CEX review & 30 testimonials for cex.io (upd. 07.2024)

- Overview: is CEX safe?

- Pros & Cons of CEX

- Services, CEX Provides

- Currencies & Payment Systems

- CEX fees

- Buying and selling limits

- Supported countries

- Customer service

- Verification at CEX

- Deposit/withdrawal speed

- Customers' testimonials

- FAQ about CEX

- CEX vs other exchanges

- Conclusion: is CEX legit or scam?

What is CEX in a nutshell? It's a trusted, respectable, well established, promising exchange service (trading platform) working with 32 cryptocurrencies: you can buy and sell coins using 3 fiat currencies (8 banks & payment systems are supported) or exchange one crypto into another here. Exchange service started the business Jul 2014, it's a fully compliant, licensed financial company. Besides the cryptocurrencies exchange, CEX also provides other services, for example, Lending, Margin Trading, Faucets (small amounts of cryptos for free), Staking, MasterNodes, etc. (passive income opportunity).

This service integrated with a number of currencies, banks, and payment systems. Hence to estimate the fees level we calculated an average fee you'll spend for an exchange here. Based on this number (1.22%) we may say that CEX charges low fees: 0.3% — 3.99% (in line with our statistics, 60% exchanges take higher average fee) and has the high purchase limits available: $20.00 — $10,000 (even though, in accordance with the statistics we've collected, 99% exchanges have higher order limits). This Trading Platform welcomes customers from 224 countries (including your country: United States!). It serves the US and allows registrations from all the 56 states and territories. On the report of the actual users, customer service is great with knowledgeable and friendly operators; the exchange is almost instant and takes less than 15 minutes! (or close). You will have to verify your account (ID Verification, Phone Number Confirmation, Selfie should be normally required) before being able to use the service.

CEX has being assigned the special status: The best Trading Platform worldwide! What does that mean? Our platform ranks all the exchanges basing on a number of factors: business model, licenses, time in the business, customers' testimonials, complaints (if any), etc. Then we compare all the leaders in each category (like trading platform) to determine who's the best-of-the-best. Hence, we are pleased to say that CEX is exactly the one!

Based on all these facts, our verdict is the following: CEX is a 100% legit and perfectly safe place to buy and sell cryptocurrencies, almost an ideal exchange with great feedback we can recommend to our dear visitors!

Overview: is CEX safe?

CEX is the Trading Platform; CEX.IO LTD (dba CEX) started the business in July 2014. The company is based in the United Kingdom with the headquarters located in the London. Official CEX address is 24th Floor One Canada Square, Canary Wharf London E14 5AB. The firm is a licensed MSB, regulated by the FinCEN; it holds the Money Transmission license. FINCEN registration number 31000176194955.

CEX was founded by Oleksandr Lutskevych. Level39 and some others are among the lead investors. CEX CEO is also Oleksandr Lutskevych.

CEX.io is one of the longest-running exchanges available today; the company started as a mining pool and cloud mining service in 2013. It's a secure and stable business, there were never hacks and theft many major exchanges suffer. I am using it myself and had zero issues.

Pros & Cons of CEX

Since CEX is rated as one of the best exchanges in the world by our visitors, there should be many strong sides clients admire and probably some downsides anyway. Let's check it out:

- It's very stable and reliable exchange service operating from 2014.07. Fully compliant and regulated business, service provided by licensed financial company.

- Cex earned perfect testimonials from the clientele.

- 32 digital currencies and 3 fiat ones are supported. Although, a lot of payment systems & banks, totally 8 are supported, both international and national ones: Visa & Mastercard, Any Local Bank, SEPA Transfer, etc.

- Fees are relatively low.

- High purchase and withdrawal limits.

- Trading platform utilizes a business model based on holding the clients funds at the online wallet; such approach has some risks.

Seems that there are not so many cons, but a lot of pros. We hope you will enjoy your experience exchanging at CEX! Try CEX today and let us know how you like it!

Services, CEX Provides

The platform provides the following cryptocurrency exchange-related services:

- Allows the customers to buy cryptocurrencies with fiat currencies

- Provides the clients with ways to "cash out" the crypto to fiat currency

- Helps you to exchange one crypto to another

- Cryptocurrency/token lending; it allows the traders earning a passive income — think of saving accounts with yearly interest, paid in crypto

- Margin (leveraged) trading; traders can access greater sums of capital than they possess by borrowing it from the exchange

- Faucets: giving away some cryptocurrencies (small amounts) for free

- And other ones! The full list: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and Staking, MasterNodes, etc. (passive income opportunity).

That's impressive number of features! According to our statistics, 95% of the competition provide less services, many just allow the buying and selling, so this trading platform is among the champions in this field!

Currencies & Payment Systems

CEX provides the service of buying and selling and exchanging 32 digital currencies using fiat currencies and crypto. Besides the fiat-to-crypto conversion and vice versa, it also allows to exchange one cryptocurrency to another. The following cryptocurrencies are available to buy-sell-swap: Aave (AAVE), Cardano (ADA), Bitcoin Cash (BCHABC), Binance Coin (BNB), Bitcoin (BTC), MakerDAO (DAI), Dash (DASH), Dogecoin (DOGE), Polkadot (DOT), Ether (ETH), Filecoin (FIL), Internet Computer (ICP), Kusama (KSM), Chainlink (LINK), Litecoin (LTC), Polygon (MATIC), NEO (NEO), OmiseGO (OMG), Solana (SOL), SushiSwap (SUSHI), Theta Network (THETA), The Open Network (TON), TRON (TRX), TrueUSD (TUSD), Uniswap (UNI), USD Coin (USDC), Tether (USDT), VeChain (VET), Wrapped Bitcoin (WBTC), Stellar (XLM), Ripple (XRP), 0x (ZRX).

There are not much exchanges with so many cryptos supported! If you are not sure, which one of these electronic currencies you are most interested in, you are welcome to read our guides. For example, these: Cryptocurrencies initial coin offerings to buy in 2024.

3 fiat currencies are supported to provide crypto purchase and selling: Euro (EUR), Pound Sterling (GBP), US Dollar (USD). The Trading Platform will let you buy and sell Bitcoins and 31 other cryptos using the following payment systems:

- Visa & Mastercard. An international payment system (available worldwide) allowing credit/debit cards payments in various currencies. USD, EUR and GBP payments are available for both buying and selling cryptocurrencies at this exchange. Visa & Mastercard is a popular way to buy BTC and other cryptocurrencies available at 7 exchanges of various types. You are welcome to find the best rate for buying bitcoin with visa & mastercard at our home page!

- Any Local Bank. An universal payment method, allowing payments from/to all the banks in various currencies. cex.io has options to use local bank transfers in the United States. Just the USD payments are available for both buying and selling cryptocurrencies at this exchange.

- SEPA Transfer. An international payment system (it's available in 46 countries) allowing international bank transfers payments in Euro currency. Just the EUR payments are available for both buying and selling cryptocurrencies at this exchange.

- Advanced Cash. An international payment system (available worldwide) allowing other payments in various currencies. EUR and USD payments are available for both buying and selling cryptocurrencies at this exchange.

- Faster Payments. A local bank (serving United Kingdom) in Pound Sterling currency. Just the GBP payments are available for both buying and selling cryptocurrencies at this exchange.

