Coinbase review & 27 testimonials for coinbase.com (05.2024)

- Overview: is Coinbase safe?

- Pros & Cons of Coinbase

- Services, Coinbase Provides

- Currencies & Payment Systems

- Coinbase fees

- Buying and selling limits

- Supported countries

- Customer service

- Verification at Coinbase

- Deposit/withdrawal speed

- Customers' testimonials

- FAQ about Coinbase

- Coinbase vs other exchanges

- Conclusion: is Coinbase legit or scam?

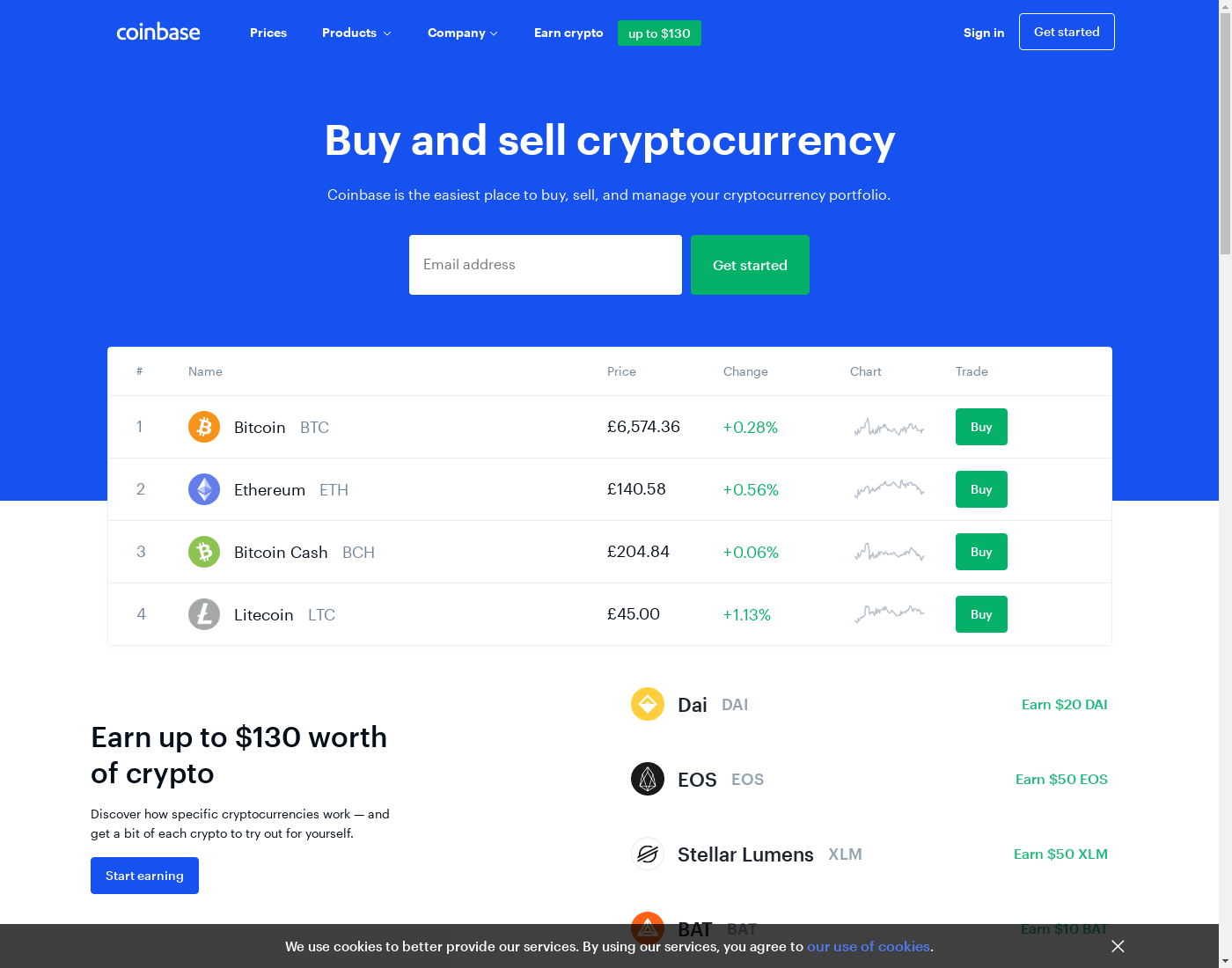

What is Coinbase in a nutshell? It's a trusted, respectable, well established, promising exchange service (e-wallet) working with 21 cryptocurrencies: you can buy and sell coins using 6 fiat currencies (8 banks & payment systems are supported). Exchange service started the business Jun 2012, it's a fully compliant, licensed financial company. Besides the cryptocurrencies exchange, Coinbase also provides other services, for example, ATM Cards, Merchant Services, Staking, MasterNodes, etc. (passive income opportunity). It also offers gifts to the clients!

This service integrated with a number of currencies, banks, and payment systems.

Hence to estimate the fees level we calculated an average fee you'll spend for an exchange here.

Based on this number

(2.25%)

we may say that Coinbase

charges

moderate fees:

1.0% — 3.99%

(in line with our statistics,

92%

exchanges offer lower average fee)

Coinbase has being assigned the special status: The best e-wallet worldwide! What does that mean? Our platform ranks all the exchanges basing on a number of factors: business model, licenses, time in the business, customers' testimonials, complaints (if any), etc. Then we compare all the leaders in each category (like e-wallet) to determine who's the best-of-the-best. Hence, we are pleased to say that Coinbase is exactly the one!

Based on all these facts, our verdict is the following: Coinbase is a 100% legit and perfectly safe place to buy and sell cryptocurrencies, almost an ideal exchange with great feedback we can recommend to our dear visitors!

