQuick was a p2p marketplace, it's also an exchange, but has slightly different business model (feel free to read details about the difference between trading platform and p2p marketplace)

- CEX had launched the service July 2014 BitQuick started the project October 2013 (BitQuick operated 9 months longer).

- CEX has all the business licenses and permissions, required by law BitQuick was an ordinary limited company without any licenses, etc. (CEX's business model makes it a better, safer choice for the customers).

- Other than providing the services of buying, selling and exchanging cryptocurrency, CEX provides some other exchange-related / financial services: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and the Staking, MasterNodes, etc. (passive income opportunity) BitQuick provided less financial or other services, related to the cryptocurrency exchange: it allowed us to purchase and sell digital currencies.

- CEX supports 32 cryptocurrencies BitQuick allowed to exchange only one crypto (BitQuick supports 31 fewer cryptocurrencies).

- 3 fiat currencies are available for buy- sell- operations at CEX You could use 1 fiat currency converting it to digital form on BitQuick (BitQuick supported 2 fiat currencies less).

- CEX accepts the deposits from and allows fund to be withdrawn to 8 banks and (fiat) payment systems BitQuick allowed the customer to use 1 various fiat payment systems and/or banks (BitQuick supported 7 banks and/or payment systems less).

- The fees CEX charges: 0.3% — 3.99% BitQuick charged the user 2.0% commission, depending on the exchange direction, payment system, etc. (BitQuick had higher fees, in general).

- The purchase limits at CEX are starting from $20.00 up to $10,000 Deposit and withdrawal limits at the BitQuick were $1.00 — $555,556 depending on the specific payment method, etc. (BitQuick had a higher limits for buying and selling orders).

- CEX allows users' registrations from 224 countries; and we are glad to say that the people from United States are welcome You could register at the BitQuick if you were a resident of one of 255 countries; it served United States among all others (BitQuick supported more countries and territories).

- When the client needs to pass through the KYC process at CEX, they usually ask to provide 3 documents and / or specific procedures: ID or Passport Verification, Phone Number Confirmation (SMS or a call), Selfie with ID in hands. In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at BitQuick normally consisted of 1 procedure: Phone Number Confirmation. (BitQuick, may it rest in peace, was more liberal with the verification, etc; CEX requires user identification for all the orders).

- As per our analysis of the community feedback, CEX currently process orders to deposit and withdraw funds in just few minutes (although the exchange itself is instant) The former users of BitQuick reported that the process of a deposit or withdrawal took about a few seconds or instantly, with zero delay (BitQuick processes requests to deposit and withdraw funds faster

- Our visitors shared 27 reviews about CEX, 100% of those are positive While BitQuick was operating, we could get 5 clients testimonials, 80% were positive (BitQuick was rated lower by their ex-clients).

We can't make a decision — is CEX a worthy alternative to BitQuick — instead of you, but we'll try to assist with the matter. Considering the fact that BitQuick had a lower rating score: 84 vs CEX rated 100, it makes sense to state that CEX should be a great replacement for now defunct p2p marketplace; definitely worth trying!

Like reading? In fact, there are more exchanges worth comparing to BitQuick, for example, those ones:

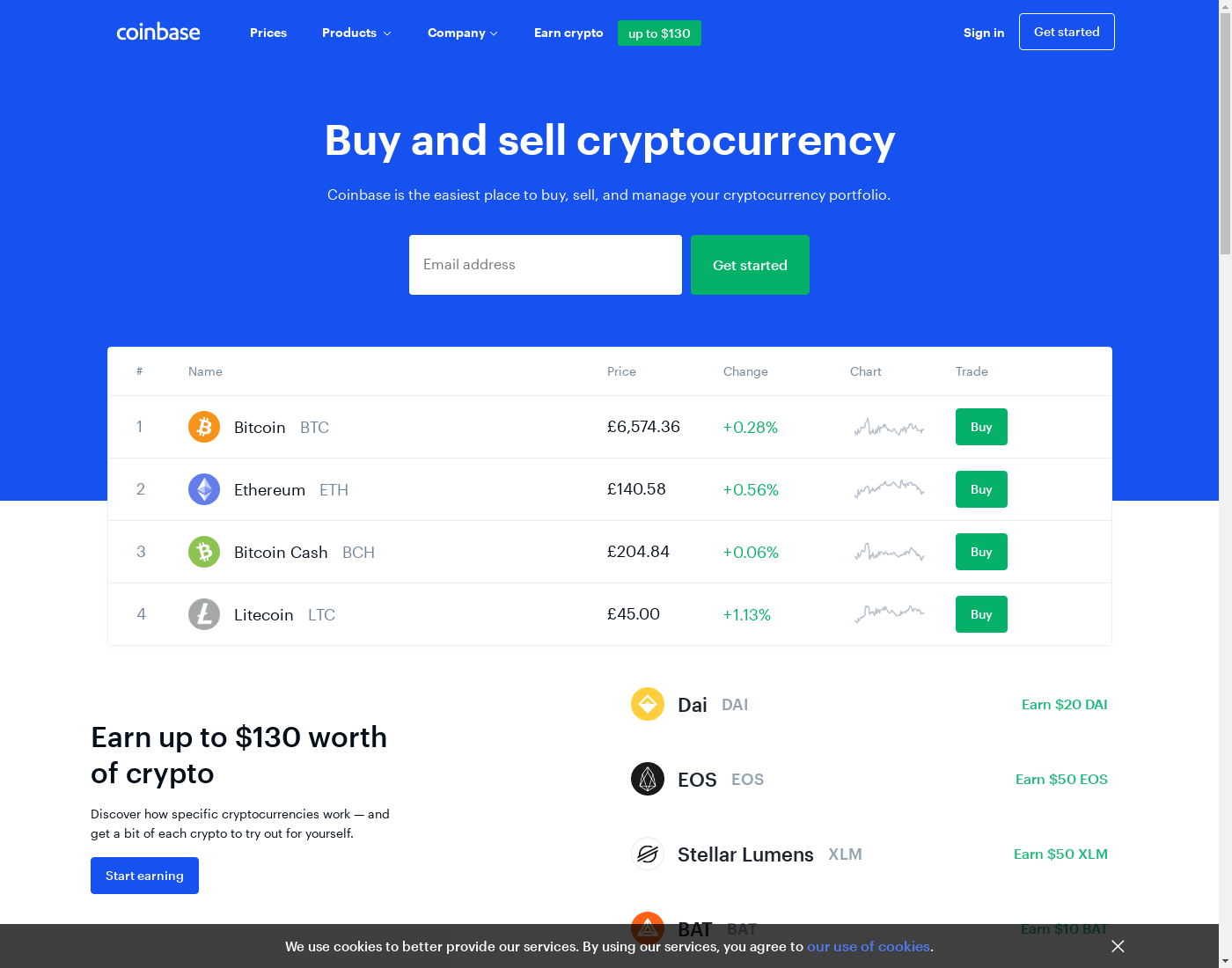

BitQuick vs Coinbase

Let's compare the most important features and key facts about the COINBASE with what BitQuick (RIP) offered us in the past to make a conclusion if Coinbase will be the optimal choice for you:

- Coinbase is a e-wallet BitQuick was a p2p marketplace, it's also an exchange, but has slightly different business model (feel free to read details about the difference between e-wallet and p2p marketplace)

- Coinbase had launched the service June 2012 BitQuick started the project October 2013 (Coinbase is operating for 1 years and 4 months longer).

- Coinbase has all the business licenses and permissions, required by law BitQuick was an ordinary limited company without any licenses, etc. (Coinbase's business model makes it a better, safer choice for the customers).

- Besides cryptocurrencies buying|selling, Coinbase provides some other exchange-related / financial services: ATM Cards, Merchant Services and the Staking, MasterNodes, etc. (passive income opportunity) BitQuick provided less financial or other services, related to the cryptocurrency exchange: it allowed us to purchase and sell digital currencies.

- Coinbase supports 21 cryptocurrencies BitQuick allowed to exchange only one crypto (BitQuick supports 20 fewer cryptocurrencies).

- 6 fiat currencies are available for buy- sell- operations at Coinbase You could use 1 fiat currency converting it to digital form on BitQuick (BitQuick supported 5 fiat currencies less).

- Coinbase accepts the deposits from and allows fund to be withdrawn to 8 banks and (fiat) payment systems BitQuick allowed the customer to use 1 various fiat payment systems and/or banks (BitQuick supported 7 banks and/or payment systems less).

- The fees Coinbase charges: 1.0% — 3.99% BitQuick charged the user 2.0% commission, depending on the exchange direction, payment system, etc. (BitQuick had lower fees in most of the cases).

