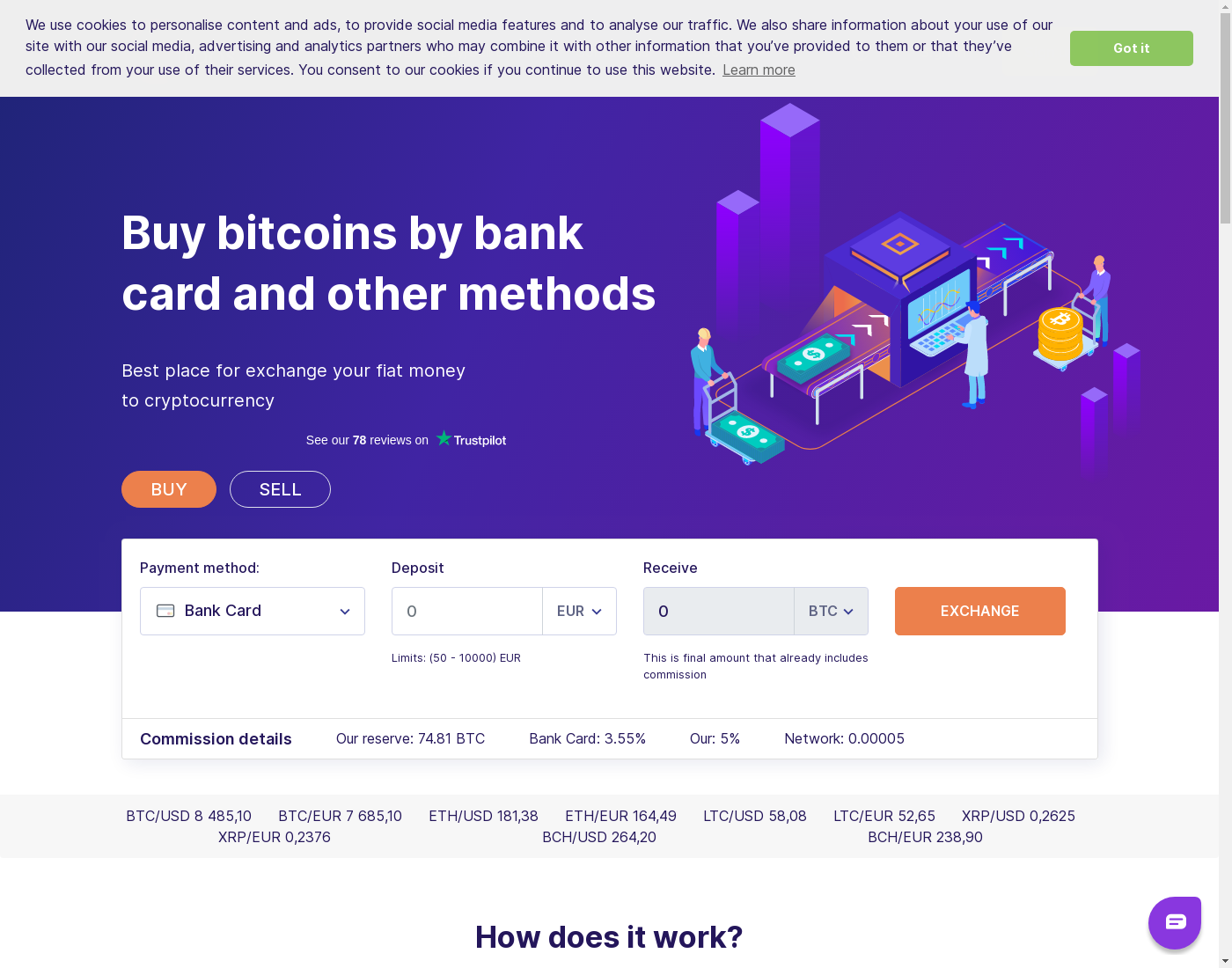

CoinToCard review: is safe exchange or scam? (07.2024)

