DSX: why closed? 9 alternatives for dsx.uk (07.2024)

What was DSX (now defunct) in a nutshell? It was maybe not the most popular, yet respectable, rather an aged exchange service (trading platform) working with 1 cryptocurrency: you could buy and sell coins using 4 fiat currencies (3 banks & payment systems were supported). Exchange service started the business Dec 2014, it was a fully compliant, licensed financial company. Besides the cryptocurrencies exchange, DSX had also provided some other services, like Fiat to Fiat Currencies Trading & Exchange.

This Trading Platform served the clients from 252 countries (although United States was never supported). Due to regulatory restrictions, US citizens and residents were not served by this exchange. In the year 2021 DSX was closed. The reason why the trading platform had to close the doors was likely the "exit scam" from the owner(s).

Research: the best alternative to DSX

Since there is no way you can use the services of dsx in 2024, we took the liberty to research the market and suggest a viable, well-known, 100% trusted alternative exchange platform. How we did it? Let's explain! Makes sense to start from figuring out what exactly we are looking for:

DSX was the Trading Platform; ePayments (Electronic Payments Association) (dba DSX) started the business in December 2014. The entity was operating for 9 years and 7 months and gained some popularity on the market. The company was based in the United Kingdom with the headquarters located in London. Official DSX registration address was 5th Floor, 24 Savile Row, London W1S 2ES. United Kingdom. The firm was a licensed MSB, regulated by the FCA; it held the E-money Institution license.

DSX was founded by Mike Rymanov. DSX CEO was also Mike Rymanov.

Although the platform itself is operated by the Digital Securities Exchange Limited, the e-money associated with a DSX account is issued by ePayments Systems Limited. Being an FCA authorised electronic money institution, ePayments provides the DSX users an access to banks and payment systems and safeguards the traders funds.

Quote about DSX from the reviewer: «DSX was the first to launch a fully regulated exchange platform in the UK. Such an approach guarantees the traders the same level of safety they get dealing with the traditional financial institutions, including funds insurance, etc.» Trading Platform was not rated by our platform. While operating, the website provided the following crypto exchange-related services:

- Allowed the clients to buy cryptocurrencies with various fiat (national) currencies

- Provided the customers with multiple ways to "cash out" the crypto to fiat currency

- Fiat to Fiat currency exchange and trading: EUR/USD and others

Considering all the abovementioned, we were looking for another trading platform allowing registrations from United States with a flawless reputation and the best rating and found a perfect match: CEX! Let's explain what makes it the best choice for you:

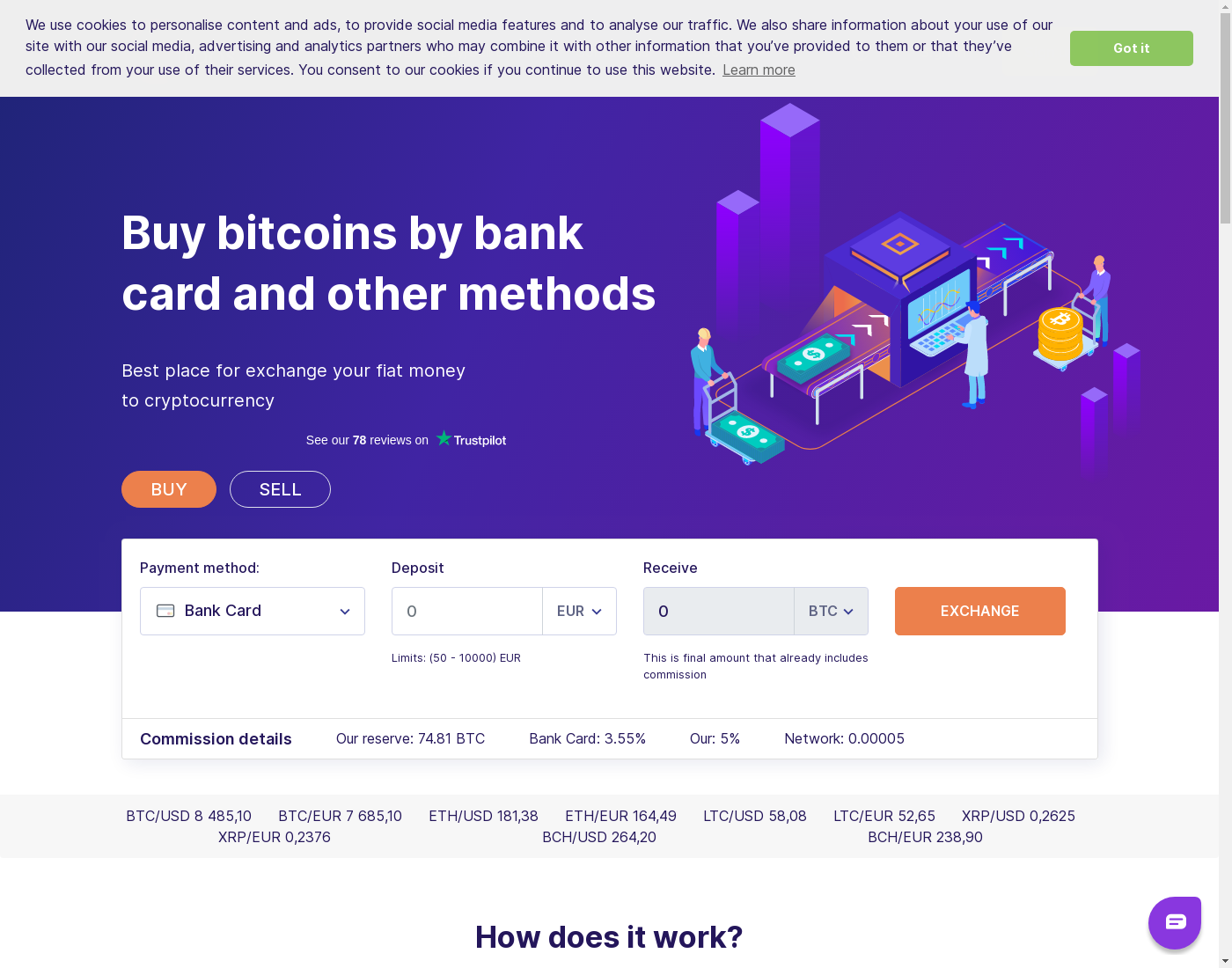

CEX is also a Trading Platform; CEX.IO LTD (dba CEX) had started doing the business in July 2014. The legal entity is established in the United Kingdom and the principal office is located in the London. Registration address of CEX is 24th Floor One Canada Square, Canary Wharf London E14 5AB. The firm is a licensed Money Service Business, regulated by the FinCEN; operating under the Money Transmission license. FINCEN registration number 31000176194955. It is a really trusted, surely a respectable, well established, interesting exchange platform (trading platform) that supports 32 cryptocurrencies and tokens: you can buy and sell crypto using 3 national currencies (8 payment systems and banks are supported) or exchange one digital currency into another here. Besides the crypto-exchange, cex.io also provides other crypto-related services, for example, Lending, Margin Trading, Faucets (small amounts of cryptos for free), Staking, MasterNodes, etc. (passive income opportunity). This is what we value the most about this great exchange service:

- It is a respectable financial company; the firm holds required license(s) and is fully compliant with the regulation

- The exchange runs the business for a long time; project was started 10 years ago

- The platform supports 32 cryptocurrencies and 3 fiat ones (totally 8 payment systems / banks are available). Apart from buying, selling and exchanging cryptocurrencies, there are other services available: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and Staking, MasterNodes, etc. (passive income opportunity)

- The service charges low fees: from 0.3% to 3.99% depending on the way of payment; the fees for exchanging the smaller amounts are rather affordable as well

- The limits for purchases and withdrawals are among the highest on the market: from $20.00 to $10,000 USD, the exact limit depends on what payment system you choose to pay or get paid to

- Customers' testimonials are top notch, 100% (27 out of 27) wrote about the positive experience doing business with CEX. According to the feedback we got from the actual users:

- Customers support is very good

- The speed of deposits and withdrawals processing is very fast

- Verification goes really fast

According to our research and the community vote, CEX is the best Trading Platform worldwide. That's a really outstanding result, considering that we compare 333 exchange platforms! Long story short, this means that cex.io truly stands out in terms of reliability, reputation, etc. - you name it... We are sure, you won't regret your choice!

More alternatives to DSX

Of course, we can suggest some more alternative exchange services you can use instead of the "dead" dsx.uk. We picked a few similar exchanges that provides more or less the same service: other ones of trading platform type mostly. Besides, we found platforms having similar rating that are popular in United States particularly and North America in general. If the only question that you want to ask is "what exchange has the best rates to buy and sell BTC and 50 cryptocurrencies?", our price comparison platform always finds the most beneficial exchange rates in United States!