- SWIFT Transfer. An international payment system (available worldwide) allowing international bank transfers payments in various currencies. GBP, EUR and USD payments are available for both buying and selling cryptocurrencies at this exchange.

- Skrill. An international payment system (available worldwide) allowing e-wallet payments in various currencies. EUR, USD and GBP payments are available for both buying and selling cryptocurrencies at this exchange.

- Epay. An international payment system (available worldwide) allowing other payments in various currencies. Just the USD payments are available for both buying and selling cryptocurrencies at this exchange.

CEX fees

The fees you need to pay at this trading platform during the process of buying and selling cryptocurrencies are easier to understand if you break it down like that (note that you can skip the details, jumping to the conclusion):

-

Deposit/withdrawal fee.

Depending on the fiat payment system and currency, it's as follows:

- 0% to deposit funds by Advanced Cash in Euro.

- 0% to deposit funds by Advanced Cash in US Dollar.

- Commission for the money withdrawal to Advanced Cash in US Dollar: 0%

- Commission for the money withdrawal to Advanced Cash in Euro: 0%

- 0% to deposit funds by Any Local Bank in US Dollar.

- Commission for the money withdrawal to Any Local Bank in US Dollar: 0%

- Commission for the money withdrawal to Epay in US Dollar: 1.0%

- 0% to deposit funds by Epay in US Dollar.

- 0% to deposit funds by Faster Payments in Pound Sterling.

- Commission for the money withdrawal to Faster Payments in Pound Sterling: 0%

- Commission for the money withdrawal to Qiwi in Russian Ruble: 2.49%

- 0.99% to deposit funds by Qiwi in Russian Ruble.

- Commission for the money withdrawal to SEPA Transfer in Euro: 0%

- 0% to deposit funds by SEPA Transfer in Euro.

- Commission for the money withdrawal to Skrill in Pound Sterling: 1.0%

- 3.99% to deposit funds by Skrill in US Dollar.

- Commission for the money withdrawal to Skrill in US Dollar: 1.0%

- 3.99% to deposit funds by Skrill in Euro.

- Commission for the money withdrawal to Skrill in Euro: 1.0%

- 3.99% to deposit funds by Skrill in Pound Sterling.

- 0% to deposit funds by SWIFT Transfer in Pound Sterling.

- Commission for the money withdrawal to SWIFT Transfer in Euro: 0.3% + €25.0

- 0.5% to deposit funds by SWIFT Transfer in Russian Ruble.

- 0% to deposit funds by SWIFT Transfer in US Dollar.

- 0% to deposit funds by SWIFT Transfer in Euro.

- Commission for the money withdrawal to SWIFT Transfer in US Dollar: 0.3% + $25.0

- Commission for the money withdrawal to SWIFT Transfer in Pound Sterling: 0.3% + £25.0

- 2.99% to deposit funds by Visa & Mastercard in Euro.

- Commission for the money withdrawal to Visa & Mastercard in Pound Sterling: 3.0% + £5.0

- Commission for the money withdrawal to Visa & Mastercard in Euro: 3.0% + €5.0

- Commission for the money withdrawal to Visa & Mastercard in Russian Ruble: 3.0% + ₽50.0

- Commission for the money withdrawal to Visa & Mastercard in US Dollar: 3.0% + $5.0

- 2.99% to deposit funds by Visa & Mastercard in US Dollar.

- 2.99% to deposit funds by Visa & Mastercard in Pound Sterling.

- 2.99% to deposit funds by Visa & Mastercard in Russian Ruble.

-

Trading fee.

This trading platform charges the following when your trade order matches and executes:

- 0.25% of the order amount, whatever fiat or crypto currency you trade.

-

Cryptocurrency withdrawal fee.

Please note that this fee applies only when you

transfer the crypto 'out': to your own wallet, to someone else, etc.!

- 0.000500 BTC when you purchase Bitcoins

- the usual transaction fee in the according crypto, when you are buying: AAVE, ADA, BCHABC, BNB, DAI, DASH, DOGE, DOT, ETH, FIL, ICP, KSM, LINK, LTC, MATIC, NEO, OMG, SOL, SUSHI, THETA, TON, TRX, TUSD, UNI, USDC, USDT, VET, WBTC, XLM, XRP, ZRX.

Are CEX fees high or low?

Now it's time to draw a conclusion: considering the average fee the exchange charges for an operation we can state that CEX takes very low fees! According to our statistics, most of the exchanges charges about the same fees CEX does. For example, an average fee you pay to buy Bitcoin with Visa & Mastercard in USD across various exchange brokers, trading platforms, p2p marketplaces and e-wallets is 0%, cex.io charges 2.99% for this. Seems fair.

Buying and selling limits

This Trading Platform has the following limits, applicable when you buy or sell cryptocurrencies (there are no limits on crypto-to-crypto swaps):

-

Purchase limits (when you buy crypto).

- USD 20 minimal buy and USD 10,000 max purchase when using Advanced Cash in Euro.

- $20 minimal buy and $10,000 max purchase when using Advanced Cash in US Dollar.

- $20 minimal buy and $10,000 max purchase when using Any Local Bank in US Dollar.

- $20 minimal buy and $10,000 max purchase when using Epay in US Dollar.

- £20 minimal buy and USD 10,000 max purchase when using Faster Payments in Pound Sterling.

- ₽10,000 minimal buy and USD 10,000 max purchase when using Qiwi in Russian Ruble.

- €20 minimal buy and USD 10,000 max purchase when using SEPA Transfer in Euro.

- $35 minimal buy and $10,000 max purchase when using Skrill in US Dollar.

- €35 minimal buy and USD 10,000 max purchase when using Skrill in Euro.

- £35 minimal buy and USD 10,000 max purchase when using Skrill in Pound Sterling.

- USD 300 minimal buy and USD 10,000 max purchase when using SWIFT Transfer in Pound Sterling.

- ₽500,000 minimal buy and USD 10,000 max purchase when using SWIFT Transfer in Russian Ruble.

- $1,000 minimal buy when using SWIFT Transfer in US Dollar.

- USD 300 minimal buy and USD 10,000 max purchase when using SWIFT Transfer in Euro.

- €20 minimal buy and €10,000 max purchase when using Visa & Mastercard in Euro.

- $20 minimal buy and $10,000 max purchase when using Visa & Mastercard in US Dollar.

- USD 20 minimal buy and USD 10,000 max purchase when using Visa & Mastercard in Pound Sterling.

- USD 20 minimal buy and USD 10,000 max purchase when using Visa & Mastercard in Russian Ruble.

-

Withdrawal limits (when you out-exchange crypto to the fiat money).

- $20 min and $10,000 maximal withdrawal when receiving money to Advanced Cash in US Dollar.

- USD 20 min and USD 10,000 maximal withdrawal when receiving money to Advanced Cash in Euro.

- $20 min and $10,000 maximal withdrawal when receiving money to Any Local Bank in US Dollar.

- $20 min and $10,000 maximal withdrawal when receiving money to Epay in US Dollar.

- £20 min and USD 10,000 maximal withdrawal when receiving money to Faster Payments in Pound Sterling.

- ₽1,200 min and ₽150,000 maximal withdrawal when receiving money to Qiwi in Russian Ruble.