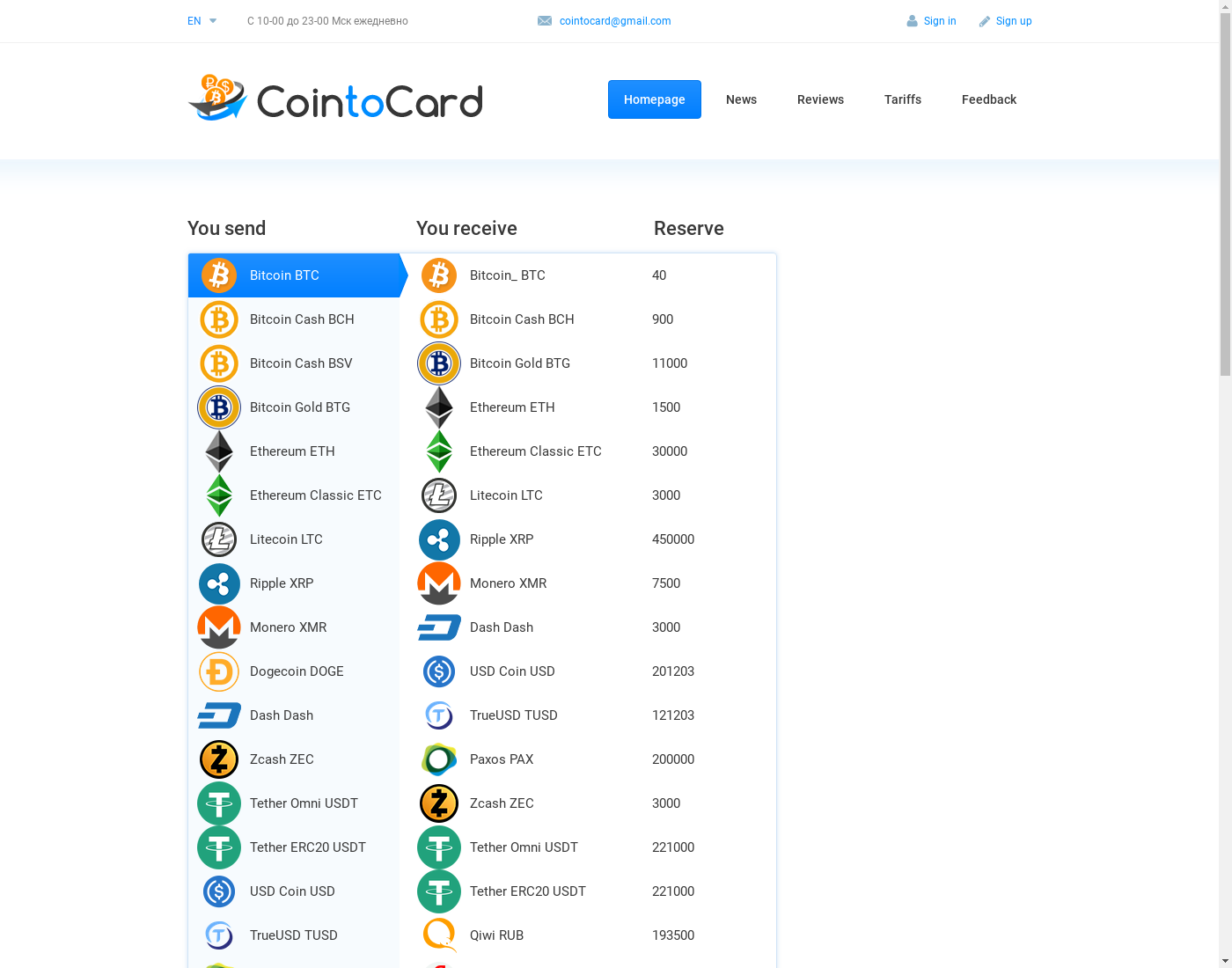

What do we know about CoinToCard? According to the data we possess, it appears to be a quite reputable, well established, promising dealer aka exchanger. It's a broker successfully operating for about 6 years and 11 months. CoinToCard supports some of the popular crypto. CoinToCard operator is an unknown entity or a group of individuals, but we must add that it appears as the usual way to do crypto-related business in their jurisdiction.

Clients from

all the

255

countries & territories

are welcome here,

together with your home country: United States!

Broker serves the US and allows registrations from

all the

56

states.

Unfortunately we couldn't yet collect enough data about the order processing speed from the actual customers,

maybe you know how fast CoinToCard processes the orders? If you do, please

share the knowledge!

Thanks a lot!

Specific types of orders may require identity verification

So, what's our opinion so far? Based on the information we currently hold, CoinToCard should be a pretty safe site to swap Bitcoins; a satisfying exchange, particularly popular among the clients! Let's appraise everything in details...

Overview: is CoinToCard safe?

Research: best alternative to CoinToCard

By reason of we can't (yet?) endorse the cointocard.org, you may feel safer choosing the website we've already appraised and checked in full. Therefore we took the liberty to research the market and suggest a viable, well-known, 100% trusted alternative exchange platform. How we did it? Let's explain! Makes sense to start from figuring out what exactly we are looking for:

A glance at the service specifics confirms that CoinToCard employs the business model of a Broker; exchange started the business August 2017 and up-to-date operates for 6 years and 11 months. It received some reviews and seems to be known on the local market. There is no information available about the company doing business as CoinToCard, etc. Please note that it's just a super-small snapshot of what we've discovered, details about the business model are available in the "what we already know about cointocard" section. Considering all the abovementioned, we were looking for another broker allowing registrations from United States with a flawless reputation and the best rating and found a perfect match: TransCoin! Let's figure out what makes it the safest choice:

TRANSCOIN is also a Broker; exchange started to provide the services in May 2018. It is a really trusted, surely a respectable, well established, interesting exchange platform (broker) that supports 1 cryptocurrency: you can This is what we value the most about this great exchange service:

- It is a respectable financial company; the firm holds required license(s) and is fully compliant with the regulation

- The business model of an exchange broker doesn't require to store the customers' money, there are no accounts, etc. The crypto (or fiat) payment will be instantly delivered to a wallet (bank or fiat payment system) of your choice

- The exchange runs the business for a long time; project was started 6 years and 2 months ago

- TransCoin accepts the registrations from 255 countries; customers from United States can use the services

- Customers' testimonials are top notch, 100% (5 out of 5) wrote about the positive experience doing business with TransCoin.

According to our research and the community vote, TransCoin is the best Broker worldwide. That's a really outstanding result, considering that we compare 333 exchange platforms! Long story short, this means that transcoin.me truly stands out in terms of reliability, reputation, etc. - you name it... We are sure, you won't regret your choice!