- Coinbase's customers are rewarded with the gifts BitQuick had neither gifts or cashback available (BitQuick & Coinbase both provide(d) more or less the same bonuses / gifts / etc. for the loyal customers).

- The purchase limits at Coinbase are starting from $2.00 up to $5,000 Deposit and withdrawal limits at the BitQuick were $1.00 — $555,556 depending on the specific payment method, etc. (BitQuick had a higher limits for buying and selling orders).

- Coinbase allows users' registrations from 39 countries; and we are glad to say that the people from United States are welcome You could register at the BitQuick if you were a resident of one of 255 countries; it served United States among all others (BitQuick supported more countries and territories).

- When the client needs to pass through the KYC process at Coinbase, they usually ask to provide 2 documents and / or specific procedures: ID or Passport Verification, Phone Number Confirmation (SMS or a call). In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at BitQuick normally consisted of 1 procedure: Phone Number Confirmation. (BitQuick, may it rest in peace, was more liberal with the verification, etc; Coinbase requires user identification for all the orders).

- As per our analysis of the community feedback, Coinbase currently process orders to deposit and withdraw funds instantly, without any delay at all or in matter of seconds; the process is fully automated The former users of BitQuick reported that the process of a deposit or withdrawal took about a few seconds or instantly, with zero delay (BitQuick & Coinbase process(ed) the fiat and crypto deposits | withdrawals with almost an equal speed).

- Our visitors shared 25 reviews about Coinbase, 96% of those are positive While BitQuick was operating, we could get 5 clients testimonials, 80% were positive (BitQuick was rated lower by their ex-clients).

We can't make a decision — is Coinbase a worthy alternative to BitQuick — instead of you, but we'll try to assist with the matter. Considering the fact that BitQuick had a lower rating score: 84 vs Coinbase rated 100, it makes sense to state that COINBASE should be a great replacement for now defunct p2p marketplace; definitely worth trying!

Like reading? In fact, there are more exchanges worth comparing to BitQuick, for example, those ones:

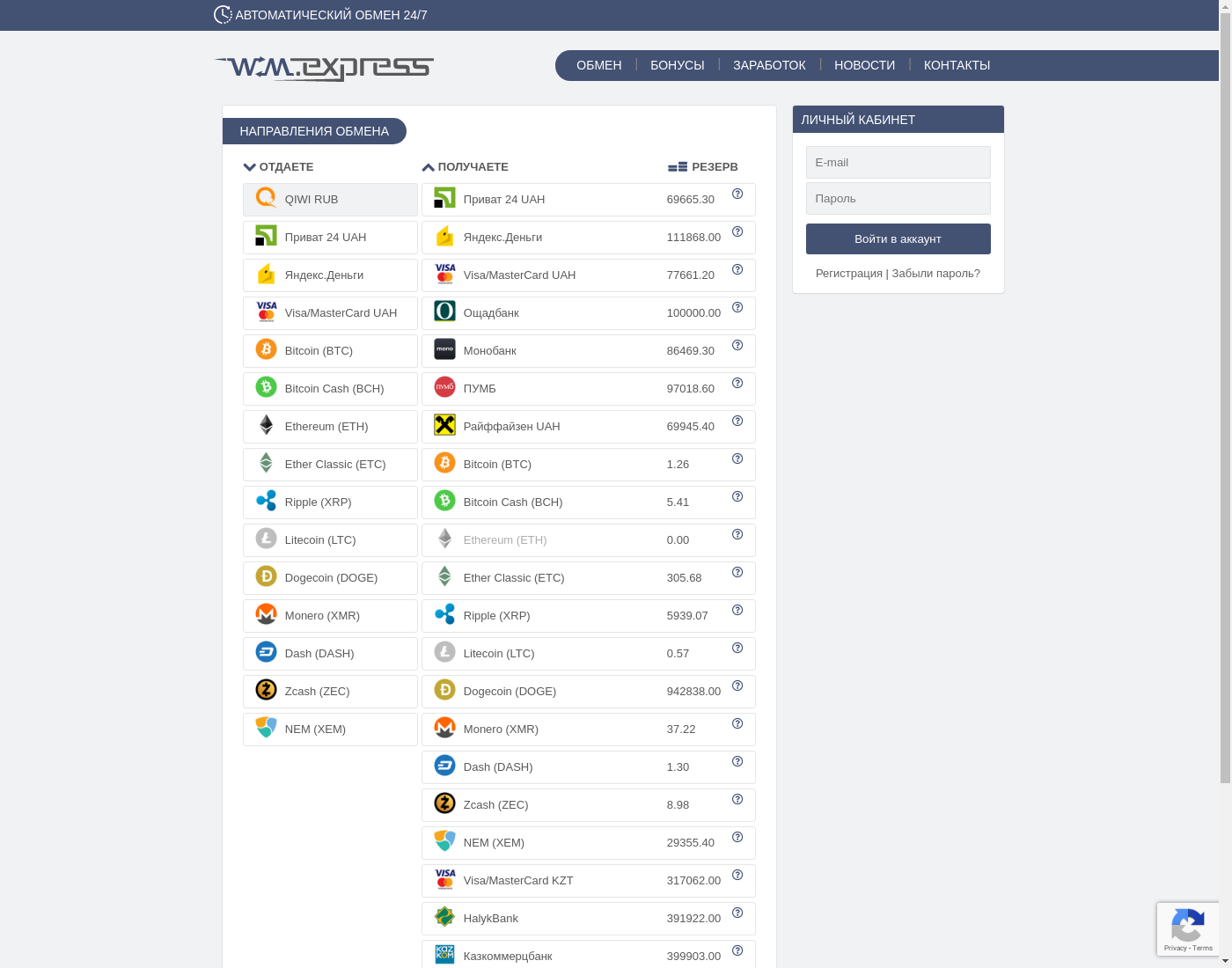

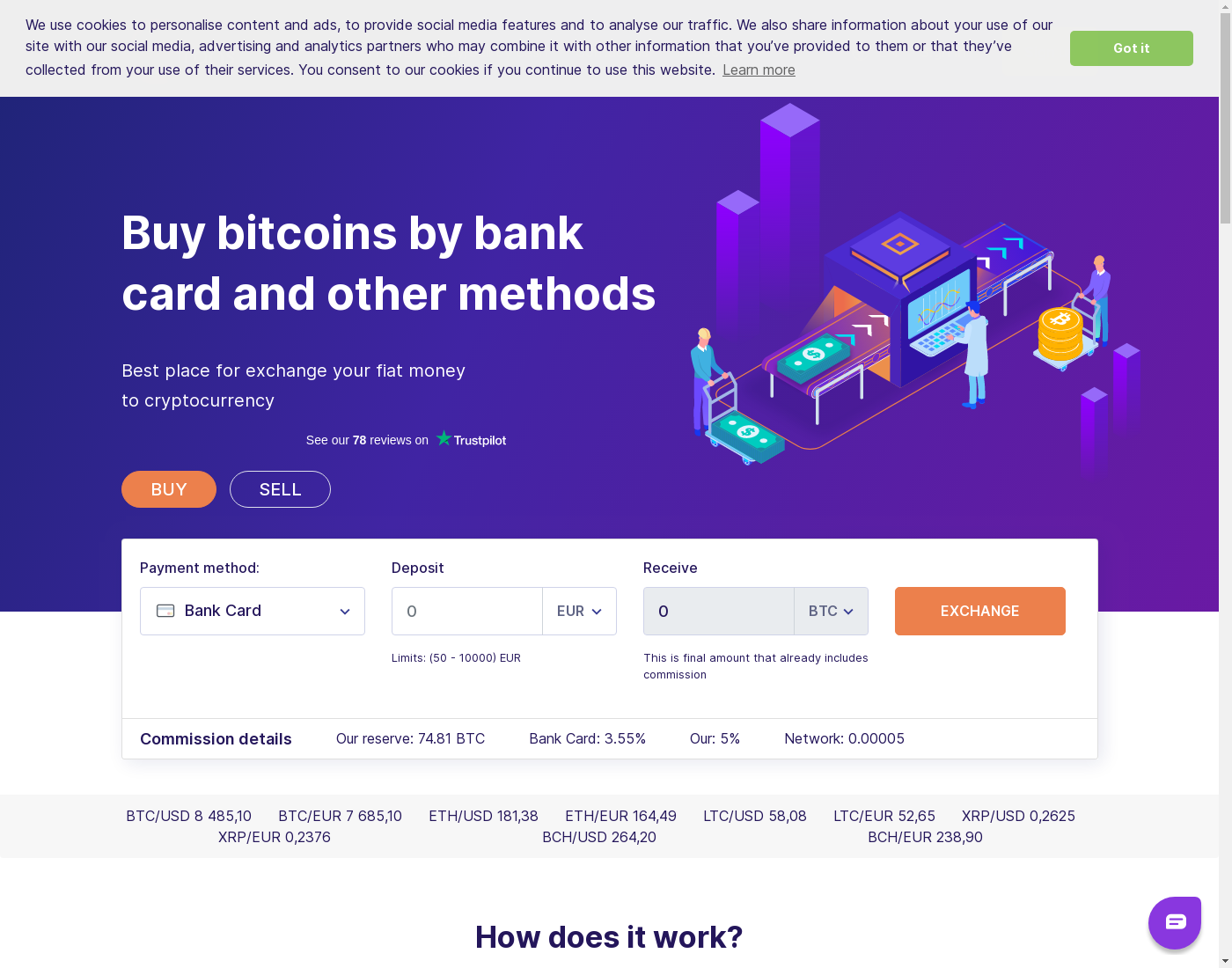

BitQuick vs WMexpress

Let's compare the most important features and key facts about the WMEXPRESS with what BitQuick (RIP) offered us in the past to make a conclusion if WMexpress will be the optimal choice for you:

- WMexpress is a broker BitQuick was a p2p marketplace, it's also an exchange, but has slightly different business model (feel free to read details about the difference between broker and p2p marketplace)

- WMexpress had launched the service August 2015 BitQuick started the project October 2013 (BitQuick operated 1 years and 10 months longer).

- WMexpress operates without any registration or no information is available about the legal entity BitQuick was an ordinary limited company without any licenses, etc. (BitQuick 's approach to the business made it a safer and more stable solution).

- Besides the service of digital currency exchange, WMexpress provides no other services BitQuick provided few more financial services: it allowed us to purchase and sell digital currencies.

- WMexpress allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You could register at the BitQuick if you were a resident of one of 255 countries; it served United States among all others (BitQuick & WMexpress support(ed) the same number of countries worldwide).

- When the client needs to pass through the KYC process at WMexpress, they usually ask to provide some (it depends on various factors) documents and / or specific procedures In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at BitQuick normally consisted of 1 procedure: Phone Number Confirmation. (BitQuick compliance stuff traditionally asked the client to provide more data, pass through more procedures).

- As per our analysis of the community feedback, WMexpress currently process orders to deposit and withdraw funds in just few minutes The former users of BitQuick reported that the process of a deposit or withdrawal took about a few seconds or instantly, with zero delay (BitQuick processes requests to deposit and withdraw funds faster

- Our visitors shared 7 reviews about WMexpress, 100% of those are positive While BitQuick was operating, we could get 5 clients testimonials, 80% were positive (BitQuick was rated lower by their ex-clients).