Overview: is Coinbase safe?

Coinbase is the e-wallet; Coinbase, Inc. (dba Coinbase) started the business in June 2012. The company is based in the United States with the headquarters located in the San Francisco. Official Coinbase address is 548 Market St #23008 San Francisco, CA 94104. The firm is a licensed MSB, regulated by the FinCEN; it holds the Money Transmission license. FINCEN registration number 31000159729658.

Coinbase was founded by Brian Armstrong & Fred Ehrsam. Union Square Ventures, Andreessen Horowitz, Ribbit Capital, etc. are among the lead investors. Coinbase CEO is Brian Armstrong; other notable people are holding various positions in firm, for example Gavin Andresen (Advisor).

It's one of the biggest and most popular exchanges in the world with millions of customers worldwide; a "unicorn" — business valued over a billion USD. Non-US clients are served by the UK-based entity, authorized by the FCA.

Coinbase has a long history, it started the business as bitcoin brokerage (one of the first in the US and worldwide), adding a number of other services along the way. It's extremely popular in the US and is one of the most trusted exchanges worldwide.

Pros & Cons of Coinbase

Since Coinbase is rated as one of the best exchanges in the world by our visitors, there should be many strong sides clients admire and probably some downsides anyway. Let's check it out:

- It's very stable and reliable exchange service operating from 2012.06. Fully compliant and regulated business, service provided by licensed financial company.

- Coinbase earned perfect testimonials from the clientele.

- 21 digital currencies and 6 fiat ones are supported: definitely a good choice! 8 payment systems and banks are supported, both international and national ones: Visa & Mastercard, Any Local Bank, SEPA Transfer, etc.

- Fees are relatively low.

- High purchase and withdrawal limits, convenient min/max amounts.

- Many countries are not supported, please check if yours is in this list before registering!

- Account verification can take a long time; (due to the results of polls taken from the clients).

- E-wallet utilizes a business model based on holding the clients funds at the online wallet; such approach has some risks.

Seems that there are not so many cons, but a lot of pros. We hope you will enjoy your experience exchanging at Coinbase! Try Coinbase today and let us know how you like it!

Services, Coinbase Provides

The platform provides the following cryptocurrency exchange-related services:

- Allows the customers to buy cryptocurrencies with fiat currencies

- Provides the clients with ways to "cash out" the crypto to fiat currency

- Issues ATM cards (debit cards) you can load with coins to shop with cryptocurrency, etc.

- Provides merchant services (accepting cryptocurrency at e-stores, etc.)

- And other ones! The full list: ATM Cards, Merchant Services and Staking, MasterNodes, etc. (passive income opportunity).

That's impressive number of features! According to our statistics, 92% of the competition provide less services, many just allow the buying and selling, so this e-wallet is among the champions in this field!

Currencies & Payment Systems

Coinbase provides the service of buying and selling 21 digital currencies using fiat currencies. The following cryptocurrencies are available to buy/sell: Aave (AAVE), Bitcoin Cash (BCHABC), Bitcoin (BTC), MakerDAO (DAI), Dogecoin (DOGE), EOS (EOS), Ether Classic (ETC), Ether (ETH), Filecoin (FIL), Internet Computer (ICP), Chainlink (LINK), Litecoin (LTC), Polygon (MATIC), SKALE (SKL), SushiSwap (SUSHI), Uniswap (UNI), USD Coin (USDC), Wrapped Bitcoin (WBTC), Stellar (XLM), Zcash (ZEC), 0x (ZRX).

There are not much exchanges with so many cryptos supported! If you are not sure, which one of these electronic currencies you are most interested in, you are welcome to read our guides. For example, these: Top 100 cryptocurrencies 2024 to invest.

6 fiat currencies are supported to provide crypto purchase and selling: Australian Dollar (AUD), Canadian Dollar (CAD), Euro (EUR), Pound Sterling (GBP), Singapore Dollar (SGD), US Dollar (USD). The e-wallet will let you buy and sell Bitcoins and 20 other cryptos using the following payment systems:

- Visa & Mastercard. An international payment system (available worldwide) allowing credit/debit cards payments in various currencies. CAD, USD, AUD, EUR, SGD and GBP payments are available for both buying and selling cryptocurrencies at this exchange. Visa & Mastercard is a popular way to buy BTC and other cryptocurrencies available at 7 exchanges of various types. You are welcome to find the best rate for buying bitcoin with visa & mastercard at our home page!

- Any Local Bank. An universal payment method, allowing payments from/to all the banks in various currencies. coinbase.com has options to use local bank transfers in the United States. Just the USD payments are available for both buying and selling cryptocurrencies at this exchange.

- SEPA Transfer. An international payment system (it's available in 46 countries) allowing international bank transfers payments in Euro currency. Just the EUR payments are available for both buying and selling cryptocurrencies at this exchange.

- Faster Payments. A local bank (serving United Kingdom) in Pound Sterling currency. Just the GBP payments are available for both buying and selling cryptocurrencies at this exchange.

- SWIFT Transfer. An international payment system (available worldwide) allowing international bank transfers payments in various currencies. Just the USD payments are available for both buying and selling cryptocurrencies at this exchange.

- Paypal. An international payment system (it's available in 232 countries) allowing e-wallet payments in various currencies. EUR, USD, CAD and GBP payments are available for selling cryptocurrency to fiat solely; at the time you can't buy crypto using this payment method here.

- SOFORT (Klarna). A local bank (it's available in 13 countries) in various currencies. Just the EUR payments are available for purchasing cryptos at the exchange.

- iDEAL. A local bank (serving Netherlands) in Euro currency. Just the EUR payments are available for purchasing cryptos at the exchange.