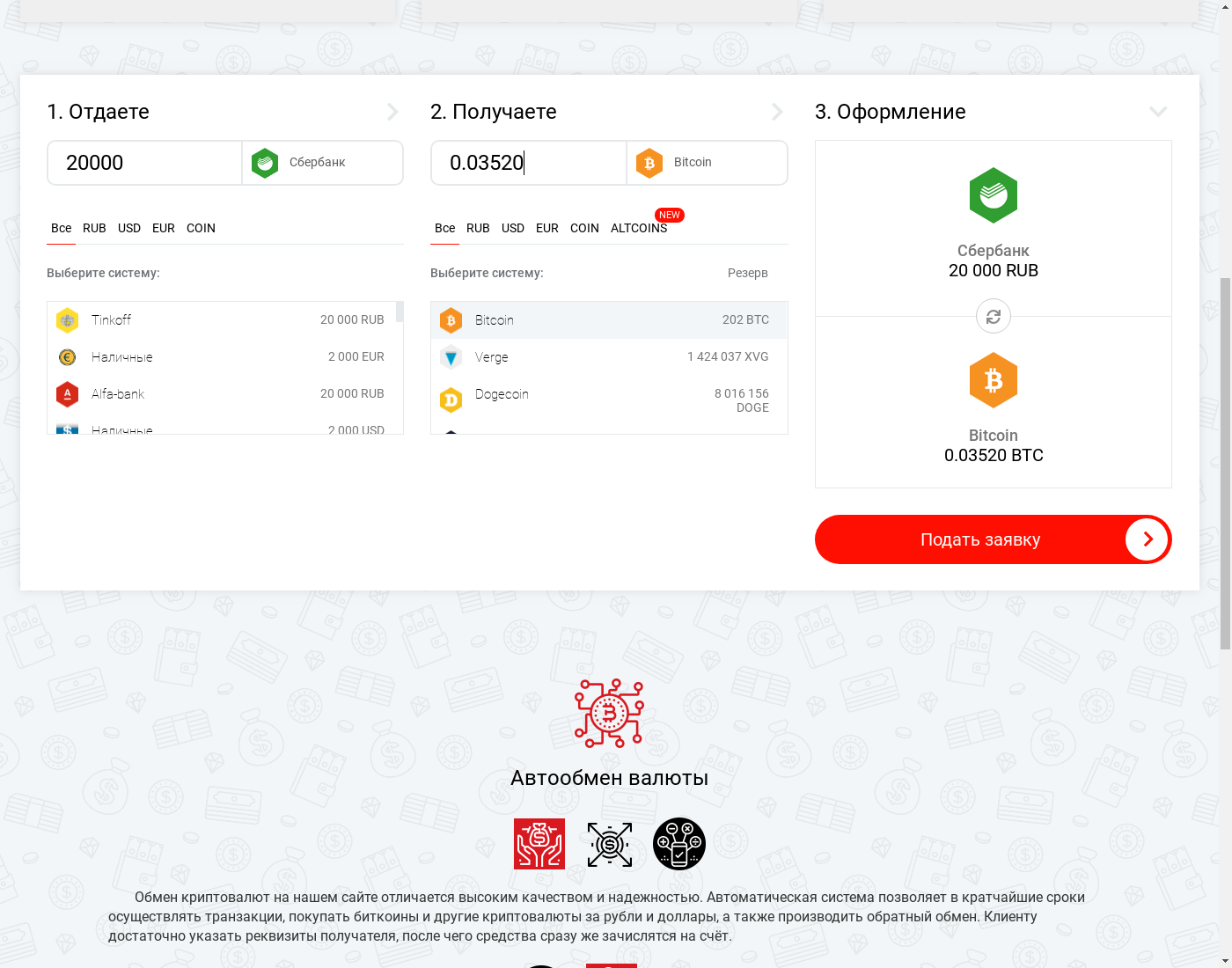

CoinToCard fees, limits, verification, etc.

Even though we still consider if we should add COINTOCARD to the list of approved exchange platforms and the individual dealers-exchangers and are in process of gathering and evaluating the information, we've already collected some data worth sharing. The business appears like a reputable broker running without serious issues from Aug 2017. We could not find any information about the company administering the website; no signs if there's any legal entity at all. That's not a good indication, but sadly it's rather a usual practice for "exchangers" operating on/from the Russian and ex-USSR market.

cointocard.org is a broker, sort of "crypto exchange bureau" online. Buying and selling aside, there's usually not much to do on such a website; but isn't it exactly what we are looking for? On a positive note, the brokers don't hold the clients' funds and typically require less trust, etc.

Dealing with a reputable service of the sort is virtually risk-free, especially if you don't send a lump sum at once. Just please remember that trading with an anonymous or almost anonymous dealer requires extra caution!

Fees & Limits at CoinToCard

We normally analyze the fees and limits even for the exchanges that are not yet listed but are in the "watch list", while we are considering if we should add these sites or not. Unfortunately, due to some technical issues the integration with CoinToCard is not yet set, and therefore we can't state anything about the fees and purchase limits at this broker. Please accept our apologies!

CoinToCard account verification

The broker may ask the customers to complete the user identification process (account verification) when certain conditions are met. Exchangers like CoinToCard operate in a gray area due to the fact that their target markets have no cryptocurrency regulation in place. Therefore such providers either have no KYC programs at all or maintain a very simple one. You'll get acquainted with the details during an order submission.

As for the estimation how long does it takes to verify an account at CoinToCard on average: we must apologize, our platform still haven't collected enough feedback from the real users of a broker. By any chance, if you know how fast cointocard.org is with an account verification, kindly let us know too. We really appreciate your commitment!

Supported countries

The website allows the user registrations from 255 countries. Actually it appears that absolutely all the countries and territories are supported by cointocard.org, it has no blacklisted geographies and no geo-restrictions!

Does CoinToCard allow the users from United States (US)?

That's right, it does! cointocard.org permits the registrations from the United States! Broker grants access to the customers from all the existing 56 states, territories, and commonwealths of the U.S.A..

American residents and the U.S. citizens are welcome to convert various crypto currencies offered by the broker.

Ops, sorry! Can't get an access to the data regarding the US operations of CoinToCard. While we are fixing that, please explore the exchange's website; there's a list of payment systems supported, etc.

Customers' testimonials

We still hadn't received any reviews of cointocard.org we could verify. We'd love to know what our valued visitors think of this website; based on that we'll decide should we approve the Broker or not. If you've already tried this service or know someone who did we are counting on you! What do you think about this exchange? Please share your experience, your thoughts... even just a few words testimonial is a great help!

FAQ about CoinToCard

Does CoinToCard holds my funds?

It does not! One of the best things dealing with the brokers is that unlike most of other exchanges, such businesses instantly deliver your funds to your own wallet after the payment clearance.

Is CoinToCard a good broker?

We believe it is! We can say so based on the score the exchange got at our platform. The details are explained in this review and we break down a score in the overview section.

Is CoinToCard licensed? Does it hold e-money license?

It is not. We even could not find any information about the business entity operating the exchange, etc.

Is CoinToCard a ripoff?

CoinToCard is certainly not a rip-off; our analysis confirms that it's rather a trustworthy exchange. Read more in our conclusion: is CoinToCard a legit exchange or scam

is CoinToCard a legit exchange?