- €20 min and USD 10,000 maximal withdrawal when receiving money to SEPA Transfer in Euro.

- £20 min and USD 10,000 maximal withdrawal when receiving money to Skrill in Pound Sterling.

- $35 min and $10,000 maximal withdrawal when receiving money to Skrill in US Dollar.

- €35 min and USD 10,000 maximal withdrawal when receiving money to Skrill in Euro.

- USD 300 min and USD 10,000 maximal withdrawal when receiving money to SWIFT Transfer in Euro.

- $300 min and $10,000 maximal withdrawal when receiving money to SWIFT Transfer in US Dollar.

- USD 300 min and USD 10,000 maximal withdrawal when receiving money to SWIFT Transfer in Pound Sterling.

- USD 20 min and USD 10,000 maximal withdrawal when receiving money to Visa & Mastercard in Pound Sterling.

- USD 20 min and USD 10,000 maximal withdrawal when receiving money to Visa & Mastercard in Euro.

- USD 20 min and ₽75,000 maximal withdrawal when receiving money to Visa & Mastercard in Russian Ruble.

- $20 min and $10,000 maximal withdrawal when receiving money to Visa & Mastercard in US Dollar.

And the good news: there are no limits on other payment systems (the limitations the payment system has aside) CEX supports! Comparing to other exchanges, CEX has one of highest buying and selling limits on the whole exchange market!

Supported countries

Platform allows the users from 224 countries to use the exchange. The following countries are supported by the trading platform:

- Aland Islands (AX)

- Albania (AL)

- American Samoa (AS)

- Andorra (AD)

- Angola (AO)

- Anguilla (AI)

- Antarctica (AQ)

- Antigua & Barbuda (AG)

- Argentina (AR)

- Armenia (AM)

- Aruba (AW)

- Ascension Island (AC)

- Australia (AU)

- Austria (AT)

- Azerbaijan (AZ)

- Bahamas (BS)

- Bahrain (BH)

- Barbados (BB)

- Belarus (BY)

- Belgium (BE)

- Belize (BZ)

- Benin (BJ)

- Bermuda (BM)

- Bhutan (BT)

- Botswana (BW)

- Bouvet Island (BV)

- Brazil (BR)

- British Indian Ocean Territory (IO)

- British Virgin Islands (VG)

- Brunei (BN)

- Bulgaria (BG)

- Burkina Faso (BF)

- Cameroon (CM)

- Canada (CA)

- Canary Islands (IC)

- Cape Verde (CV)

- Caribbean Netherlands (BQ)

- Cayman Islands (KY)

- Ceuta & Melilla (EA)

- Chad (TD)

- Chile (CL)

- China (CN)

- Christmas Island (CX)

- Cocos (Keeling) Islands (CC)

- Colombia (CO)

- Comoros (KM)

- Congo - Brazzaville (CG)

- Cook Islands (CK)

- Costa Rica (CR)

- Côte d’Ivoire (CI)

- Croatia (HR)

- Curaçao (CW)

- Cyprus (CY)

- Czech Republic (CZ)

- Denmark (DK)

- Diego Garcia (DG)

- Djibouti (DJ)

- Dominica (DM)

- Dominican Republic (DO)

- Egypt (EG)

- El Salvador (SV)

- Equatorial Guinea (GQ)

- Eritrea (ER)

- Estonia (EE)

- Falkland Islands (FK)

- Faroe Islands (FO)

- Fiji (FJ)

- Finland (FI)

- France (FR)

- French Guiana (GF)

- French Polynesia (PF)

- French Southern Territories (TF)

- Gabon (GA)

- Gambia (GM)

- Georgia (GE)

- Germany (DE)

- Ghana (GH)

- Gibraltar (GI)

- Greece (GR)

- Greenland (GL)

- Grenada (GD)

- Guadeloupe (GP)

- Guam (GU)

- Guatemala (GT)

- Guernsey (GG)

- Guinea (GN)

- Guinea-Bissau (GW)

- Guyana (GY)

- Haiti (HT)

- Heard Island and McDonald Islands (HM)

- Honduras (HN)

- Hong Kong SAR China (HK)

- Hungary (HU)

- India (IN)

- Indonesia (ID)

- Ireland (IE)

- Isle of Man (IM)

- Israel (IL)

- Italy (IT)

- Jamaica (JM)

- Japan (JP)

- Jersey (JE)

- Jordan (JO)

- Kazakhstan (KZ)

- Kenya (KE)

- Kiribati (KI)

- Kosovo (XK)

- Kuwait (KW)

- Kyrgyzstan (KG)

- Latvia (LV)

- Lesotho (LS)

- Liberia (LR)

- Liechtenstein (LI)

- Lithuania (LT)

- Luxembourg (LU)

- Macau SAR China (MO)

- Macedonia (MK)

- Madagascar (MG)

- Malawi (MW)

- Malaysia (MY)

- Maldives (MV)

- Mali (ML)

- Malta (MT)

- Marshall Islands (MH)

- Martinique (MQ)

- Mauritania (MR)

- Mauritius (MU)

- Mayotte (YT)

- Mexico (MX)

- Micronesia (FM)

- Moldova (MD)

- Monaco (MC)

- Mongolia (MN)

- Montenegro (ME)

- Montserrat (MS)

- Mozambique (MZ)

- Myanmar (Burma) (MM)

- Namibia (NA)

- Nauru (NR)

- Netherlands (NL)

- New Caledonia (NC)

- New Zealand (NZ)

- Nicaragua (NI)

- Niger (NE)

- Nigeria (NG)

- Niue (NU)

- Norfolk Island (NF)

- Northern Mariana Islands (MP)

- North Korea (KP)

- Norway (NO)

- Oman (OM)

- Palau (PW)

- Palestinian Territories (PS)

- Panama (PA)

- Papua New Guinea (PG)

- Paraguay (PY)

- Peru (PE)

- Philippines (PH)

- Pitcairn Islands (PN)

- Poland (PL)

- Portugal (PT)

- Puerto Rico (PR)

- Qatar (QA)

- Réunion (RE)

- Romania (RO)

- Russia (RU)

- Rwanda (RW)

- Samoa (WS)

- San Marino (SM)

- São Tomé & Príncipe (ST)

- Saudi Arabia (SA)

- Senegal (SN)

- Serbia (RS)

- Seychelles (SC)

- Sierra Leone (SL)

- Singapore (SG)

- Sint Maarten (SX)

- Slovakia (SK)

- Slovenia (SI)

- Solomon Islands (SB)

- South Africa (ZA)

- South Georgia & South Sandwich Islands (GS)

- South Korea (KR)

- Spain (ES)

- Sri Lanka (LK)

- St. Barthélemy (BL)

- St. Helena (SH)

- St. Lucia (LC)

- St. Martin (MF)

- St. Pierre & Miquelon (PM)

- St. Vincent & Grenadines (VC)

- Suriname (SR)

- Svalbard & Jan Mayen (SJ)

- Swaziland (SZ)

- Sweden (SE)

- Switzerland (CH)

- Taiwan (TW)

- Tajikistan (TJ)

- Tanzania (TZ)

- Thailand (TH)

- Timor-Leste (TL)

- Togo (TG)

- Tokelau (TK)

- Tonga (TO)

- Trinidad & Tobago (TT)

- Tristan da Cunha (TA)

- Tunisia (TN)

- Turkey (TR)

- Turkmenistan (TM)

- Turks & Caicos Islands (TC)

- Tuvalu (TV)

- Ukraine (UA)

- United Arab Emirates (AE)

- United Kingdom (GB)

- United States (US)

- Uruguay (UY)

- U.S. Outlying Islands (UM)

- U.S. Virgin Islands (VI)

- Uzbekistan (UZ)

- Vatican City (VA)

- Venezuela (VE)

- Wallis & Futuna (WF)

- Western Sahara (EH)

- Zambia (ZM)

Does CEX allow the users from United States (US)?