Coinbase fees

The fees you need to pay at this e-wallet during the process of buying and selling cryptocurrencies are easier to understand if you break it down like that (note that you can skip the details, jumping to the conclusion):

-

Deposit/withdrawal fee.

Depending on the fiat payment system and currency, it's as follows:

- 1.49% (but not less than $1.49) to deposit funds by Any Local Bank in US Dollar.

- Commission for the money withdrawal to Any Local Bank in US Dollar: 1.49% (but not less than $1.49)

- 1.49% to deposit funds by Faster Payments in Pound Sterling.

- Commission for the money withdrawal to Faster Payments in Pound Sterling: 1.49% + £1.0 (but not less than £1.49)

- 1.49% to deposit funds by iDEAL in Euro.

- Commission for the money withdrawal to Paypal in Pound Sterling: 1.49% (but not less than £1.49)

- Commission for the money withdrawal to Paypal in Euro: 1.49%

- Commission for the money withdrawal to Paypal in US Dollar: 1.49%

- Commission for the money withdrawal to Paypal in Canadian Dollar: 1.0%

- 1.49% to deposit funds by SEPA Transfer in Euro.

- Commission for the money withdrawal to SEPA Transfer in Euro: 1.49% + 0.15 (but not less than 1.49)

- 1.49% to deposit funds by SEPA Transfer in Euro.

- Commission for the money withdrawal to SEPA Transfer in Euro: 1.49% + €0.15

- 1.49% to deposit funds by SOFORT (Klarna) in Euro.

- 1.49% + $10.0 to deposit funds by SWIFT Transfer in US Dollar.

- Commission for the money withdrawal to SWIFT Transfer in US Dollar: 1.49% + $25.0

- 3.99% (but not less than $1.49) to deposit funds by Visa & Mastercard in US Dollar.

- 3.99% (but not less than 1.49) to deposit funds by Visa & Mastercard in Canadian Dollar.

- Commission for the money withdrawal to Visa & Mastercard in Euro: 2.0% + €0.55

- 3.99% to deposit funds by Visa & Mastercard in Mexican Peso.

- 3.99% to deposit funds by Visa & Mastercard in Chilean Peso.

- 3.99% (but not less than 1.49) to deposit funds by Visa & Mastercard in Australian Dollar.

- 3.99% (but not less than €1.49) to deposit funds by Visa & Mastercard in Euro.

- 3.99% (but not less than £1.49) to deposit funds by Visa & Mastercard in Pound Sterling.

- 3.99% (but not less than 1.49) to deposit funds by Visa & Mastercard in Singapore Dollar.

- Commission for the money withdrawal to Visa & Mastercard in US Dollar: 1.5% + $0.55

- Commission for the money withdrawal to Visa & Mastercard in Pound Sterling: 2.0% + £0.55

-

Cryptocurrency withdrawal fee.

Please note that this fee applies only when you

transfer the crypto out of this wallet: to the third party, etc.

- the usual transaction fee in the according crypto, when you are buying: AAVE, BCHABC, BTC, DAI, DOGE, EOS, ETC, ETH, FIL, ICP, LINK, LTC, MATIC, SKL, SUSHI, UNI, USDC, WBTC, XLM, ZEC, ZRX.

- 0 BTC: great news! at the moment there is no such a fee!

Are Coinbase fees high or low?

Now it's time to draw a conclusion: considering the average fee the exchange charges for an operation we can state that Coinbase charges moderate fees. According to our statistics, most of the exchanges charges about the same fees Coinbase does. For example, an average fee you pay to buy Bitcoin with Visa & Mastercard in USD across various exchange brokers, trading platforms, p2p marketplaces and e-wallets is 0%, coinbase.com charges 3.99% for this. Seems fair.

Buying and selling limits

This e-wallet has the following limits, applicable when you buy or sell cryptocurrencies:

-

Purchase limits (when you buy crypto).

- $2 minimal buy and $25,000 max purchase when using Any Local Bank in US Dollar.

- £2 minimal buy and £25,000 max purchase when using Faster Payments in Pound Sterling.

- €1 minimal buy and €10,000 max purchase when using iDEAL in Euro.

- EUR 2 minimal buy and EUR 25,000 max purchase when using SEPA Transfer in Euro.

- €1 minimal buy and €50,000 max purchase when using SEPA Transfer in Euro.

- €1 minimal buy and €10,000 max purchase when using SOFORT (Klarna) in Euro.

- $2 minimal buy and $25,000 max purchase when using SWIFT Transfer in US Dollar.

- $2 minimal buy and $5,000 max purchase when using Visa & Mastercard in US Dollar.

- CAD 2 minimal buy and CAD 5,000 max purchase when using Visa & Mastercard in Canadian Dollar.

- MXN 2 minimal buy and USD 10,000 max purchase when using Visa & Mastercard in Mexican Peso.

- CLP 2 minimal buy and USD 5,000 max purchase when using Visa & Mastercard in Chilean Peso.

- AUD 2 minimal buy and AUD 5,000 max purchase when using Visa & Mastercard in Australian Dollar.

- €2 minimal buy and €5,000 max purchase when using Visa & Mastercard in Euro.

- £2 minimal buy and £5,000 max purchase when using Visa & Mastercard in Pound Sterling.

- SGD 2 minimal buy and SGD 5,000 max purchase when using Visa & Mastercard in Singapore Dollar.

-

Withdrawal limits (when you out-exchange crypto to the fiat money).

- $2 min and $25,000 maximal withdrawal when receiving money to Any Local Bank in US Dollar.

- £2 min and £25,000 maximal withdrawal when receiving money to Faster Payments in Pound Sterling.

- £2 min and £6,500 maximal withdrawal when receiving money to Paypal in Pound Sterling.

- €1 min and €7,500 maximal withdrawal when receiving money to Paypal in Euro.