Our research confirms that CoinToCard is a legitimate exchange; we consider listing the broker among the recommended exchanges. Despite the fact that COINTOCARD operates without any business licenses, etc. (unfortunately, it's rather common practice for Russian, CIS, and Eastern Europe based exchangers) so in case of any force-majeure, etc. the risk of losing money increases; please deal with caution! Our proposed rating score is 71 | 100, feel free to read more about what does it means and how the scoring is calculated.

Can I trust CoinToCard with my money?

It appears that the crypto-users trust CoinToCard for a number of reasons, read why we preliminary assess the 71/100 result for the exchange. As far as we know, the community trusts broker so you likely won't regret believing them. And remember, whatever service you use, it never hurts to test it with a smaller amount first! Especially when you are dealing with unregulated exchanges and the individual exchangers.

Is CoinToCard instant?

Exchange with CoinToCard is not instant, although as far as we know, the broker operators execute all the orders in minutes; it feels almost like a fully automated service.

CoinToCard vs other exchanges

In case you prefer to deal with a broker that was already fully checked and rated by our reviewers, algorithms, and the actual clientele, we took the liberty to compile a list of alternative sites you may use instead of CoinToCard. There are similar exchanges providing more or less the same services; let's see what else is available right away and compare it to the reviewed business! Besides, we found platforms having similar rating that are popular in United States particularly and North America in general. And by the way, if you are eager to pick an exchange basing on a rate and fees mostly, our price comparison platform always finds the most reasonable exchange rates in United States!

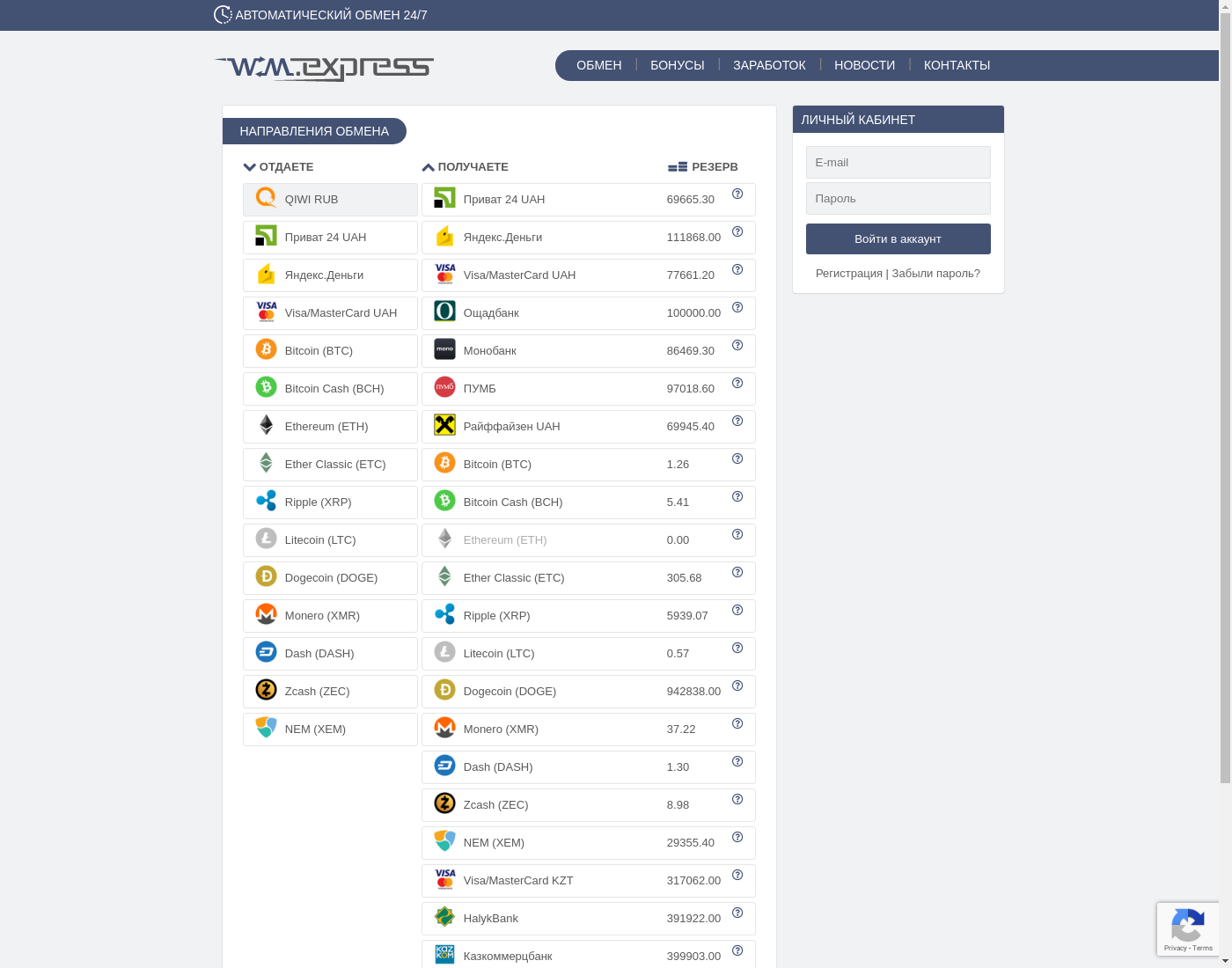

CoinToCard vs WMexpress

A comparison of the key features and the principal facts about WMEXPRESS versus CoinToCard; just take a glance to decide if WMexpress will be the optimal choice for you or at least if it's worth checking our full study:

- WMexpress is a broker The way cointocard.org website functions fits the broker format, both following the same approach to the business.

- WMexpress had launched the service August 2015 CoinToCard started the project August 2017 (WMexpress is operating for 1 years and 11 months longer).

- WMexpress operates without any registration or no information is available about the legal entity CoinToCard carries on the operations without registering a legal entity or there's no information publicly available about the firm (both websites follow the same corporate model i.e. the absence of such one, almost an identical approach to the operational and legal matters, etc.).