Yes, cex.io allows the registrations from the United States! Trading Platform permits the users from 56 states and territories to register at and use the services exchange provides:

- Alabama (AL)

- Alaska (AK)

- American Samoa (AS)

- Arizona (AZ)

- Arkansas (AR)

- California (CA)

- Colorado (CO)

- Connecticut (CT)

- Delaware (DE)

- District of Columbia (DC)

- Florida (FL)

- Georgia (GA)

- Guam (GU)

- Hawaii (HI)

- Idaho (ID)

- Illinois (IL)

- Indiana (IN)

- Iowa (IA)

- Kansas (KS)

- Kentucky (KY)

- Louisiana (LA)

- Maine (ME)

- Maryland (MD)

- Massachusetts (MA)

- Michigan (MI)

- Minnesota (MN)

- Mississippi (MS)

- Missouri (MO)

- Montana (MT)

- Nebraska (NE)

- Nevada (NV)

- New Hampshire (NH)

- New Jersey (NJ)

- New Mexico (NM)

- New York (NY)

- North Carolina (NC)

- North Dakota (ND)

- Northern Mariana Islands (MP)

- Ohio (OH)

- Oklahoma (OK)

- Oregon (OR)

- Pennsylvania (PA)

- Puerto Rico (PR)

- Rhode Island (RI)

- South Carolina (SC)

- South Dakota (SD)

- Tennessee (TN)

- Texas (TX)

- U.S. Virgin Islands (VI)

- Utah (UT)

- Vermont (VT)

- Virginia (VA)

- Washington (WA)

- West Virginia (WV)

- Wisconsin (WI)

- Wyoming (WY)

It's possible to use the USD currency to buy/sell 32 cryptocurrencies at the CEX: 6 banks and payment systems totally (out of the 8 the trading platform supports, that's 75% of all the available ones) can be used by people from the U.S.A.:

- Any Local Bank

- Skrill

- Visa & Mastercard

- Advanced Cash

- Epay

- SWIFT Transfer

Customer service

According to the community and the exchange users' testimonials, the support team of CEX is friendly, knowledgeable, works fast, etc. The analysis of reviews is the following:

Verification at CEX

The trading platform requires it's clients to pass through obligatory user identification (account verification). The following procedures should be completed before the client will be able to buy and sell on the exchange:

- ID verification

- Phone confirmation

- Selfie

The exchange strictly follows the KYC (Know Your Client) policies and does extra due diligence. Compliance department (the one taking care of user identification process) may ask a lot of additional information and documents during the account verification.

According to the data submitted by the customers with the reviews and testimonials, the average time the account verification takes is no longer than an hour! The feedback is the following:

A very good result! Verification just takes a little bit of your time and the best thing is that you do it only once.

Deposit/withdrawal speed

Although the exchange process is fully automated on any e-wallet or trading platform, you may face some delay when you send the money "outside", i.e. say you are withdrawing the BTC you purchased to your personal wallet. Let's see what other cryptocurrency enthusiasts say about how fast is cex.io!

Is CEX instant?

So, what can we see? According to the feedback we got from other users of this trading platform worldwide, CEX is almost instant, processing orders very fast: it delivers the funds in 15 minutes max! That's great to know!

Customers' testimonials

Our users left 27 testimonials about their experience dealing with CEX, 100% of the testimonials are positive, 0% are neutral and there are 0 negative ones. Feel free to read as many of these as you like!

My favorite exchange! A very trusted one, great support, fast withdrawals and a great app. AAA+

Bought some btc with my card, I was a bit nervous providing my id and details first but after research found out CEX very trustworthy. Will definitely use again after few days!

I strongly recommend this exchange they always been fast and good to me

I LOVE THIS ONE! Great support great fees all really great here ❤ 100% MY CHOICE

Very Nice. App is also very good

Great exchange!!! I am now regular here, use it for both trading and buying BTC. Fees are low and service is good. 5/5 from me!

Being a great fan of cryptocurrencies, I tried several sites allowing to buy and sell bitcoins, and this one is my personal favorite! It's rather hard to find bitcoin exchange accepting credit and debit cards, especially with affordable fee, so I was very happy when encountered CEX. Besides credit cards they have a lot of other payment options (including instant ones) but when I'm shopping online I prefer to pay with my card.

i have exchnage from bitcoin to litecoin just few minutes waiting i got my money from CEX!!

I am huge fan of CEX, best crypto exchange platform I ever tried! Should add I tried many

The platform is trusted and everything works fine. But the verification!!! It's almost like an interrogation in police or something. During the process they will ask you: - How you make money. You should be ready to confirm all that! Almost like "show us your first dollar earned and proof that it's legit" LOL - Where this monies are coming too. - Bank account statements... Selfies. Like u r instagram model LOL.. and MANY MANY QUESTIONS!! DAMN! I was hoping that crypto exchange will be askin less questions. In fact I never being asked THAT MUCH during bank account opening in any country I ever lived. But everything else is very very good!

Cool software, nice customer service reacting very fast. I enjoy trading here very much 👍

I like CEX EXCHANGE and use it for a long time. I wish they add more different ways to put money in. Say some cash deposits in the US, paypal etc. but it's great app anyway!

Great exchange! Margin trading works fine for me, earned some coins there. Thanks guys !!

Damn, they ask a lot of questions during the verification. Everything else is almost perfect 🔥

I trade here. It's all good, interface is convenient and everything. The only downside is that if you will use it to buy or sell... man this gonna hurt! KYC is ridiculous, they want to know all. Damn, my wife knows less about me than these guys now 👌🤣☝

CEX is definitely a good, trusted exchange. But their customers verification process is somewhat ridiculous. They do ask A LOT of questions!! Really. Get ready to explain how you earn money, how you use it, etc, etc. Damn, I was so happy I finally was verified! Other than that, everything is cool. Ah only the cryptocurrency withdrawal can be bit faster, seems that it's verified by staff everytime (?) because when you order it. have to wait for like 15 minutes, sometimes longer, sometimes faster. I can recommend to use this one if you need to buy some BTCs using SWIFT bank wire transfer, this is reliable exchange and you won't need to worry about safety of your monies. But get ready to explain where you get these $$$ to the Compliance Team!!!

Overall result if great! 100% positive testimonials is something the business owners are very proud of, such a rating is hard to get and even harder to maintain! It means the community really trusts and likes the CEX services, so most likely, you'd enjoy it too!

FAQ about CEX

Does CEX holds my funds?

Yes, it does. Although you can always withdraw the funds to your e-currency wallet "by default" CEX holds your balance at it's own hot storage wallet. This is the standard practice for all the trading platforms, although we recommend to keep only the funds you need for the trading at the exchange.