- $2 min and $10,000 maximal withdrawal when receiving money to Paypal in US Dollar.

- CAD 1 min and CAD 12,000 maximal withdrawal when receiving money to Paypal in Canadian Dollar.

- EUR 2 min and EUR 25,000 maximal withdrawal when receiving money to SEPA Transfer in Euro.

- €1 min and €50,000 maximal withdrawal when receiving money to SEPA Transfer in Euro.

- $2 min and $25,000 maximal withdrawal when receiving money to SWIFT Transfer in US Dollar.

And the good news: there are no limits on other payment systems (the limitations the payment system has aside) Coinbase supports! Comparing to other exchanges, Coinbase has a very convenient buying/selling limits setup; the minimal amount is tiny and the max is high. Whatever amount you have in mind, you can exchange it at this e-wallet!

Supported countries

Platform allows the users from 39 countries to use the exchange. The following countries are supported by the e-wallet:

- Andorra (AD)

- Australia (AU)

- Austria (AT)

- Belgium (BE)

- Bulgaria (BG)

- Canada (CA)

- Chile (CL)

- Croatia (HR)

- Cyprus (CY)

- Czech Republic (CZ)

- Denmark (DK)

- Finland (FI)

- Gibraltar (GI)

- Greece (GR)

- Guernsey (GG)

- Hungary (HU)

- Iceland (IS)

- Ireland (IE)

- Isle of Man (IM)

- Italy (IT)

- Latvia (LV)

- Liechtenstein (LI)

- Lithuania (LT)

- Malta (MT)

- Mexico (MX)

- Monaco (MC)

- Netherlands (NL)

- Norway (NO)

- Poland (PL)

- Portugal (PT)

- San Marino (SM)

- Singapore (SG)

- Slovakia (SK)

- Slovenia (SI)

- Spain (ES)

- Sweden (SE)

- Switzerland (CH)

- United Kingdom (GB)

- United States (US)

Does Coinbase allow the users from United States (US)?

Yes, coinbase.com allows the registrations from the United States! E-wallet permits the users from 56 states and territories to register at and use the services exchange provides:

- Alabama (AL)

- Alaska (AK)

- American Samoa (AS)

- Arizona (AZ)

- Arkansas (AR)

- California (CA)

- Colorado (CO)

- Connecticut (CT)

- Delaware (DE)

- District of Columbia (DC)

- Florida (FL)

- Georgia (GA)

- Guam (GU)

- Hawaii (HI)

- Idaho (ID)

- Illinois (IL)

- Indiana (IN)

- Iowa (IA)

- Kansas (KS)

- Kentucky (KY)

- Louisiana (LA)

- Maine (ME)

- Maryland (MD)

- Massachusetts (MA)

- Michigan (MI)

- Minnesota (MN)

- Mississippi (MS)

- Missouri (MO)

- Montana (MT)

- Nebraska (NE)

- Nevada (NV)

- New Hampshire (NH)

- New Jersey (NJ)

- New Mexico (NM)

- New York (NY)

- North Carolina (NC)

- North Dakota (ND)

- Northern Mariana Islands (MP)

- Ohio (OH)

- Oklahoma (OK)

- Oregon (OR)

- Pennsylvania (PA)

- Puerto Rico (PR)

- Rhode Island (RI)

- South Carolina (SC)

- South Dakota (SD)

- Tennessee (TN)

- Texas (TX)

- U.S. Virgin Islands (VI)

- Utah (UT)

- Vermont (VT)

- Virginia (VA)

- Washington (WA)

- West Virginia (WV)

- Wisconsin (WI)

- Wyoming (WY)

It's possible to use the USD currency to buy/sell 21 cryptocurrencies at the Coinbase: 4 banks and payment systems totally (out of the 8 the e-wallet supports, that's 50% of all the available ones) can be used by people from the U.S.A.:

- Any Local Bank

- Paypal — please note — just the withdrawals to this payment system are available at the moment!

- Visa & Mastercard

- SWIFT Transfer

Customer service

Verification at Coinbase

The e-wallet requires it's clients to pass through obligatory user identification (account verification). The following procedures should be completed before the client will be able to buy and sell on the exchange:

- ID verification

- Phone confirmation

According to the data submitted by the customers with the reviews and testimonials, the average time the account verification takes is no less than a couple of days. The feedback is the following:

Looks like this exchange is among the slowest ones in the field. But remember, you have to pass through the user identification only once!

Deposit/withdrawal speed

Although the exchange process is fully automated on any e-wallet or trading platform, you may face some delay when you send the money "outside", i.e. say you are withdrawing the BTC you purchased to your personal wallet. Let's see what other cryptocurrency enthusiasts say about how fast is coinbase.com!

Is Coinbase instant?

So, what can we see? According to the feedback we got from other users of this e-wallet worldwide, Coinbase is instant: money arrives right after you order it all the time. That's great to know!

Customers' testimonials

Our users left 25 testimonials about their experience dealing with Coinbase, 96% of the testimonials are positive, 4% are neutral and there are 0 negative ones. Feel free to read as many of these as you like!

Bought ETH few times, smooth transactions on all occasions

worked OK, exchanged $500 today, 5* service

My favorite exchange and wallet. The most trusted in the US. ✌

Use it for years, zero issues so far. It's a most trusted service I used in the industry! 👍🏿

One of the exchanges I used almost since my day one in crypto. What can I say, it's super reliable for sure. Such huge companies won't steal from customers )) The support is far from good though, seems they have TOO MUCH clients to serve them all. KYC can also be ridiculous like "you use your money for gambling => BANNED". But if you just need fast buy/sell option and your country is supported. IT'S ALMOST PERFECT ONE! 👍 just remember that the support is bad, hopefully you won't need it )

Used this one and Coinbae Pro also, not bad but there are better ones IMO. But if you are just startin with crypto and stuff, this is a smart choice

Support may be some slow in case of responding time to tickets and verification time but also very helpful. All my purchases and cashouts were done without troubles. Thank you!

there are plenty of exchanges for aussies, but this is one of tops! limits are good at least for my case and everything is fast

Once it was the best exchange for me, now just OK but I found better. What I like is the design and interface and what I don't - slow support and rather small limits. The fees are reasonable.