- WMexpress allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You are permitted to register at the CoinToCard being a resident of any of 255 countries; United States is granted with an access among all others (CoinToCard & WMexpress authorize sign-ups from the same number of countries worldwide).

- When the client needs to pass through the KYC process at WMexpress, they usually ask to provide some (it depends on various factors) documents and / or specific procedures In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at CoinToCard typically involves a few (varies case-by-case) individual procedures. (CoinToCard & WMexpress alike abide by the roughly analogous KYC policies requiring a user to complete almost identical stages during the verification).

So, is WMexpress a better alternative to CoinToCard? Such a conclusion by any means can't be drawn by us instead of you, but we'll try to assist with the matter. CoinToCard & WMexpress alike are sharing the same score: 71 (out of 100). Therefore both together should be of the matching quality. Nevertheless, we'd like to recommend WMexpress simply because we know it better!

Like reading? In fact, there are more exchanges worth comparing to CoinToCard, such as:

CoinToCard vs chby

A comparison of the key features and the principal facts about CHBY versus CoinToCard; just take a glance to decide if chby will be the optimal choice for you or at least if it's worth checking our full study:

- chby is a broker The way cointocard.org website functions fits the broker format, both following the same approach to the business.

- chby had launched the service July 2018 CoinToCard started the project August 2017 (CoinToCard operated 11 months longer).

- chby operates without any registration or no information is available about the legal entity CoinToCard carries on the operations without registering a legal entity or there's no information publicly available about the firm (both websites follow the same corporate model i.e. the absence of such one, almost an identical approach to the operational and legal matters, etc.).

- chby allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You are permitted to register at the CoinToCard being a resident of any of 255 countries; United States is granted with an access among all others (CoinToCard & chby authorize sign-ups from the same number of countries worldwide).

- When the client needs to pass through the KYC process at chby, they usually ask to provide some (it depends on various factors) documents and / or specific procedures In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at CoinToCard typically involves a few (varies case-by-case) individual procedures. (CoinToCard & chby alike abide by the roughly analogous KYC policies requiring a user to complete almost identical stages during the verification).

So, is chby a better alternative to CoinToCard? Such a conclusion by any means can't be drawn by us instead of you, but we'll try to assist with the matter. Since the CHBY exchange service got a lower rating at our platform: 70 versus 71 that CoinToCard accomplished, our advice is either to go for CoinToCard, or, even better to look into few others first; particularly the ranked "best-of-the-best" TransCoin!

Like reading? In fact, there are more exchanges worth comparing to CoinToCard, such as:

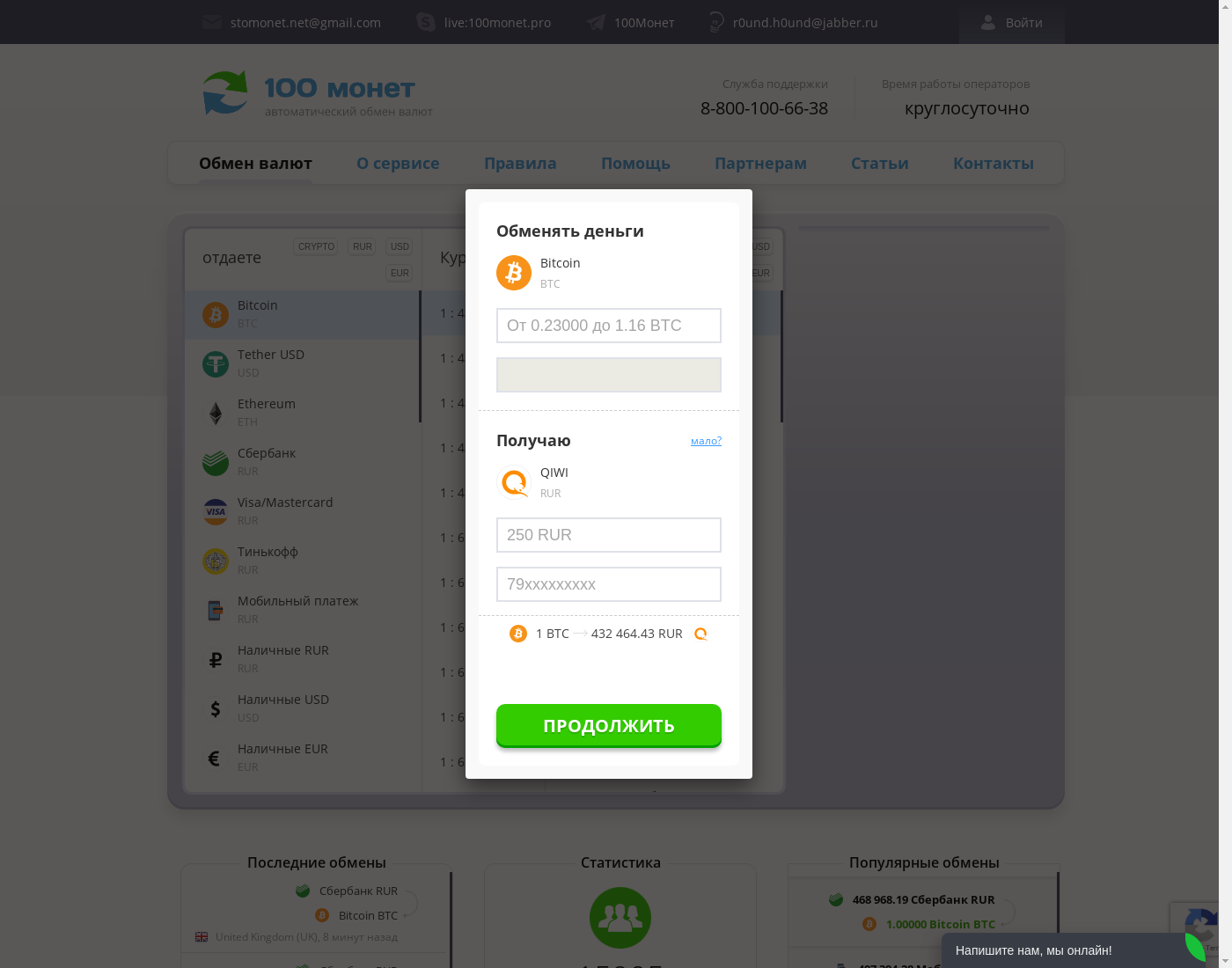

CoinToCard vs 100monet

A comparison of the key features and the principal facts about 100MONET versus CoinToCard; just take a glance to decide if 100monet will be the optimal choice for you or at least if it's worth checking our full study:

- 100monet is a broker The way cointocard.org website functions fits the broker format, both following the same approach to the business.