Is CEX a good trading platform?

According to our rating and the clients' testimonials, it is! Feel free to get acquainted with the details reading this review or just jump to the conclusion!

Is CEX licensed? Does it hold e-money license?

Yes, CEX.IO LTD (entity doing business as CEX exchange) is licenced and regulated financial company. It holds Money Transmission license and is regulated by the FinCEN of the United Kingdom.

Is CEX registered with the FINCEN?

Yes, CEX.IO LTD aka CEX is registered with the U.S. Financial Intelligence Unit as Money Services Business (MSB); FinCEN registration number is 31000176194955.

Does CEX have any features like lending, deposits with interest, etc.?

It does! Feel free to check the exchange website to know the details.

Does CEX provides Margin Trading?

It does. Margin trading is possible at CEX; if you wish to, you may trade with leverage here!

Is CEX a ripoff?

It definitely isn't! Feel free to read the whole this review to understand why or check our conclusion: is CEX legit or scam.

Is CEX licensed in the US?

CEX is registered as MSB (Money Service Business) in FinCEN as a foreign Money Transmitter, and is allowed to serve customers, residing in the following states: Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District Of Columbia, Indiana, Kentucky, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, Pennsylvania, Rhode Island, South Carolina, Utah, West Virginia, Wisconsin

CEX vs other exchanges

Let's compare cex.io to other similar exchange services with more or less the same features: others of trading platform type mostly. Besides, seems reasonable to compare the platform with the exchanges having similar rating and serving (mostly) the same geographic, etc. Remember that if you wish to find the exchange offering the best price to buy/sell Bitcoin and 50 other cryptos, check the best rates to buy bitcoin and crypto in United States!

CEX vs BITEXBOOK

Let's compare the key features of these two platforms to see which one suits you best:

- BITEXBOOK is a trading platform CEX is a trading platform, both are using the same business model.

- BITEXBOOK had started the business May 2018 CEX started the business July 2014 (CEX operates 3 years and 10 months longer).

- BITEXBOOK is an ordinary company without licenses, etc. CEX has all the required business licenses and permissions (CEX utilizes a safer and more stable business model).

- Besides buying and selling cryptocurrencies, bitexbook.com provides the following extra services: Cash codes CEX provides more exchange-related services: it allows us to purchase and sell digital currencies, swap cryptocoins and tokens, and besides that: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and the Staking, MasterNodes, etc. (passive income opportunity).

- BITEXBOOK supports 1 cryptocurrency CEX allows to swap 32 cryptos (CEX additionally works with 31 added cryptocurrencies/tokens).

- 2 fiat currencies are available on bitexbook.com website You'll be able to use 3 national currencies to swap with digital ones at CEX (CEX supports 1 paper currency up).

- BITEXBOOK accepts deposits from and allows withdrawals to 7 fiat payment systems / banks CEX allows the user to utilize 8 various fiat payment systems and/or banks (CEX supports 1 fiat payment systems and banks more).

- BITEXBOOK charges 0.8% — 5.5% fee CEX charges the client 0.3% — 3.99% fee, depending on the currency, payment system, etc. (CEX has lower fees in general).

- Buying limits at BITEXBOOK start from $0.10 and are up to $100,000 Deposit/withdraw limits at CEX are $20.00 — $10,000 depending on the payment method (CEX has lower buying/selling limits).

- BITEXBOOK allows registrations from 255 countries; United States is among the supported ones You may register at CEX if you reside in one of 224 countries; it serves United States among others (CEX supports less countries).

- During the account verification BITEXBOOK usually asks for 2 documents and/or procedures (address confirmation, selfie) User identification at CEX usually consists of 3 different procedures: id verification, phone confirmation, selfie and the process usually takes no longer than an hour (CEX's compliance program and fraud prevention policies oblige the client to complete more steps during the verification).

Although the final decision, which exchange — BITEXBOOK or CEX — is better is up to you, we'll try to help you with the decision. Both exchanges are great, since at least one of them is not yet rated at our platform, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

CEX vs EXMO

Let's compare the key features of these two platforms to see which one suits you best:

- EXMO is a trading platform CEX is a trading platform, both are using the same business model.

- EXMO had started the business May 2013 CEX started the business July 2014 (exmo.me is working for 1 years and 2 months longer time).

- exmo.me has all the required business licenses and permissions CEX has all the required business licenses and permissions (both exchange services operate using the same approach to the business, utilizing a same legal model).

- Besides buying, selling and exchanging cryptocurrencies, exmo.me provides the following extra services: Cash codes, OTC trading and the Margin Trading CEX provides more exchange-related services: it allows us to purchase and sell digital currencies, swap cryptocoins and tokens, and besides that: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and the Staking, MasterNodes, etc. (passive income opportunity).

- EXMO supports 24 cryptocurrencies and tokens CEX allows to swap 32 cryptos (CEX additionally works with 8 added cryptocurrencies/tokens).

- 5 fiat currencies are available on exmo.me website You'll be able to use 3 national currencies to swap with digital ones at CEX (CEX supports 2 fiat currencies less).

- EXMO accepts deposits from and allows withdrawals to 9 fiat payment systems / banks CEX allows the user to utilize 8 various fiat payment systems and/or banks (CEX supports 1 banks and fiat payment systems less).

- EXMO charges 0.15% — 5.95% fee CEX charges the client 0.3% — 3.99% fee, depending on the currency, payment system, etc. (CEX has lower fees in general).

- Buying limits at EXMO start from $1.00 and are up to $20,000 Deposit/withdraw limits at CEX are $20.00 — $10,000 depending on the payment method (CEX has lower buying/selling limits).

- EXMO allows registrations from 255 countries; United States is among the supported ones You may register at CEX if you reside in one of 224 countries; it serves United States among others (CEX supports less countries).

- Our visitors rated customer care at the EXMO 5.0 / 5.0 Customers' service at CEX exchange was rated 4.55 / 5.0 by our visitors (CEX customer care was rated less).

- During the account verification EXMO usually asks for 3 documents and/or procedures (id verification, address confirmation, selfie) and it takes no longer than an hour in most of the cases User identification at CEX usually consists of 3 different procedures: id verification, phone confirmation, selfie and the process usually takes no longer than an hour (While EXMO agrees on certain exceptions granting no verification for specific orders, CEX follows the stricter rules and sets more restrictions).

- Due to results of community feedback, EXMO process deposit/withdrawal orders in about in couple of minutes (although the exchange is instant) Due to results of community feedback, CEX process deposit/withdrawal orders in about in couple of minutes (although the exchange itself is instant) (CEX processes deposits and withdrawals slower).

- Our users left 20 testimonials about EXMO, 95% of which are positive We've collected 27 users testimonials about CEX, 100% are positive (CEX has better testimonials from the clients).