Cool exchange for CAD, one of the best I ever tried bro! 🙏 Thank you for amazing service!

I used this exchange several times and have never had a problem. All my transactions, crypto and fiat, have completed rapidly, never had to contact support. Account verification was also rather fast

Wallet is good. Bad is that India is not supported country to add money! I wish one day to see us in the list

Nice wallet and good deposit options. My choice, I recommend to all!

I bought my first sats here. Good wallet for a noob! Safe and easy

Trusted exchange, but customer support is slow as a sloth. Or worse? Good that I have no problems, but when you need to ask smth, it may result in a looooong wait.

One of the best exchange sites web I ever tried. Works perfect for me!

Coinbase has one of the lowest fees when you buy BTC with your Visa or MasterCard debit or credit card. I am not sure they accept prepaid and gift cards but if your card has a name on it and it's yours 😁 Coinbase will be great choice.

Good one. No need to store money here especially if you are goin to spend it for something you won't tell everyone or your momma 😅 but to buy with your card this is one of the best!!!

Good exchange. Everything is cool but the support is unbeliaveably slow and sometimes too mush questions asked. I've heard you can wait for weeks! In my case it was days, very bad result anyway. They also love to block accounts when you gamble etc. Why I can't spend my own money for something I like. AND WHY YOU EVEN CARE HOW I SPEND MY COINS?? What's wrong with you people?? 🥶

It was my first wallet when I started use cryptocurrencies. Very easy to start and deposit money. Some people say their support is awful, but honestly, why would you even need it?? Everything works well so I dunno, there is no need in anything else. I vouch for Coinbase, it's one of the best crypto wallets and the best one with fiat deposits!

Coinbase is a very good service if you just buy coins here and transfer to some wallet of your choice. Just remember that and you'd love the coinbase like I do!

I use it for a while buying some BTC with my MasterCard. All works perfectly, thanks !!!

Overall result if great! 100% positive testimonials is something the business owners are very proud of, such a rating is hard to get and even harder to maintain! It means the community really trusts and likes the Coinbase services, so most likely, you'd enjoy it too!

FAQ about Coinbase

Does Coinbase holds my funds?

Yes, it does. Although you can always withdraw the funds to your e-currency wallet "by default" Coinbase holds your balance at it's own hot storage wallet. That's something all e-wallet providers do; it's their main purpose, after all!

Is Coinbase a good e-wallet?

According to our rating and the clients' testimonials, it is! Feel free to get acquainted with the details reading this review or just jump to the conclusion!

Is Coinbase licensed? Does it hold e-money license?

Yes, Coinbase, Inc. (entity doing business as Coinbase exchange) is licenced and regulated financial company. It holds Money Transmission license and is regulated by the FinCEN of the United States.

Is Coinbase registered with the FINCEN?

Yes, Coinbase, Inc. aka Coinbase is registered with the U.S. Financial Intelligence Unit as Money Services Business (MSB); FinCEN registration number is 31000159729658.

Does Coinbase provide a debit card (ATM card)?

Yes, Coinbase provides such a card, you can get one if you are residing in any of the supported countries.

Does Coinbase provide services for the merchants willing to accept crypto?

It is! You may accept payments in all the cryptocurrencies supported by the Coinbase and get paid in fiat or your preferred crypto.

Is Coinbase a ripoff?

It definitely isn't! Feel free to read the whole this review to understand why or check our conclusion: is Coinbase legit or scam.

Is Coinbase FDIC Insured?

If you are a United States resident, your Coinbase USD Wallet is covered by FDIC insurance, up to a maximum of $250,000. Please note that the insurance won't cover the loses resulting from from unauthorized access to your personal account(s).

Coinbase vs other exchanges

Let's compare coinbase.com to other similar exchange services with more or less the same features: others of e-wallet type mostly. Besides, seems reasonable to compare the platform with the exchanges having similar rating and serving (mostly) the same geographic, etc. Remember that if you wish to find the exchange offering the best price to buy/sell Bitcoin and 50 other cryptos, check the best rates to buy bitcoin and crypto in United States!

Coinbase vs CEX

Let's compare the key features of these two platforms to see which one suits you best:

- CEX is a trading platform Coinbase is an e-wallet, it has a different business model (feel free to read about the differences between trading platform and e-wallet)

- CEX had started the business July 2014 Coinbase started the business June 2012 (Coinbase operates 2 years and 1 months longer).

- cex.io has all the required business licenses and permissions Coinbase has all the required business licenses and permissions (both exchange services operate using the same approach to the business, utilizing a same legal model).

- Besides buying, selling and exchanging cryptocurrencies, cex.io provides the following extra services: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and the Staking, MasterNodes, etc. (passive income opportunity) Coinbase provides us with less services, related to the crypto exchange: it allows us to purchase and sell digital currencies, and besides that: ATM Cards, Merchant Services and the Staking, MasterNodes, etc. (passive income opportunity).

- CEX supports 32 cryptocurrencies and tokens Coinbase allows to swap 21 cryptos (Coinbase works with 11 cryptocurrencies & tokens fewer).

- 3 fiat currencies are available on cex.io website You'll be able to use 6 national currencies to swap with digital ones at Coinbase (Coinbase supports 3 fiat currencies more).