- 100monet had launched the service December 2014 CoinToCard started the project August 2017 (100monet is operating for 2 years and 8 months longer).

- 100monet operates without any registration or no information is available about the legal entity CoinToCard carries on the operations without registering a legal entity or there's no information publicly available about the firm (both websites follow the same corporate model i.e. the absence of such one, almost an identical approach to the operational and legal matters, etc.).

- 100monet allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You are permitted to register at the CoinToCard being a resident of any of 255 countries; United States is granted with an access among all others (CoinToCard & 100monet authorize sign-ups from the same number of countries worldwide).

- When the client needs to pass through the KYC process at 100monet, they usually ask to provide some (it depends on various factors) documents and / or specific procedures The process of Customer Identification at CoinToCard typically involves a few (varies case-by-case) individual procedures. (CoinToCard & 100monet alike abide by the roughly analogous KYC policies requiring a user to complete almost identical stages during the verification).

So, is 100monet a better alternative to CoinToCard? Such a conclusion by any means can't be drawn by us instead of you, but we'll try to assist with the matter. Since the 100MONET exchange service got a lower rating at our platform: 67 versus 71 that CoinToCard accomplished, our advice is either to go for CoinToCard, or, even better to look into few others first; particularly the ranked "best-of-the-best" TransCoin!

Like reading? In fact, there are more exchanges worth comparing to CoinToCard, such as:

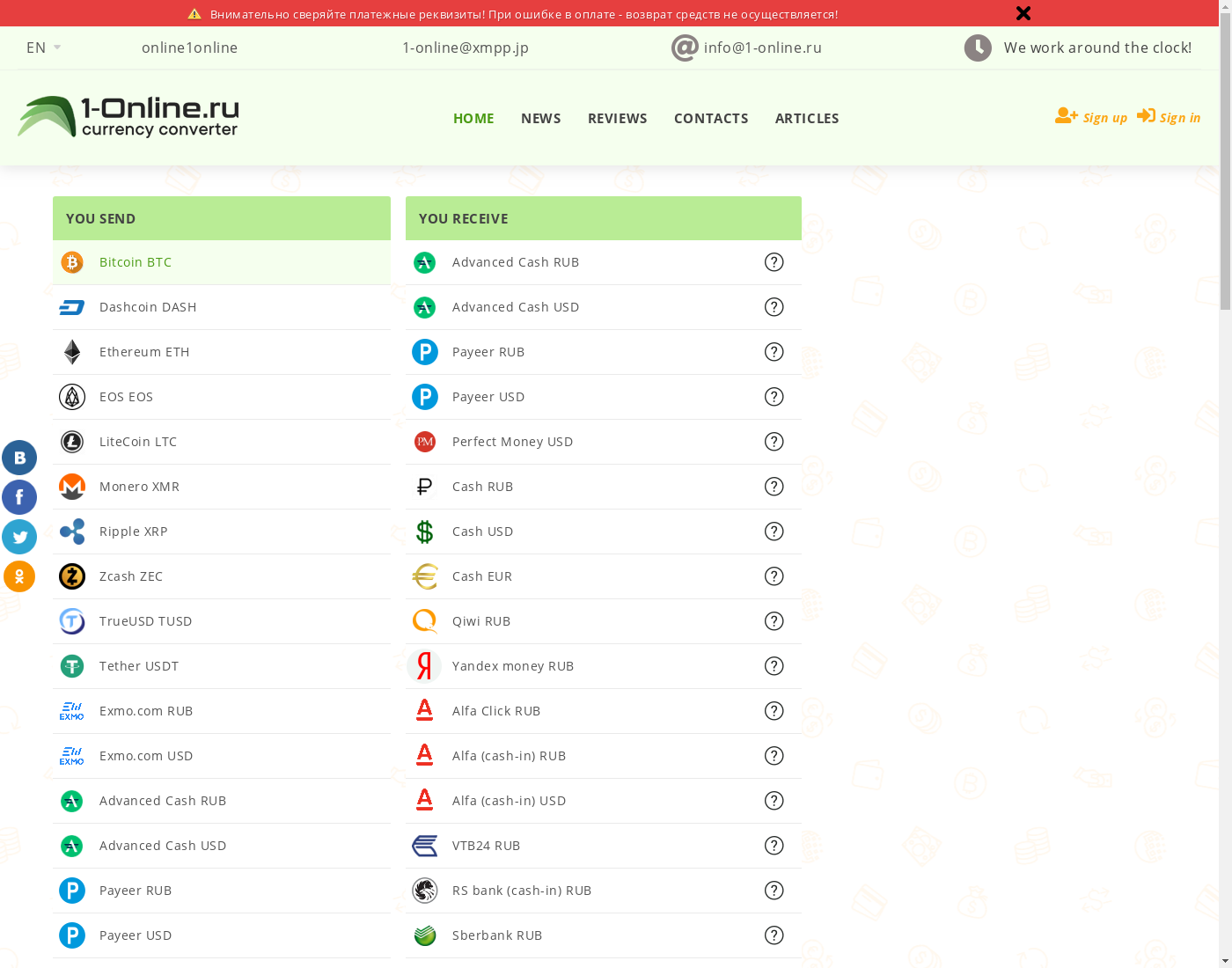

CoinToCard vs 1-online

A comparison of the key features and the principal facts about 1-ONLINE versus CoinToCard; just take a glance to decide if 1-online will be the optimal choice for you or at least if it's worth checking our full study:

- 1-online is a broker The way cointocard.org website functions fits the broker format, both following the same approach to the business.