Although the final decision, which exchange — EXMO or CEX — is better is up to you, we'll try to help you with the decision. Both exchanges are great, since both exchanges are equally rated, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

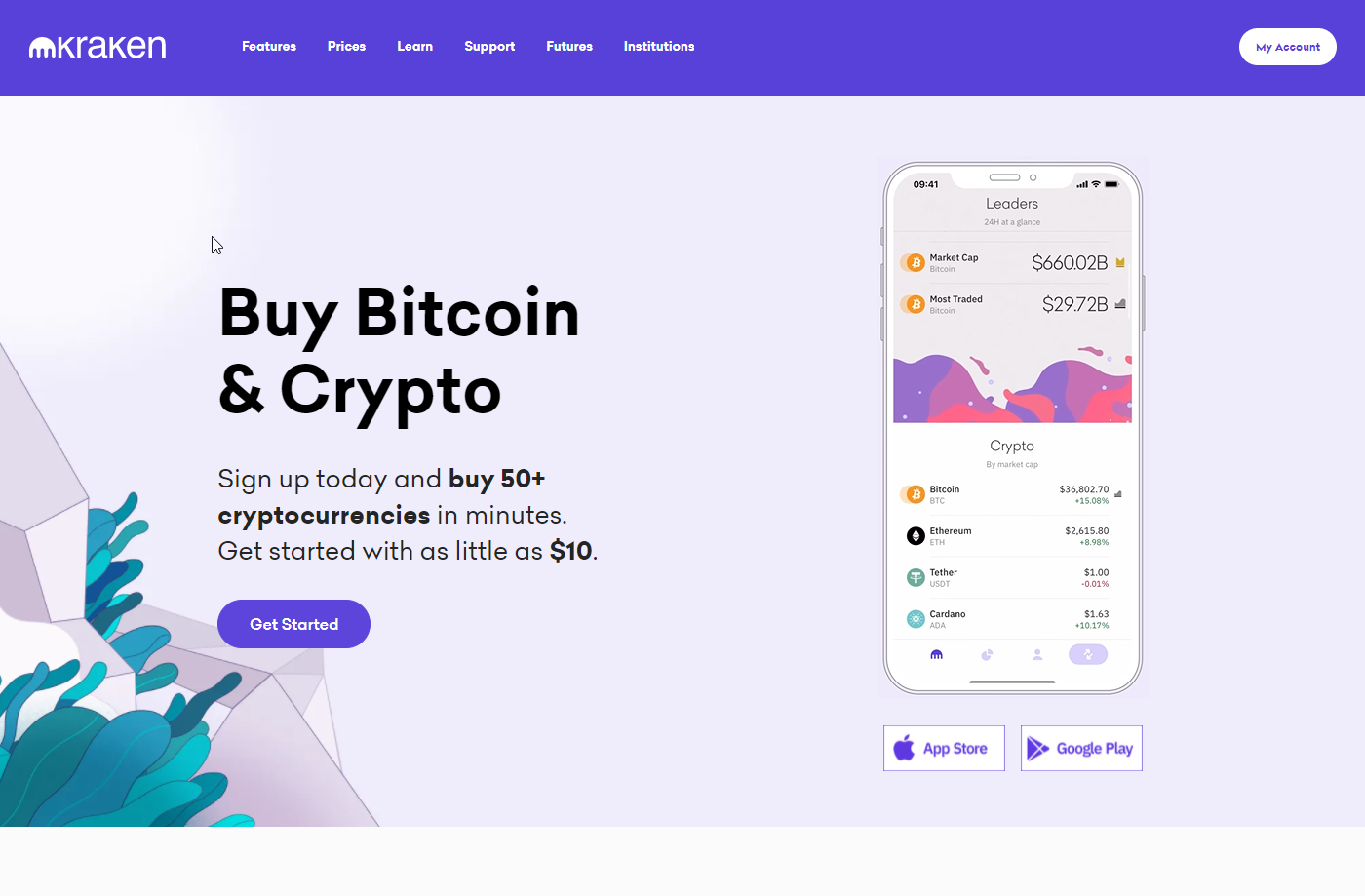

CEX vs Kraken

Let's compare the key features of these two platforms to see which one suits you best:

- Kraken is a trading platform CEX is a trading platform, both are using the same business model.

- Kraken had started the business July 2011 CEX started the business July 2014 (kraken.com is working for 2 years and 11 months longer time).

- kraken.com has all the required business licenses and permissions CEX has all the required business licenses and permissions (both exchange services operate using the same approach to the business, utilizing a same legal model).

- Besides buying, selling and exchanging cryptocurrencies, kraken.com provides the following extra services: Mobile wallet, OTC trading, Margin Trading, Futures Trading and the Staking, MasterNodes, etc. (passive income opportunity) CEX provides us with less services, related to the crypto exchange: it allows us to purchase and sell digital currencies, swap cryptocoins and tokens, and besides that: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and the Staking, MasterNodes, etc. (passive income opportunity).

- Kraken supports 34 cryptocurrencies and tokens CEX allows to swap 32 cryptos (CEX works with 2 cryptocurrencies & tokens fewer).

- 7 fiat currencies are available on kraken.com website You'll be able to use 3 national currencies to swap with digital ones at CEX (CEX supports 4 fiat currencies less).

- Kraken accepts deposits from and allows withdrawals to 10 fiat payment systems / banks CEX allows the user to utilize 8 various fiat payment systems and/or banks (CEX supports 2 banks and fiat payment systems less).

- Kraken charges 0.25% — 3.75% fee CEX charges the client 0.3% — 3.99% fee, depending on the currency, payment system, etc. (CEX has lower fees in general).

- Buying limits at Kraken start from $14.58 and are up to $365 Deposit/withdraw limits at CEX are $20.00 — $10,000 depending on the payment method (CEX has lower buying/selling limits).

- Kraken allows registrations from 234 countries; United States is among the supported ones You may register at CEX if you reside in one of 224 countries; it serves United States among others (CEX supports less countries).

- Our visitors rated customer care at the Kraken 5.0 / 5.0 Customers' service at CEX exchange was rated 4.55 / 5.0 by our visitors (CEX customer care was rated less).

- During the account verification Kraken usually asks for 2 documents and/or procedures (id verification, address confirmation) and it takes no longer than an hour in most of the cases User identification at CEX usually consists of 3 different procedures: id verification, phone confirmation, selfie and the process usually takes no longer than an hour (CEX's compliance program and fraud prevention policies oblige the client to complete more steps during the verification).

- Due to results of community feedback, Kraken process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated Due to results of community feedback, CEX process deposit/withdrawal orders in about in couple of minutes (although the exchange itself is instant) (CEX processes deposits and withdrawals slower).

- Our users left 3 testimonials about Kraken, 100% of which are positive We've collected 27 users testimonials about CEX, 100% are positive (CEX & Kraken share the same percentage of positive user reviews).