- CEX accepts deposits from and allows withdrawals to 8 fiat payment systems / banks Coinbase allows the user to utilize 8 various fiat payment systems and/or banks (Coinbase & CEX support the same number of banks and payment systems).

- CEX charges 0.3% — 3.99% fee Coinbase charges the client 1.0% — 3.99% fee, depending on the currency, payment system, etc. (Coinbase has higher fees, generally).

- CEX offers no gifts to the customers, cashback is also not available Coinbase offers gifts to the customers (Coinbase & CEX both provide the same bonuses for customers).

- Buying limits at CEX start from $20.00 and are up to $10,000 Deposit/withdraw limits at Coinbase are $2.00 — $5,000 depending on the payment method (Coinbase has lower buying/selling limits).

- CEX allows registrations from 224 countries; United States is among the supported ones You may register at Coinbase if you reside in one of 39 countries; it serves United States among others (Coinbase supports less countries).

- During the account verification CEX usually asks for 3 documents and/or procedures (id verification, phone confirmation, selfie) and it takes no less than a couple of days in most of the cases User identification at Coinbase usually consists of 2 different procedures: id verification, phone confirmation and the process usually takes no less than a couple of days (Coinbase's KYC, AML, etc programs and policies permit a user to finish fewer procedures, to share reduced personal information).

- Due to results of community feedback, CEX process deposit/withdrawal orders in about in couple of minutes (although the exchange is instant) Due to results of community feedback, Coinbase process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated (Coinbase processes deposits and withdrawals faster

- Our users left 27 testimonials about CEX, 100% of which are positive We've collected 25 users testimonials about Coinbase, 96% are positive (Coinbase & CEX was rated lower by the community).

Although the final decision, which exchange — CEX or Coinbase — is better is up to you, we'll try to help you with the decision. Both exchanges are great, since both exchanges are equally rated, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

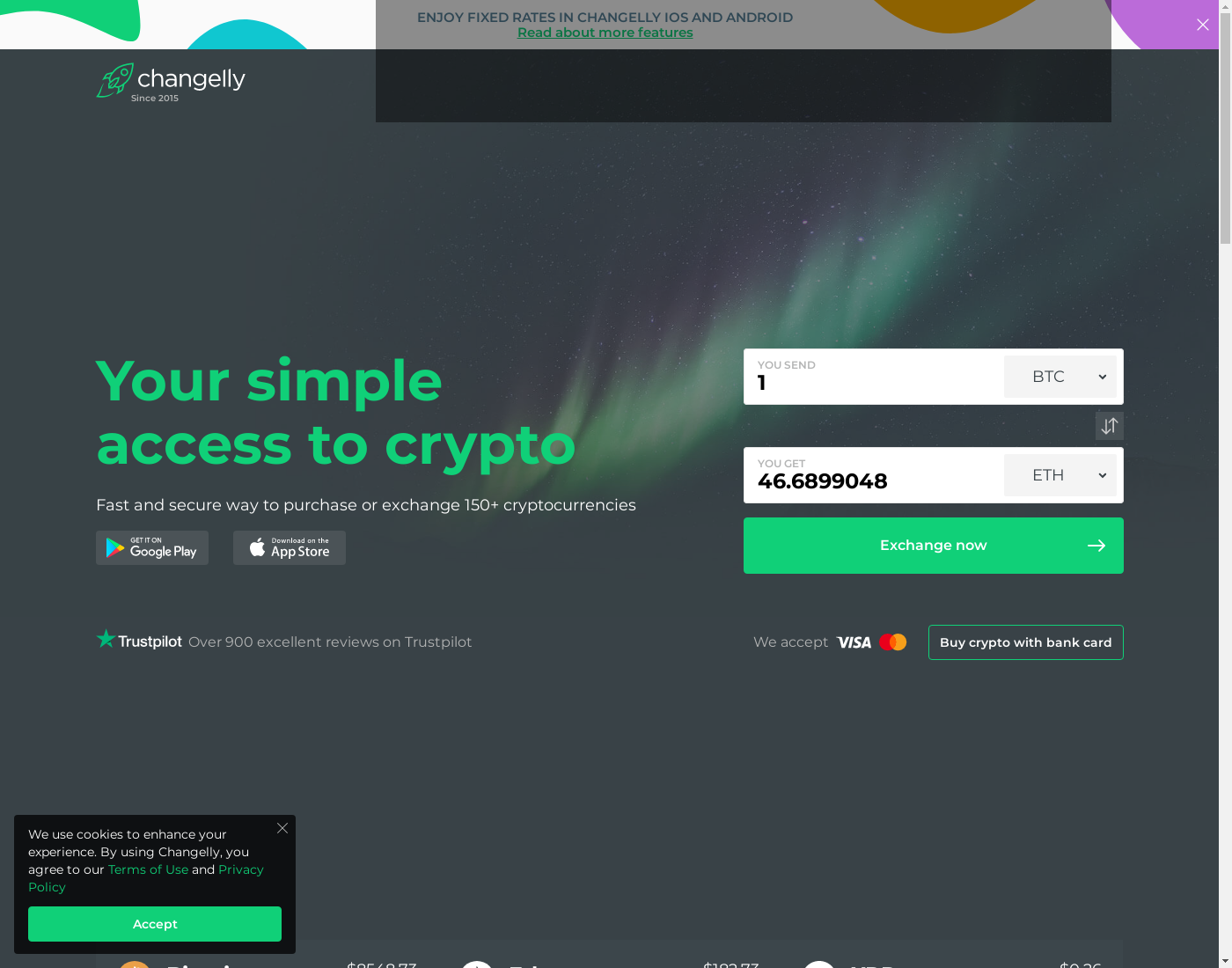

Coinbase vs Changelly

Let's compare the key features of these two platforms to see which one suits you best:

- Changelly is a broker Coinbase is an e-wallet, it has a different business model (feel free to read about the differences between broker and e-wallet)

- Changelly had started the business December 2013 Coinbase started the business June 2012 (Coinbase operates 1 years and 6 months longer).