- 1-online had launched the service February 2017 CoinToCard started the project August 2017 (1-online is operating for 5 months longer).

- 1-online operates without any registration or no information is available about the legal entity CoinToCard carries on the operations without registering a legal entity or there's no information publicly available about the firm (both websites follow the same corporate model i.e. the absence of such one, almost an identical approach to the operational and legal matters, etc.).

- 1-online allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You are permitted to register at the CoinToCard being a resident of any of 255 countries; United States is granted with an access among all others (CoinToCard & 1-online authorize sign-ups from the same number of countries worldwide).

- When the client needs to pass through the KYC process at 1-online, they usually ask to provide some (it depends on various factors) documents and / or specific procedures In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at CoinToCard typically involves a few (varies case-by-case) individual procedures. (CoinToCard & 1-online alike abide by the roughly analogous KYC policies requiring a user to complete almost identical stages during the verification).

So, is 1-online a better alternative to CoinToCard? Such a conclusion by any means can't be drawn by us instead of you, but we'll try to assist with the matter. Since the 1-ONLINE exchange service got a lower rating at our platform: 67 versus 71 that CoinToCard accomplished, our advice is either to go for CoinToCard, or, even better to look into few others first; particularly the ranked "best-of-the-best" TransCoin!

Like reading? In fact, there are more exchanges worth comparing to CoinToCard, such as:

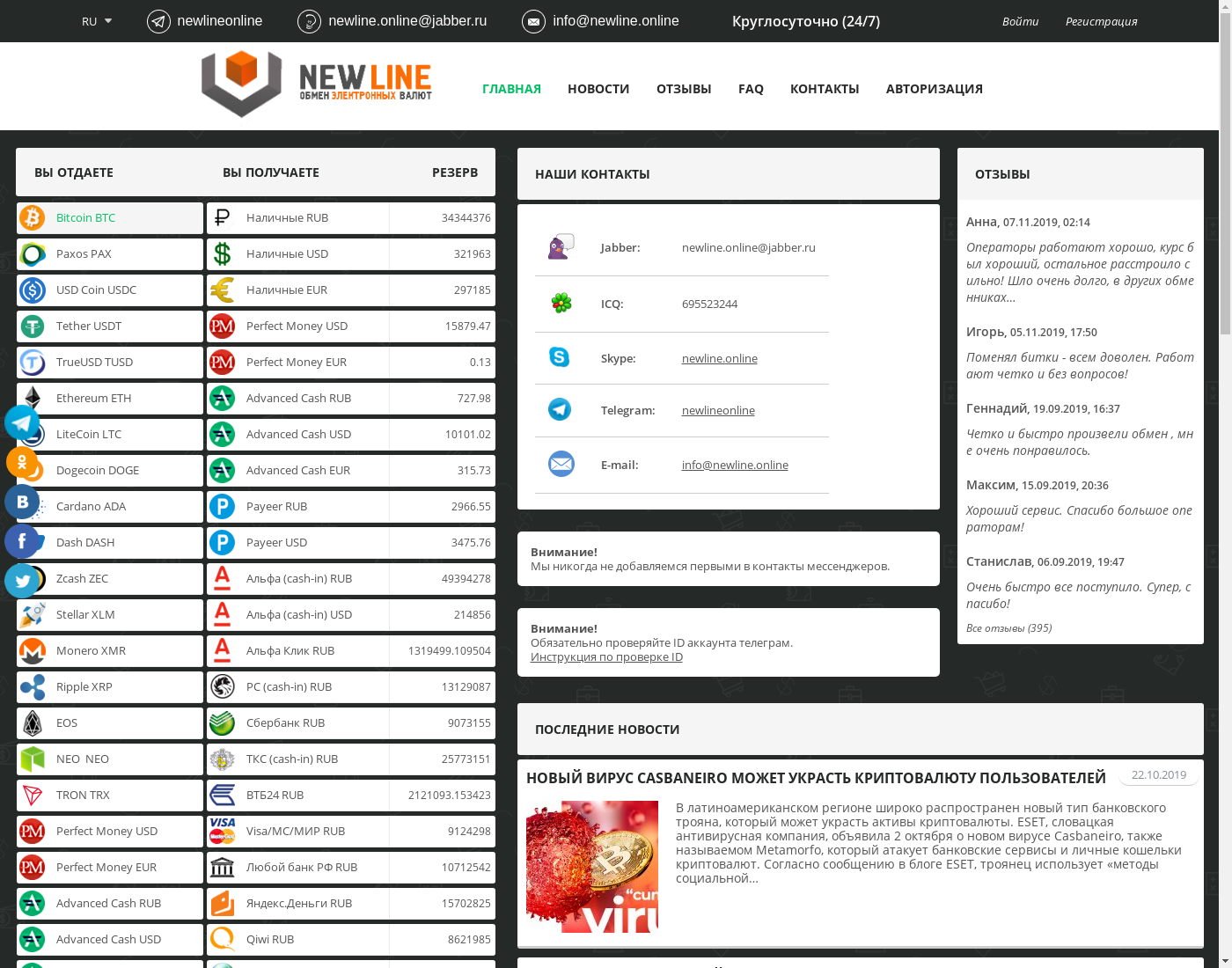

CoinToCard vs Newline

A comparison of the key features and the principal facts about NEWLINE versus CoinToCard; just take a glance to decide if Newline will be the optimal choice for you or at least if it's worth checking our full study:

- Newline is a broker The way cointocard.org website functions fits the broker format, both following the same approach to the business.

- Newline had launched the service March 2016 CoinToCard started the project August 2017 (Newline is operating for 1 years and 4 months longer).