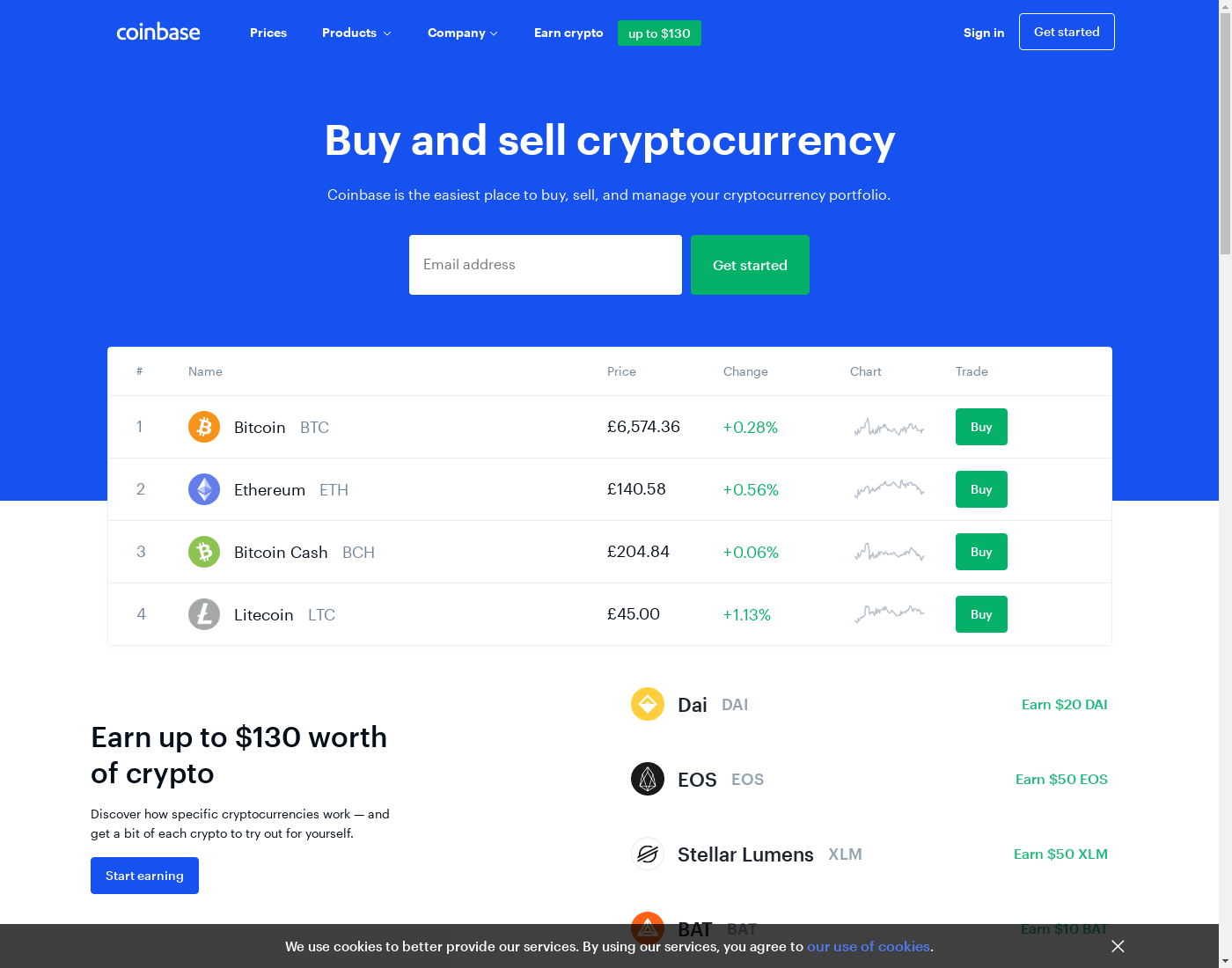

DSX vs Coinbase

Let's compare the most important features and key facts about the COINBASE with what DSX (RIP) offered us in the past to make a conclusion if Coinbase will be the optimal choice for you:

- Coinbase is a e-wallet DSX was a trading platform, it's also an exchange, but has slightly different business model (feel free to read details about the difference between e-wallet and trading platform)

- Coinbase had launched the service June 2012 DSX started the project December 2014 (Coinbase is operating for 2 years and 6 months longer).

- Coinbase has all the business licenses and permissions, required by law DSX had all the required licenses, permissions, etc. (both websites operate(d) using the same business model, similar approach to the business, legal matters, etc.).

- Besides cryptocurrencies buying|selling, Coinbase provides some other exchange-related / financial services: ATM Cards, Merchant Services and the Staking, MasterNodes, etc. (passive income opportunity) DSX provided less financial or other services, related to the cryptocurrency exchange: it allowed us to purchase and sell digital currencies, and also: Fiat to Fiat Currencies Trading & Exchange.

- Coinbase supports 21 cryptocurrencies DSX allowed to exchange only one crypto (DSX supports 20 fewer cryptocurrencies).

- 6 fiat currencies are available for buy- sell- operations at Coinbase You could use 4 fiat currencies to swap with crytos and tokens on DSX (DSX supported 2 fiat currencies less).

- Coinbase accepts the deposits from and allows fund to be withdrawn to 8 banks and (fiat) payment systems DSX allowed the customer to use 3 various fiat payment systems and/or banks (DSX supported 5 banks and/or payment systems less).