- Changelly is an ordinary company without licenses, etc. Coinbase has all the required business licenses and permissions (Coinbase utilizes a safer and more stable business model).

- Besides buying, selling and exchanging cryptocurrencies, Changelly provides no extra services Coinbase provides more exchange-related services: it allows us to purchase and sell digital currencies, and besides that: ATM Cards, Merchant Services and the Staking, MasterNodes, etc. (passive income opportunity).

- Changelly supports 43 cryptocurrencies and tokens Coinbase allows to swap 21 cryptos (Coinbase works with 22 cryptocurrencies & tokens fewer).

- 34 fiat currencies are available on changelly.com website You'll be able to use 6 national currencies to swap with digital ones at Coinbase (Coinbase supports 28 fiat currencies less).

- Changelly accepts deposits from and allows withdrawals to 1 fiat payment systems / banks Coinbase allows the user to utilize 8 various fiat payment systems and/or banks (Coinbase supports 7 fiat payment systems and banks more).

- Changelly charges 7.25% fee Coinbase charges the client 1.0% — 3.99% fee, depending on the currency, payment system, etc. (Coinbase & Changelly charge the customer with the equal fee level, more or less).

- Changelly offers no gifts to the customers, cashback is also not available Coinbase offers gifts to the customers (Coinbase & Changelly both provide the same bonuses for customers).

- Buying limits at Changelly start from $30.00 and are up to $12,000 Deposit/withdraw limits at Coinbase are $2.00 — $5,000 depending on the payment method (Coinbase has lower buying/selling limits).

- Changelly allows registrations from 242 countries; we are sorry, but United States is not supported this time You may register at Coinbase if you reside in one of 39 countries; it serves United States among others (Coinbase supports less countries).

- During the account verification Changelly usually asks for 2 documents and/or procedures (id verification, address confirmation) User identification at Coinbase usually consists of 2 different procedures: id verification, phone confirmation and the process usually takes no less than a couple of days (While Changelly agrees on certain exceptions granting no verification for specific orders, Coinbase follows the stricter rules and sets more restrictions).

- Due to results of community feedback, Changelly process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated Due to results of community feedback, Coinbase process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated (Coinbase & Changelly process the deposits and withdrawals with equal speed).

- Our users left 17 testimonials about Changelly, 94% of which are positive We've collected 25 users testimonials about Coinbase, 96% are positive (Coinbase has better testimonials from the clients).

Although the final decision, which exchange — Changelly or Coinbase — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although Coinbase has a better total rating 100 vs Changelly's 84, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