Although the final decision, which exchange — Kraken or CEX — is better is up to you, we'll try to help you with the decision. Both exchanges are great, since both exchanges are equally rated, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

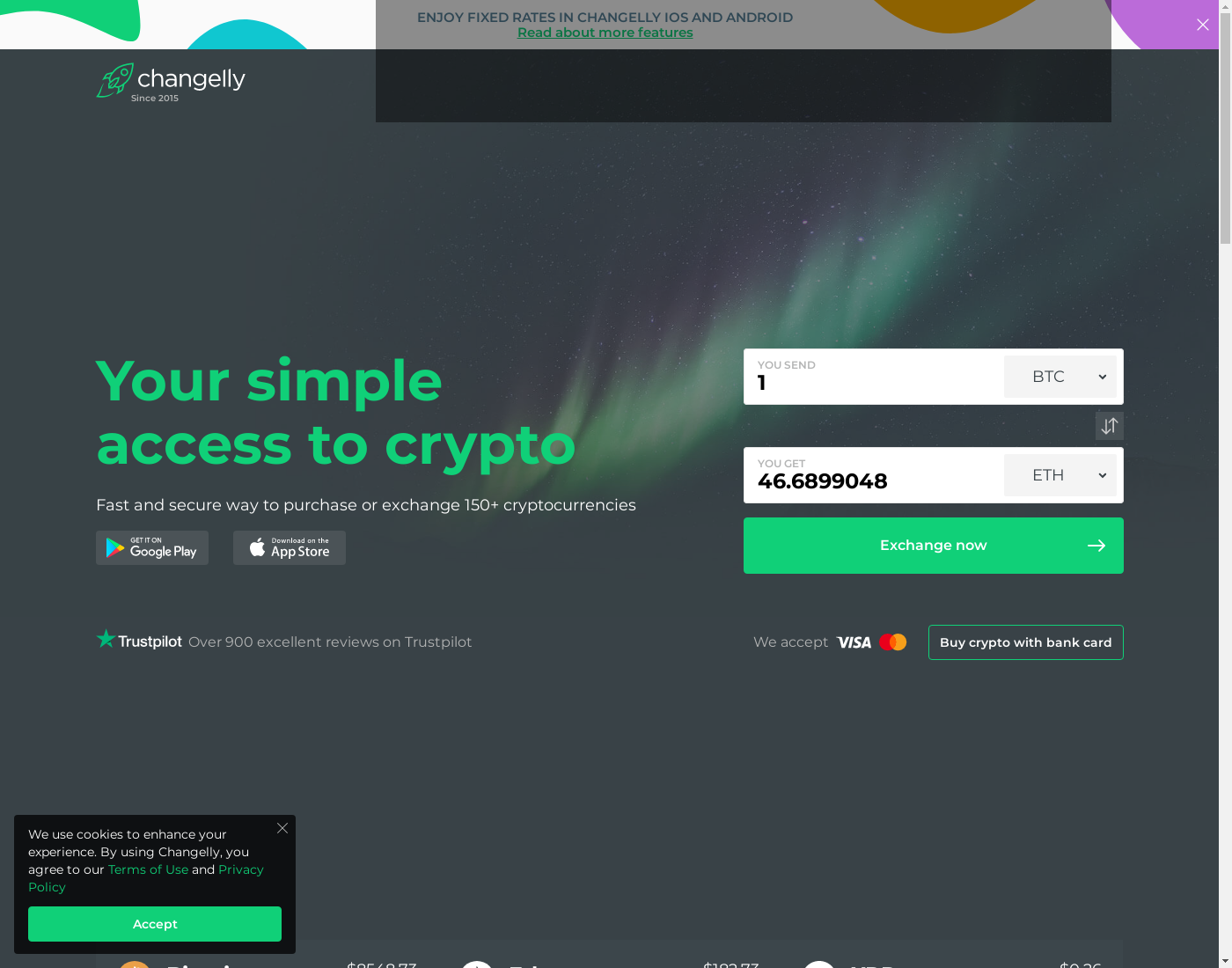

CEX vs Changelly

Let's compare the key features of these two platforms to see which one suits you best:

- Changelly is a broker CEX is a trading platform, it has a different business model (feel free to read about the differences between broker and trading platform)

- Changelly had started the business December 2013 CEX started the business July 2014 (changelly.com is working for 6 months longer time).

- Changelly is an ordinary company without licenses, etc. CEX has all the required business licenses and permissions (CEX utilizes a safer and more stable business model).

- Besides buying, selling and exchanging cryptocurrencies, Changelly provides no extra services CEX provides more exchange-related services: it allows us to purchase and sell digital currencies, swap cryptocoins and tokens, and besides that: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and the Staking, MasterNodes, etc. (passive income opportunity).

- Changelly supports 43 cryptocurrencies and tokens CEX allows to swap 32 cryptos (CEX works with 11 cryptocurrencies & tokens fewer).

- 34 fiat currencies are available on changelly.com website You'll be able to use 3 national currencies to swap with digital ones at CEX (CEX supports 31 fiat currencies less).

- Changelly accepts deposits from and allows withdrawals to 1 fiat payment systems / banks CEX allows the user to utilize 8 various fiat payment systems and/or banks (CEX supports 7 fiat payment systems and banks more).

- Changelly charges 7.25% fee CEX charges the client 0.3% — 3.99% fee, depending on the currency, payment system, etc. (CEX has lower fees in general).

- Buying limits at Changelly start from $30.00 and are up to $12,000 Deposit/withdraw limits at CEX are $20.00 — $10,000 depending on the payment method (CEX has lower buying/selling limits).

- Changelly allows registrations from 242 countries; we are sorry, but United States is not supported this time You may register at CEX if you reside in one of 224 countries; it serves United States among others (CEX supports less countries).

- Our visitors rated customer care at the Changelly 5.0 / 5.0 Customers' service at CEX exchange was rated 4.55 / 5.0 by our visitors (CEX customer care was rated less).

- During the account verification Changelly usually asks for 2 documents and/or procedures (id verification, address confirmation) User identification at CEX usually consists of 3 different procedures: id verification, phone confirmation, selfie and the process usually takes no longer than an hour (While Changelly agrees on certain exceptions granting no verification for specific orders, CEX follows the stricter rules and sets more restrictions).

- Due to results of community feedback, Changelly process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated Due to results of community feedback, CEX process deposit/withdrawal orders in about in couple of minutes (although the exchange itself is instant) (CEX processes deposits and withdrawals slower).

- Our users left 17 testimonials about Changelly, 94% of which are positive We've collected 27 users testimonials about CEX, 100% are positive (CEX has better testimonials from the clients).

Although the final decision, which exchange — Changelly or CEX — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although CEX has a better total rating 100 vs Changelly's 84, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