- The fees Coinbase charges: 1.0% — 3.99% DSX charged the user 0.8% — 2.6% commission, depending on the exchange direction, payment system, etc. (DSX had lower fees in most of the cases).

- Coinbase's customers are rewarded with the gifts DSX had neither gifts or cashback available (DSX & Coinbase both provide(d) more or less the same bonuses / gifts / etc. for the loyal customers).

- The purchase limits at Coinbase are starting from $2.00 up to $5,000 Deposit and withdrawal limits at the DSX were $10.00 — $1,500 depending on the specific payment method, etc. (DSX had a higher limits for buying and selling orders).

- Coinbase allows users' registrations from 39 countries; and we are glad to say that the people from United States are welcome You could register at the DSX if you were a resident of one of 252 countries; but users from United States were not able to use the service (DSX supported more countries and territories).

- When the client needs to pass through the KYC process at Coinbase, they usually ask to provide 2 documents and / or specific procedures: ID or Passport Verification, Phone Number Confirmation (SMS or a call). In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at DSX normally consisted of 4 individual procedures: the ID Verification, Phone Number Confirmation, an Address Confirmation, a Card Verification. (DSX's compliance program required the clients to pass through more identification procedures, to provide extra personal data).

We can't make a decision — is Coinbase a worthy alternative to DSX — instead of you, but we'll try to assist with the matter. Coinbase got a nice ranking score at our platform: 100 / 100 and we assume it would be a good replacement for DSX, worth inspecting, at least!

Like reading? In fact, there are more exchanges worth comparing to DSX, for example, those ones:

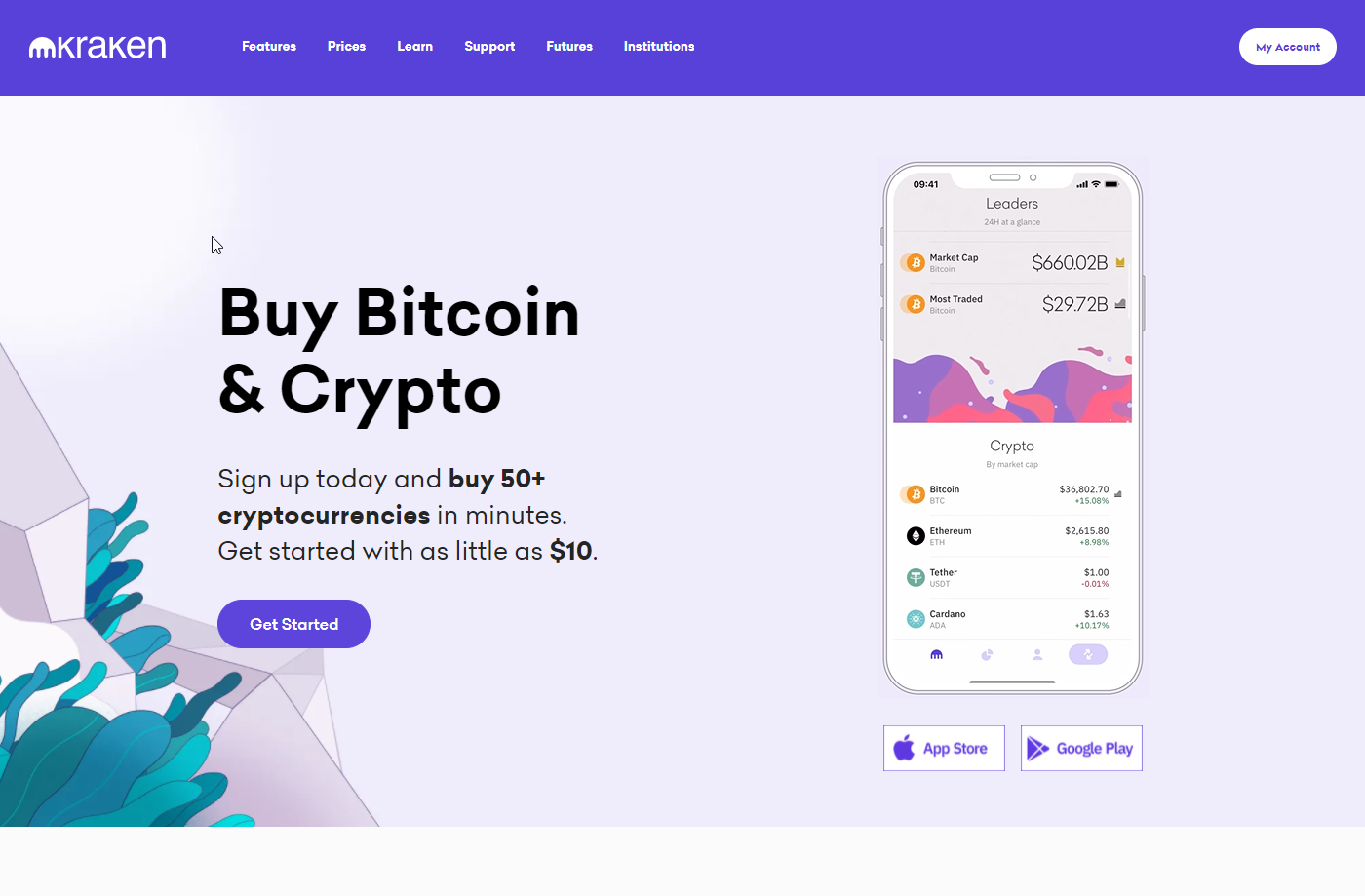

DSX vs Kraken

Let's compare the most important features and key facts about the KRAKEN with what DSX (RIP) offered us in the past to make a conclusion if Kraken will be the optimal choice for you:

- Kraken is a trading platform DSX was a trading platform, both following the same approach to the business.

- Kraken had launched the service July 2011 DSX started the project December 2014 (Kraken is operating for 3 years and 4 months longer).

- Kraken has all the business licenses and permissions, required by law DSX had all the required licenses, permissions, etc. (both websites operate(d) using the same business model, similar approach to the business, legal matters, etc.).

- Other than providing the services of buying, selling and exchanging cryptocurrency, Kraken provides some other exchange-related / financial services: Mobile wallet, OTC trading, Margin Trading, Futures Trading and the Staking, MasterNodes, etc. (passive income opportunity) DSX provided less financial or other services, related to the cryptocurrency exchange: it allowed us to purchase and sell digital currencies, and also: Fiat to Fiat Currencies Trading & Exchange.

- Kraken supports 34 cryptocurrencies DSX allowed to exchange only one crypto (DSX supports 33 fewer cryptocurrencies).

- 7 fiat currencies are available for buy- sell- operations at Kraken You could use 4 fiat currencies to swap with crytos and tokens on DSX (DSX supported 3 fiat currencies less).

- Kraken accepts the deposits from and allows fund to be withdrawn to 10 banks and (fiat) payment systems DSX allowed the customer to use 3 various fiat payment systems and/or banks (DSX supported 7 banks and/or payment systems less).

- The fees Kraken charges: 0.25% — 3.75% DSX charged the user 0.8% — 2.6% commission, depending on the exchange direction, payment system, etc. (DSX had lower fees in most of the cases).

- The purchase limits at Kraken are starting from $14.58 up to $365 Deposit and withdrawal limits at the DSX were $10.00 — $1,500 depending on the specific payment method, etc. (DSX had a higher limits for buying and selling orders).

- Kraken allows users' registrations from 234 countries; and we are glad to say that the people from United States are welcome You could register at the DSX if you were a resident of one of 252 countries; but users from United States were not able to use the service (DSX supported more countries and territories).

- When the client needs to pass through the KYC process at Kraken, they usually ask to provide 2 documents and / or specific procedures: ID or Passport Verification, current Address Confirmation (utility bill, bank or credit card statement, etc.). In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at DSX normally consisted of 4 individual procedures: the ID Verification, Phone Number Confirmation, an Address Confirmation, a Card Verification. (DSX's compliance program required the clients to pass through more identification procedures, to provide extra personal data).

We can't make a decision — is Kraken a worthy alternative to DSX — instead of you, but we'll try to assist with the matter. Kraken got a nice ranking score at our platform: 100 / 100 and we assume it would be a good replacement for DSX, worth inspecting, at least!

Like reading? In fact, there are more exchanges worth comparing to DSX, for example, those ones:

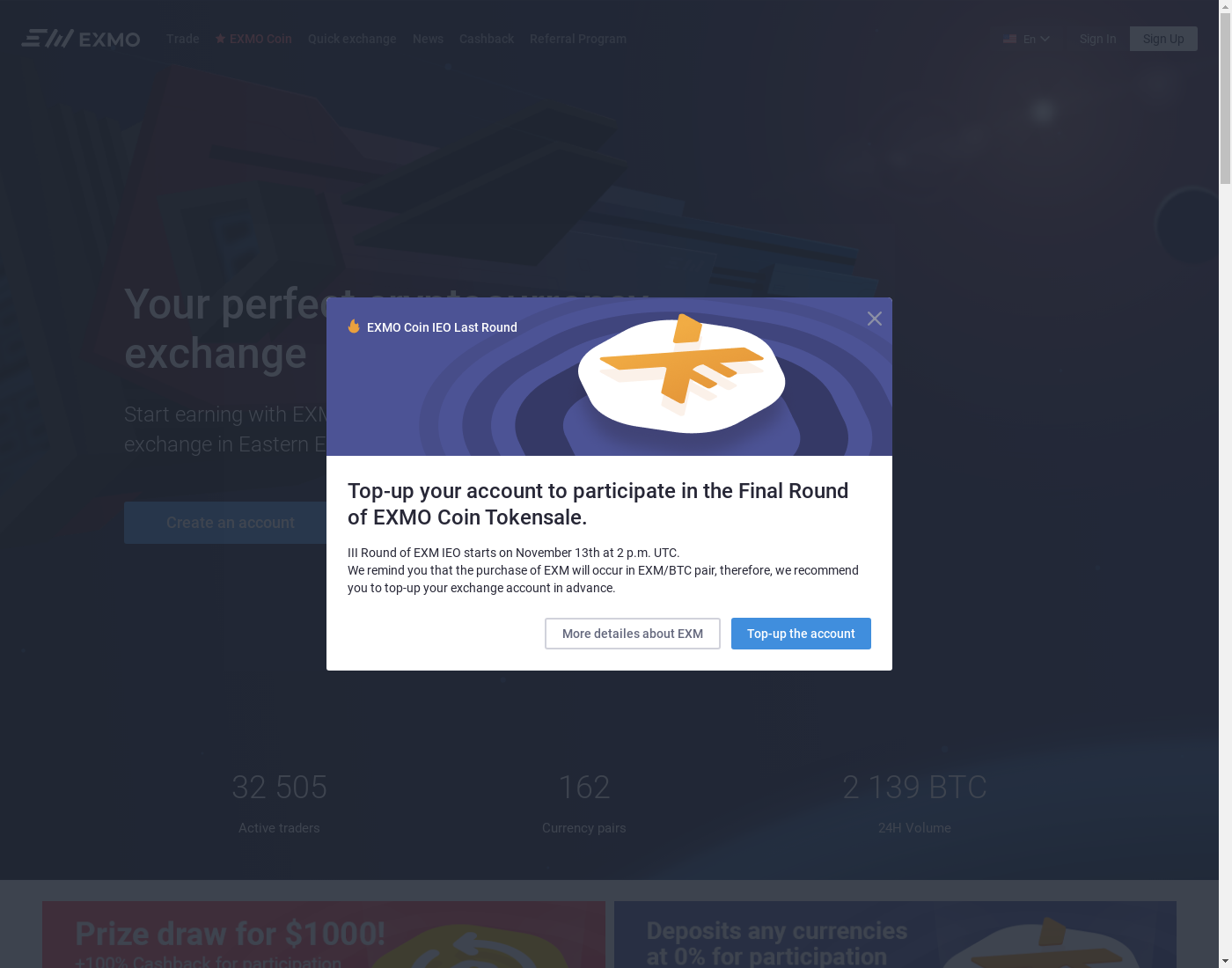

DSX vs EXMO

Let's compare the most important features and key facts about the EXMO with what DSX (RIP) offered us in the past to make a conclusion if EXMO will be the optimal choice for you:

- EXMO is a trading platform DSX was a trading platform, both following the same approach to the business.

- EXMO had launched the service May 2013 DSX started the project December 2014 (EXMO is operating for 1 years and 7 months longer).

- EXMO has all the business licenses and permissions, required by law DSX had all the required licenses, permissions, etc. (both websites operate(d) using the same business model, similar approach to the business, legal matters, etc.).

- Other than providing the services of buying, selling and exchanging cryptocurrency, EXMO provides some other exchange-related / financial services: Cash codes, OTC trading and the Margin Trading DSX provided less financial or other services, related to the cryptocurrency exchange: it allowed us to purchase and sell digital currencies, and also: Fiat to Fiat Currencies Trading & Exchange.

- EXMO supports 24 cryptocurrencies DSX allowed to exchange only one crypto (DSX supports 23 fewer cryptocurrencies).

- 5 fiat currencies are available for buy- sell- operations at EXMO You could use 4 fiat currencies to swap with crytos and tokens on DSX (DSX supported 1 fiduciary currency less).

- EXMO accepts the deposits from and allows fund to be withdrawn to 9 banks and (fiat) payment systems DSX allowed the customer to use 3 various fiat payment systems and/or banks (DSX supported 6 banks and/or payment systems less).

- The fees EXMO charges: 0.15% — 5.95% DSX charged the user 0.8% — 2.6% commission, depending on the exchange direction, payment system, etc. (DSX & EXMO charge(d) more or less equal fees).

- The purchase limits at EXMO are starting from $1.00 up to $20,000 Deposit and withdrawal limits at the DSX were $10.00 — $1,500 depending on the specific payment method, etc. (DSX had a higher limits for buying and selling orders).

- EXMO allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You could register at the DSX if you were a resident of one of 252 countries; but users from United States were not able to use the service (DSX had less countries supported).