We can't make a decision — is WMexpress a worthy alternative to BitQuick — instead of you, but we'll try to assist with the matter. Since the WMEXPRESS exchange service got a lower rating at our platform: 71 versus 84 that BitQuick used to have, it may make sense to also review another possible replacements for a non-working p2p marketplace, particularly the ranked "best-of-the-best" Bitpapa!

Like reading? In fact, there are more exchanges worth comparing to BitQuick, for example, those ones:

BitQuick vs chby

Let's compare the most important features and key facts about the CHBY with what BitQuick (RIP) offered us in the past to make a conclusion if chby will be the optimal choice for you:

- chby is a broker BitQuick was a p2p marketplace, it's also an exchange, but has slightly different business model (feel free to read details about the difference between broker and p2p marketplace)

- chby had launched the service July 2018 BitQuick started the project October 2013 (BitQuick operated 4 years and 9 months longer).

- chby operates without any registration or no information is available about the legal entity BitQuick was an ordinary limited company without any licenses, etc. (BitQuick 's approach to the business made it a safer and more stable solution).

- Besides the service of digital currency exchange, chby provides no other services BitQuick provided few more financial services: it allowed us to purchase and sell digital currencies.

- chby allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You could register at the BitQuick if you were a resident of one of 255 countries; it served United States among all others (BitQuick & chby support(ed) the same number of countries worldwide).

- When the client needs to pass through the KYC process at chby, they usually ask to provide some (it depends on various factors) documents and / or specific procedures In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at BitQuick normally consisted of 1 procedure: Phone Number Confirmation. (BitQuick compliance stuff traditionally asked the client to provide more data, pass through more procedures).