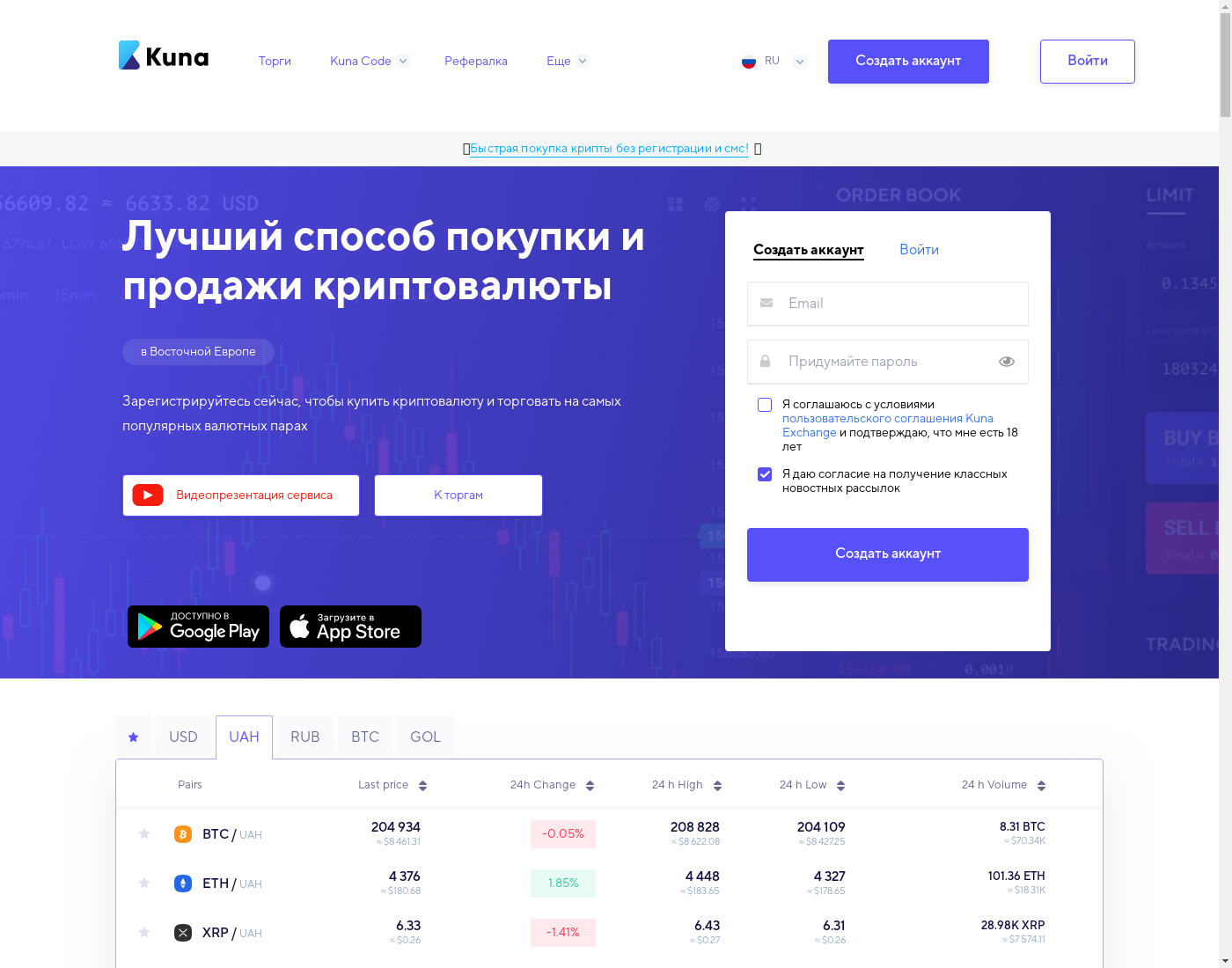

CEX vs Kuna

Let's compare the key features of these two platforms to see which one suits you best:

- Kuna is a trading platform CEX is a trading platform, both are using the same business model.

- Kuna had started the business January 2016 CEX started the business July 2014 (CEX operates 1 years and 5 months longer).

- Kuna is an ordinary company without licenses, etc. CEX has all the required business licenses and permissions (CEX utilizes a safer and more stable business model).

- Besides buying and selling cryptocurrencies, kuna.io provides the following extra services: Cash codes CEX provides more exchange-related services: it allows us to purchase and sell digital currencies, swap cryptocoins and tokens, and besides that: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and the Staking, MasterNodes, etc. (passive income opportunity).

- Kuna supports 1 cryptocurrency CEX allows to swap 32 cryptos (CEX additionally works with 31 added cryptocurrencies/tokens).

- 3 fiat currencies are available on kuna.io website You'll be able to use 3 national currencies to swap with digital ones at CEX (CEX & Kuna permit the same number of fiat currencys).

- Kuna accepts deposits from and allows withdrawals to 7 fiat payment systems / banks CEX allows the user to utilize 8 various fiat payment systems and/or banks (CEX supports 1 fiat payment systems and banks more).

- Kuna charges 1.0% — 3.0% fee CEX charges the client 0.3% — 3.99% fee, depending on the currency, payment system, etc. (CEX has lower fees in general).

- Buying limits at Kuna start from $1.00 and are up to $10,000 Deposit/withdraw limits at CEX are $20.00 — $10,000 depending on the payment method (CEX has lower buying/selling limits).

- Kuna allows registrations from 251 countries; we are sorry, but United States is not supported this time You may register at CEX if you reside in one of 224 countries; it serves United States among others (CEX supports less countries).

- Our visitors rated customer care at the Kuna 5.0 / 5.0 Customers' service at CEX exchange was rated 4.55 / 5.0 by our visitors (CEX customer care was rated less).

- Kuna allows the user to be anonymous, there is no account verification, etc. User identification at CEX usually consists of 3 different procedures: id verification, phone confirmation, selfie and the process usually takes no longer than an hour (Unlike kuna.io that agrees to serve anonyms, CEX abides certain KYC, AML/CTF policies, there's an account verification)

- Due to results of community feedback, Kuna process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated Due to results of community feedback, CEX process deposit/withdrawal orders in about in couple of minutes (although the exchange itself is instant) (CEX processes deposits and withdrawals slower).

- Our users left 4 testimonials about Kuna, 100% of which are positive We've collected 27 users testimonials about CEX, 100% are positive (CEX & Kuna share the same percentage of positive user reviews).

Although the final decision, which exchange — Kuna or CEX — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although CEX has a better total rating 100 vs Kuna's 84, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

Conclusion: is CEX legit or scam?

Now it's time to draw a conclusion, is cex.io a scam or is it a legit exchange? We are 100% sure CEX is the most trusted and absolutely legit exchange platform with an outstanding reputation in the crypto community; one of the industry leaders. There is no way it can be even considered to be called a scam! Let's summarize what we like most (and what we don't) about the CEX:

- It is licensed, regulatory compliant financial company

- The trading platform holds users' funds

- This company has being in the business for a long time; exchange was started 10 years ago

- Exchange supports 32 cryptocurrencies and 3 fiat ones (totally 8 payment systems / banks are available). Besides buying, selling and exchanging digital currencies, the following services are available: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and Staking, MasterNodes, etc. (passive income opportunity)

- It charges low fees: from 0.3% to 3.99% depending on the payment method; although the exchange of smaller amounts is rather inexpensive

- The purchase and withdrawal limits are among the highest: from $20.00 to $10,000 USD, it depends on a payment system choice

- CEX allows registrations from 224 countries; people from United States may use the service

- Clients' testimonials are perfect, 100% (27 out of 27) note their positive experience dealing with CEX. According to the customers feedback:

- Customer support is good

- Deposits and withdrawals are very fast

- Verification is really fast

Although you may find some complaints about CEX, all the businesses of this size have some. It's clearly a legit business with a good reputation and my own experience with the exchange confirms that it's a trusted and solid one. The only complaint I have is the KYC process. The Compliance team asked me more questions most of the banks do and although I was not trading hundreds BTC at once or something like that, I had to explain and confirm the source of funds, etc. The overall experience is great and other reviews you'll find at our platform confirm that.

Last but not least, according to our rating and the feedback from the CEX clientele, we consider it as "The best Trading Platform worldwide!" That means the platform really stands out from the 333 exchange services we monitor; our ranking algorithms and the input we got from the actual exchange customers confirm that. With all the features and positive reviews, it's obvious why CEX has been so successful for 10+ years and we invite you to check out by yourself!