- Newline operates without any registration or no information is available about the legal entity CoinToCard carries on the operations without registering a legal entity or there's no information publicly available about the firm (both websites follow the same corporate model i.e. the absence of such one, almost an identical approach to the operational and legal matters, etc.).

- Newline allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You are permitted to register at the CoinToCard being a resident of any of 255 countries; United States is granted with an access among all others (CoinToCard & Newline authorize sign-ups from the same number of countries worldwide).

- When the client needs to pass through the KYC process at Newline, they usually ask to provide some (it depends on various factors) documents and / or specific procedures In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at CoinToCard typically involves a few (varies case-by-case) individual procedures. (CoinToCard & Newline alike abide by the roughly analogous KYC policies requiring a user to complete almost identical stages during the verification).

So, is Newline a better alternative to CoinToCard? Such a conclusion by any means can't be drawn by us instead of you, but we'll try to assist with the matter. Since the NEWLINE exchange service got a lower rating at our platform: 65 versus 71 that CoinToCard accomplished, our advice is either to go for CoinToCard, or, even better to look into few others first; particularly the ranked "best-of-the-best" TransCoin!

Like reading? In fact, there are more exchanges worth comparing to CoinToCard, such as:

Conclusion: is CoinToCard legit or scam?

Seems it's time to finalize the report, to make a judgment call. Is CoinToCard a scam or is it a legitimate exchange? How secure the cointocard.org website is? Can you trust CoinToCard with your money? And (in our case) the most frequently asked question: Why the broker is not yet ranked at ExchangeRates.Pro? Let's start by answering the last question and, you'll see, the replies to the rest will follow. Can't wait? Help yourself jumping to the final verdict!

Why we hadn't yet ranked and fully listed COINTOCARD and what does it mean?

The routine for adding a new exchange, especially if it's a Broker, to ExchangeRates.Pro listing is rather a long process and it depends on few factors we don't control directly. Our approach to the process is «better be safe than sorry»; we already have 37 well-tested platforms providing similar to CoinToCard functionality. 22 different exchange websites of broker type are among those and additionally, there are 4 peer-to-peer marketplaces. 9,455 exchange offers are available right away; these cover almost all the payment systems and local banks available in United States and North America for buying and selling BTC, cryptos, and tokens with US Dollar, EURos, whatever. Hence, we never hurry to add more websites until we are 100% sure we did everything we could to verify the data and test every service well ourselves. It takes time. Moreover, there are two circumstances that are out of our direct control:

- All the exchange services, most notably the broker type ones are staying in the "pending approval" state until we collect at least a few reviews from the genuine customers, the ones we can actually verify. In addition, we monitor the clients' testimonials at the trusted review platforms, social networks, etc., and postpone the approval until we find enough evidence that the broker has no unresolved complaints and there are enough convincing users recommendations.

- We receive the new applications daily and like over 90% are from the other Brokers. It consumes a lot of time to check each and every one; there's a large queue and we have to be selective when choosing which applications to process first. Considering there's 278 pending applications from other "exchangers", websites that are very similar to CoinToCard, we can't promise that we'll process this one very fast, our apologies.

Exceptions from these two rules may happen only in very rare extraordinary cases. As you can see, we move forward with listing new exchanges slowly and the queue for Brokers is the largest one, but as a consequence, only the best brokers are getting approved. Although we can't endorse CoinToCard and hadn't rated it (in full) yet, we believe that it should get approval if we won't receive any complaints.

So is CoinToCard a legit exchange or a fraud?

Looking at the data we possess, it's clear that CoinToCard is not a scam, not a fraudulent website, etc., you name it. Even though we are not endorsing this broker, it appears to be trustworthy and worth trying. Furthermore, it could become a nice addition to our listing, considering there won't be any complaints or accusations from the users. Try exchanging at CoinToCard yourself and don't forget to share your experience!

Alternative solution: how to find the best rate to exchange BTC & crypto in United States and North America

There is another way of finding the most worthy alternative to CoinToCard that will work best for you. What if instead of opposing the features of various exchanges we'll compare the terms of the specific offerings that all the marketplaces, brokers, dealers, and even individual exchangers provide? That's exactly what our platform does! We assist you in choosing the most appropriate deal considering:

- The fees and rates provided at the moment by 21 exchange websites of a "Broker" type and 9,455 other offers.

- BTC/USD exchange rate at those ; the availability of service for the residents of United States.

- Which local banks & payment systems out of 154 serving US are the fastest, most convenient and cost-efficient personally for you.

- Amount you need to swap: say, the conditions for exchanging USD 1 will be significantly different from the terms of $67,853.0 conversion.

- And of course, you see the rating, users reviews (up-to-date 533 real clients testimonials), etc. for all the offers available!

Our platform could find 38 offers to buy, sell, exchange BTC available to users from United States, and 36 of these are for the US Dollar currency. There are totally 27 exchange services supporting US. Some of those are providing the access to USD|BTC market, including such types as e-wallet, P2P Marketplace, Trading Platform, etc. 5 exchanges has active offers for these currencies right now; you can buy/sell using 19 local and international payment systems & banks! The local dealers and exchanges are mentioning the support of 19 local banking institutions and the payment systems. According to the latest data we have, the lowest fee to purchase BTC with USD locally is available for Etana, that's a local payment system. The most popular domestic options for purchasing BTC @ US:

- Barter from Flutterwave | 50 ads

- GoBank Card | 34 ads

- MyVanilla Reloadable | 22 ads

- JCPenney | 13 ads

- Cash in Person | 5 ads

- Nike | 4 ads

- Cash App (Square) | 4 ads

- Other Gift Cards | 4 ads

- Visa & Mastercard | 3 ads

- Netspend Prepaid | 3 ads

Our software couldn't get an access to the data what's available at cointocard.org for the clients from United States, however we are sure that you'll find a worthy alternative on one of 36 exchange websites we compare the rates at! Check out what the local dealers and platforms are offering: currently there are 19 domestic banks supported. Besides, you may find something interesting browsing 9,455 offers available with 19 ways to pay internationally, either to neighboring countries in North America or to any other part of the world.