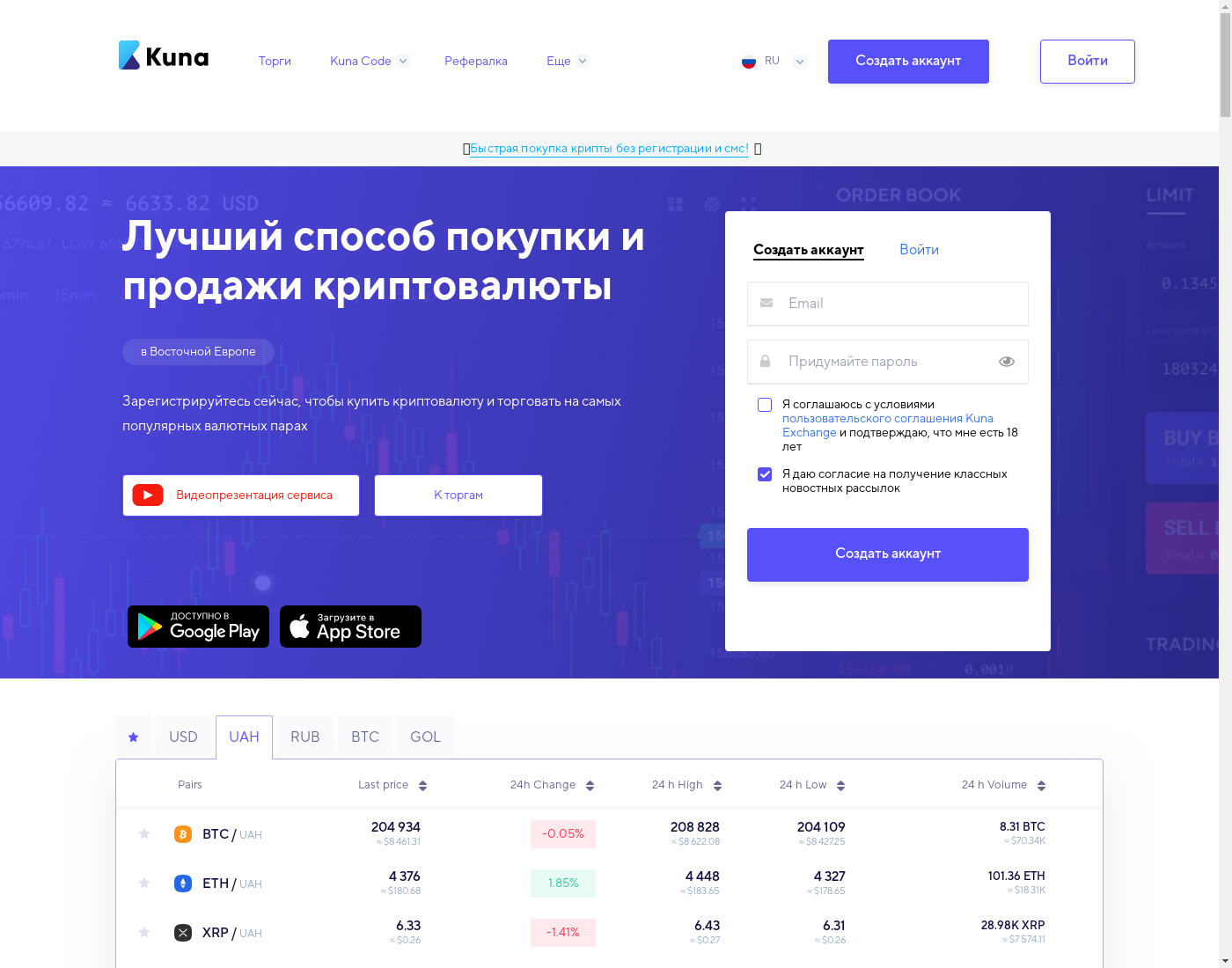

Coinbase vs Kuna

Let's compare the key features of these two platforms to see which one suits you best:

- Kuna is a trading platform Coinbase is an e-wallet, it has a different business model (feel free to read about the differences between trading platform and e-wallet)

- Kuna had started the business January 2016 Coinbase started the business June 2012 (Coinbase operates 3 years and 6 months longer).

- Kuna is an ordinary company without licenses, etc. Coinbase has all the required business licenses and permissions (Coinbase utilizes a safer and more stable business model).

- Besides buying and selling cryptocurrencies, kuna.io provides the following extra services: Cash codes Coinbase provides more exchange-related services: it allows us to purchase and sell digital currencies, and besides that: ATM Cards, Merchant Services and the Staking, MasterNodes, etc. (passive income opportunity).

- Kuna supports 1 cryptocurrency Coinbase allows to swap 21 cryptos (Coinbase additionally works with 20 added cryptocurrencies/tokens).

- 3 fiat currencies are available on kuna.io website You'll be able to use 6 national currencies to swap with digital ones at Coinbase (Coinbase supports 3 fiat currencies more).

- Kuna accepts deposits from and allows withdrawals to 7 fiat payment systems / banks Coinbase allows the user to utilize 8 various fiat payment systems and/or banks (Coinbase supports 1 fiat payment systems and banks more).

- Kuna charges 1.0% — 3.0% fee Coinbase charges the client 1.0% — 3.99% fee, depending on the currency, payment system, etc. (Coinbase has higher fees, generally).

- Kuna offers no gifts to the customers, cashback is also not available Coinbase offers gifts to the customers (Coinbase & Kuna both provide the same bonuses for customers).

- Buying limits at Kuna start from $1.00 and are up to $10,000 Deposit/withdraw limits at Coinbase are $2.00 — $5,000 depending on the payment method (Coinbase has lower buying/selling limits).

- Kuna allows registrations from 251 countries; we are sorry, but United States is not supported this time You may register at Coinbase if you reside in one of 39 countries; it serves United States among others (Coinbase supports less countries).

- Kuna allows the user to be anonymous, there is no account verification, etc. User identification at Coinbase usually consists of 2 different procedures: id verification, phone confirmation and the process usually takes no less than a couple of days (Unlike kuna.io that agrees to serve anonyms, Coinbase abides certain KYC, AML/CTF policies, there's an account verification)

- Due to results of community feedback, Kuna process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated Due to results of community feedback, Coinbase process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated (Coinbase & Kuna process the deposits and withdrawals with equal speed).

- Our users left 4 testimonials about Kuna, 100% of which are positive We've collected 25 users testimonials about Coinbase, 96% are positive (Coinbase & Kuna was rated lower by the community).

Although the final decision, which exchange — Kuna or Coinbase — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although Coinbase has a better total rating 100 vs Kuna's 84, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

Conclusion: is Coinbase legit or scam?

Now it's time to draw a conclusion, is coinbase.com a scam or is it a legit exchange? We are 100% sure Coinbase is the most trusted and absolutely legit exchange platform with an outstanding reputation in the crypto community; one of the industry leaders. There is no way it can be even considered to be called a scam! Let's summarize what we like most (and what we don't) about the Coinbase:

- It is licensed, regulatory compliant financial company

- The e-wallet holds users' funds

- This company has being in the business for a long time; exchange was started 12 years and 1 months ago

- Exchange supports 21 cryptocurrencies and 6 fiat ones (totally 8 payment systems / banks are available). Besides buying, selling and exchanging digital currencies, the following services are available: ATM Cards, Merchant Services and Staking, MasterNodes, etc. (passive income opportunity)

- It charges moderate fees: from 1.0% to 3.99% depending on the payment method; although the exchange of smaller amounts is rather inexpensive

- The purchase and withdrawal limits are high and you may exchange small amounts, if you wish to: from $2.00 to $5,000 USD, it depends on a payment system choice

- Coinbase allows registrations from 39 countries; people from United States may use the service

- Exchange will gift you free money on certain conditions.

- Clients' testimonials are perfect, 100% (25 out of 25) note their positive experience dealing with Coinbase. According to the customers feedback:

- Deposits and withdrawals are instant

- Verification is not very fast

Coinbase is without any doubt, legit and safe. Although as any big business, there are complaints; in this case, most of these are blaming the customer service and rigorous Know Your Customer (KYC) process with many questions asked. If you don't mind these and if your country is supported, Coinbase is an excellent choice!

Last but not least, according to our rating and the feedback from the Coinbase clientele, we consider it as "The best e-wallet worldwide!" That means the platform really stands out from the 333 exchange services we monitor; our ranking algorithms and the input we got from the actual exchange customers confirm that. With all the features and positive reviews, it's obvious why Coinbase has been so successful for 12+ years and we invite you to check out by yourself!