- As per our analysis of the community feedback, chby currently process orders to deposit and withdraw funds in just few minutes The former users of BitQuick reported that the process of a deposit or withdrawal took about a few seconds or instantly, with zero delay (BitQuick processes requests to deposit and withdraw funds faster

- Our visitors shared 6 reviews about chby, 100% of those are positive While BitQuick was operating, we could get 5 clients testimonials, 80% were positive (BitQuick was rated lower by their ex-clients).

We can't make a decision — is chby a worthy alternative to BitQuick — instead of you, but we'll try to assist with the matter. Since the CHBY exchange service got a lower rating at our platform: 70 versus 84 that BitQuick used to have, it may make sense to also review another possible replacements for a non-working p2p marketplace, particularly the ranked "best-of-the-best" Bitpapa!

Like reading? In fact, there are more exchanges worth comparing to BitQuick, for example, those ones:

BitQuick vs TransCoin

Let's compare the most important features and key facts about the TRANSCOIN with what BitQuick (RIP) offered us in the past to make a conclusion if TransCoin will be the optimal choice for you:

- TransCoin is a broker BitQuick was a p2p marketplace, it's also an exchange, but has slightly different business model (feel free to read details about the difference between broker and p2p marketplace)

- TransCoin had launched the service May 2018 BitQuick started the project October 2013 (BitQuick operated 4 years and 7 months longer).

- TransCoin has all the business licenses and permissions, required by law BitQuick was an ordinary limited company without any licenses, etc. (TransCoin's business model makes it a better, safer choice for the customers).

- Besides the service of digital currency exchange, TransCoin provides no other services BitQuick provided few more financial services: it allowed us to purchase and sell digital currencies.

- TransCoin supports 1 cryptocurrencies BitQuick allowed to exchange only one crypto (BitQuick & TransCoin count the same number of electronic currencys).

- TransCoin allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You could register at the BitQuick if you were a resident of one of 255 countries; it served United States among all others (BitQuick & TransCoin support(ed) the same number of countries worldwide).

- When the client needs to pass through the KYC process at TransCoin, they usually ask to provide some (it depends on various factors) documents and / or specific procedures The process of Customer Identification at BitQuick normally consisted of 1 procedure: Phone Number Confirmation. (BitQuick compliance stuff traditionally asked the client to provide more data, pass through more procedures).

- Our visitors shared 5 reviews about TransCoin, 100% of those are positive While BitQuick was operating, we could get 5 clients testimonials, 80% were positive (BitQuick was rated lower by their ex-clients).

We can't make a decision — is TransCoin a worthy alternative to BitQuick — instead of you, but we'll try to assist with the matter. Considering the fact that BitQuick had a lower rating score: 84 vs TransCoin rated 100, it makes sense to state that TRANSCOIN should be a great replacement for now defunct p2p marketplace; definitely worth trying!

Like reading? In fact, there are more exchanges worth comparing to BitQuick, for example, those ones:

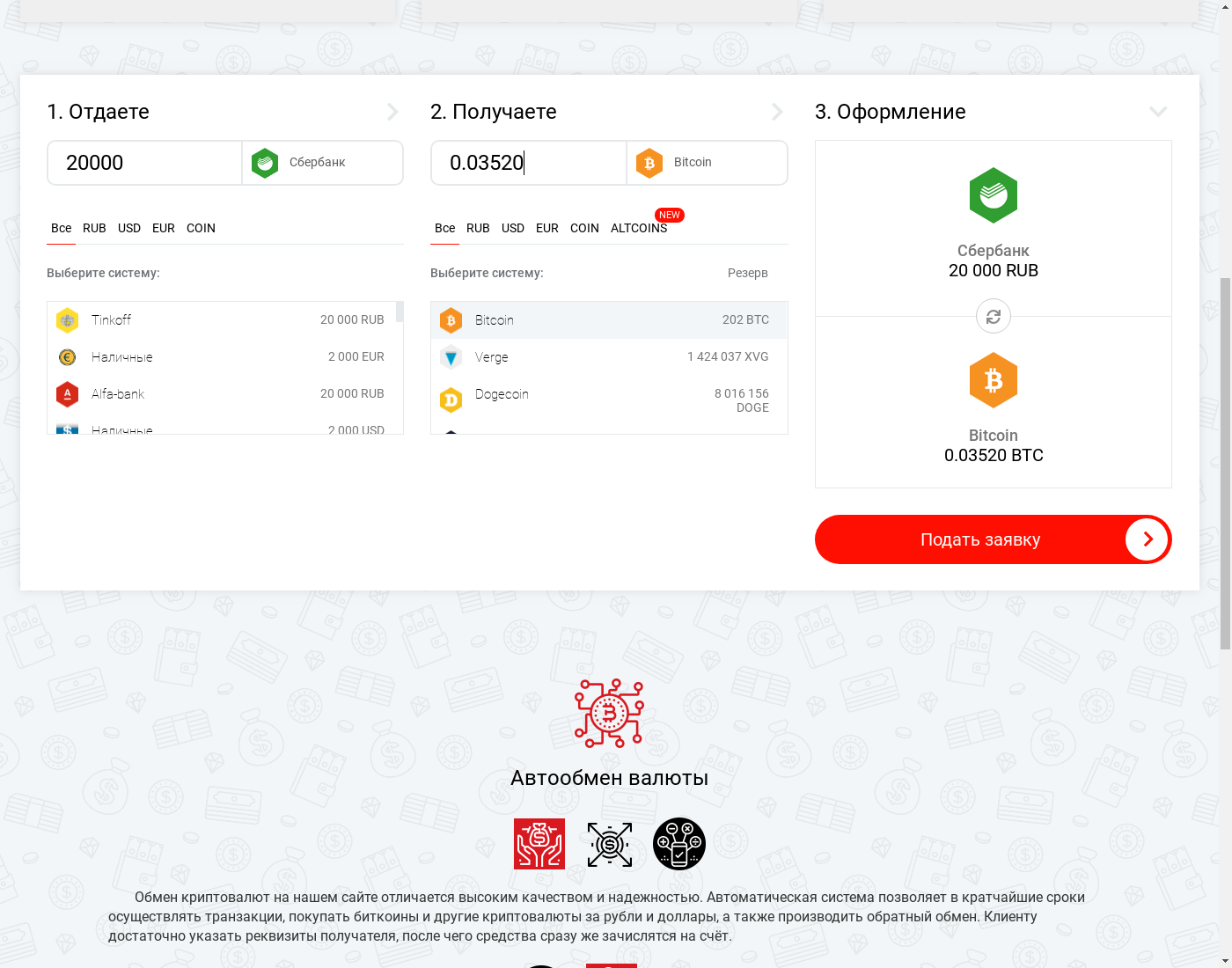

Another approach: finding the best rate to exchange BTC & crypto in United States and North America

There is another way of finding the most worthy alternative to BitQuick that will work best for you considering:

- The fees and rates provided at the moment by 3 exchange websites of a "P2P Marketplace" type and 9,401 other offers.

- BTC/USD exchange rate at those ; the availability of service for the residents of United States.

- Which local banks & payment systems out of 154 serving US are the fastest, most convenient and cost-efficient personally for you.

- Amount you need to swap: say, the conditions for exchanging USD 1 will be significantly different from the terms of $67,803.0 conversion.

- And of course, you see the rating, users reviews (up-to-date 533 real clients testimonials), etc. for all the offers available!

Our platform could find 36 offers to buy, sell, exchange BTC available to users from United States, and 34 of these are for the US Dollar currency. There are totally 27 exchange services supporting US. Some of those are providing the access to USD|BTC market, including such types as e-wallet, P2P Marketplace, Trading Platform, etc. 5 exchanges has active offers for these currencies right now; you can buy/sell using 18 local and international payment systems & banks! The local dealers and exchanges are mentioning the support of 18 local banking institutions and the payment systems. According to the latest data we have, the lowest fee to purchase BTC with USD locally is available for Etana, that's a local payment system. The most popular domestic options for purchasing BTC @ US:

- Barter from Flutterwave | 50 ads

- GoBank Card | 34 ads

- MyVanilla Reloadable | 22 ads

- JCPenney | 13 ads

- Cash in Person | 5 ads

- Nike | 4 ads

- Cash App (Square) | 4 ads

- Other Gift Cards | 4 ads

- Visa & Mastercard | 3 ads

- Netspend Prepaid | 3 ads

BitQuick supported domestic US Dollar currency to buy and sell crypto. Exchange platforms we are monitoring also have some beneficial ways to exchange. Totally 18 payment methods and banks are covered in North America and the rest of the world!