- When the client needs to pass through the KYC process at EXMO, they usually ask to provide 3 documents and / or specific procedures: ID or Passport Verification, current Address Confirmation (utility bill, bank or credit card statement, etc.), Selfie with ID in hands. In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at DSX normally consisted of 4 individual procedures: the ID Verification, Phone Number Confirmation, an Address Confirmation, a Card Verification. (DSX KYC policies were super-strict, no exemptions allowed, any kind of trade required client identification; the good news is that EXMO is more tolerant!)

We can't make a decision — is EXMO a worthy alternative to DSX — instead of you, but we'll try to assist with the matter. EXMO got a nice ranking score at our platform: 100 / 100 and we assume it would be a good replacement for DSX, worth inspecting, at least!

Like reading? In fact, there are more exchanges worth comparing to DSX, for example, those ones:

DSX vs TransCoin

Let's compare the most important features and key facts about the TRANSCOIN with what DSX (RIP) offered us in the past to make a conclusion if TransCoin will be the optimal choice for you:

- TransCoin is a broker DSX was a trading platform, it's also an exchange, but has slightly different business model (feel free to read details about the difference between broker and trading platform)

- TransCoin had launched the service May 2018 DSX started the project December 2014 (DSX operated 3 years and 4 months longer).

- TransCoin has all the business licenses and permissions, required by law DSX had all the required licenses, permissions, etc. (both websites operate(d) using the same business model, similar approach to the business, legal matters, etc.).

- Besides the service of digital currency exchange, TransCoin provides no other services DSX provided few more financial services: it allowed us to purchase and sell digital currencies, and also: Fiat to Fiat Currencies Trading & Exchange.

- TransCoin supports 1 cryptocurrencies DSX allowed to exchange only one crypto (DSX & TransCoin count the same number of electronic currencys).

- TransCoin allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You could register at the DSX if you were a resident of one of 252 countries; but users from United States were not able to use the service (DSX had less countries supported).

- When the client needs to pass through the KYC process at TransCoin, they usually ask to provide some (it depends on various factors) documents and / or specific procedures The process of Customer Identification at DSX normally consisted of 4 individual procedures: the ID Verification, Phone Number Confirmation, an Address Confirmation, a Card Verification. (DSX compliance stuff traditionally asked the client to provide more data, pass through more procedures).

We can't make a decision — is TransCoin a worthy alternative to DSX — instead of you, but we'll try to assist with the matter. TransCoin got a nice ranking score at our platform: 100 / 100 and we assume it would be a good replacement for DSX, worth inspecting, at least!

Like reading? In fact, there are more exchanges worth comparing to DSX, for example, those ones:

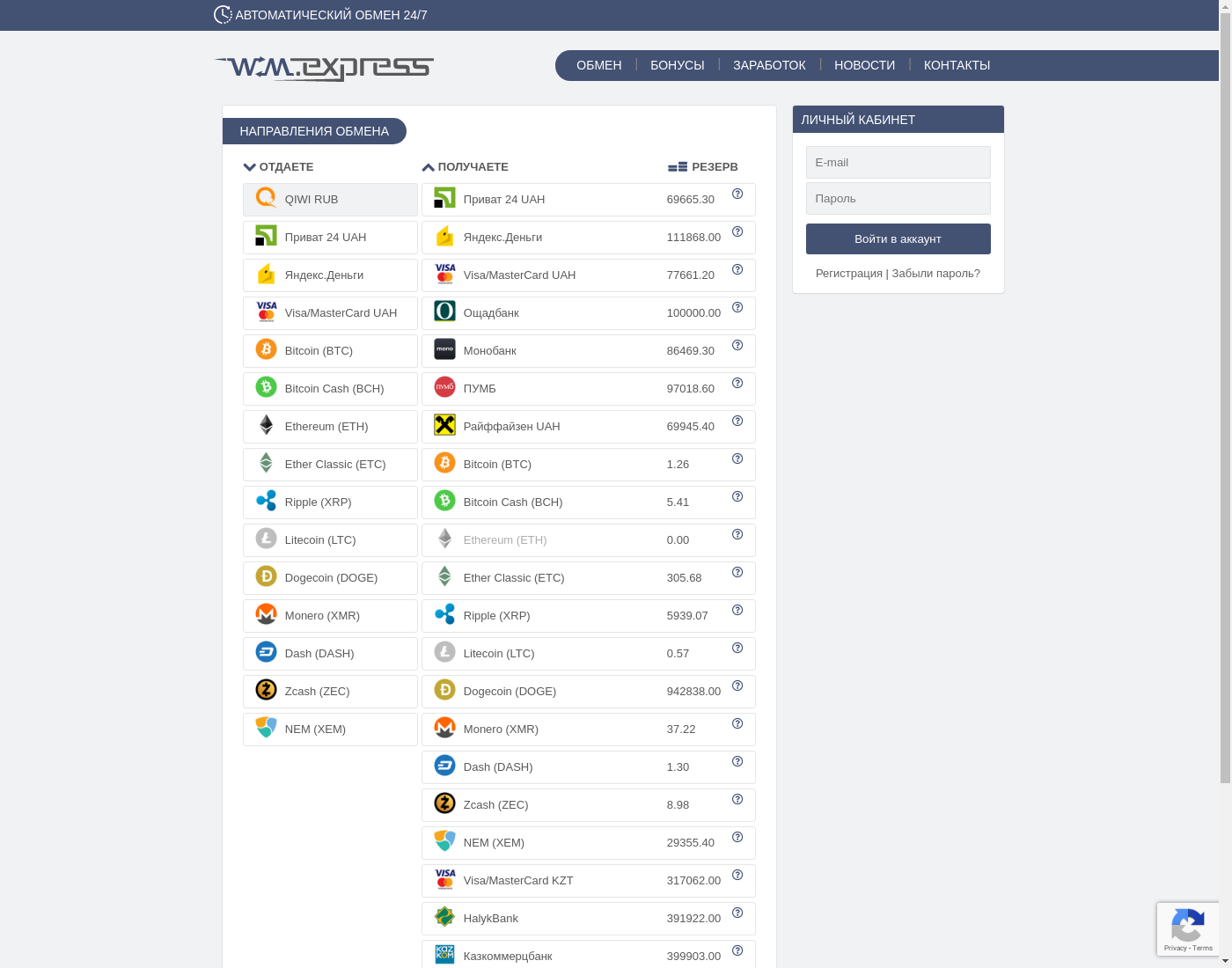

DSX vs WMexpress

Let's compare the most important features and key facts about the WMEXPRESS with what DSX (RIP) offered us in the past to make a conclusion if WMexpress will be the optimal choice for you:

- WMexpress is a broker DSX was a trading platform, it's also an exchange, but has slightly different business model (feel free to read details about the difference between broker and trading platform)

- WMexpress had launched the service August 2015 DSX started the project December 2014 (DSX operated 8 months longer).

- WMexpress operates without any registration or no information is available about the legal entity DSX had all the required licenses, permissions, etc. (DSX 's approach to the business made it a safer and more stable solution).

- Besides the service of digital currency exchange, WMexpress provides no other services DSX provided few more financial services: it allowed us to purchase and sell digital currencies, and also: Fiat to Fiat Currencies Trading & Exchange.

- WMexpress allows users' registrations from 255 countries; and we are glad to say that the people from United States are welcome You could register at the DSX if you were a resident of one of 252 countries; but users from United States were not able to use the service (DSX had less countries supported).

- When the client needs to pass through the KYC process at WMexpress, they usually ask to provide some (it depends on various factors) documents and / or specific procedures In most of the cases, it takes about a day or two, as per the actual clientele survey results The process of Customer Identification at DSX normally consisted of 4 individual procedures: the ID Verification, Phone Number Confirmation, an Address Confirmation, a Card Verification. (DSX compliance stuff traditionally asked the client to provide more data, pass through more procedures).

We can't make a decision — is WMexpress a worthy alternative to DSX — instead of you, but we'll try to assist with the matter. Although we can't say we are really impressed with the rating WMEXPRESS currently has: 71 of 100, there are plenty of other services that can replace a dysfunctional trading platform, mostly the highest ranked CEX!

Like reading? In fact, there are more exchanges worth comparing to DSX, for example, those ones:

Another approach: finding the best rate to exchange BTC & crypto in United States and North America

There is another way of finding the most worthy alternative to DSX that will work best for you considering:

- The fees and rates provided at the moment by 8 exchange websites of a "Trading Platform" type and 9,498 other offers.

- BTC/ exchange rate at those or BTC/USD, etc; the availability of service for the residents of United States (and the support).

- Which local banks & payment systems out of 154 serving US are the fastest, most convenient and cost-efficient personally for you.

- Amount you need to swap: say, the conditions for exchanging 1.01 will be significantly different from the terms of $67,853.0 conversion.

- And of course, you see the rating, users reviews (up-to-date 533 real clients testimonials), etc. for all the offers available!

Our platform could find 38 offers to buy, sell, exchange BTC available to users from United States, and 36 of these are for the US Dollar currency. There are totally 27 exchange services supporting US. Some of those are providing the access to USD|BTC market, including such types as e-wallet, P2P Marketplace, Trading Platform, etc. 5 exchanges has active offers for these currencies right now; you can buy/sell using 19 local and international payment systems & banks! The local dealers and exchanges are mentioning the support of 19 local banking institutions and the payment systems. According to the latest data we have, the lowest fee to purchase BTC with USD locally is available for Etana, that's a local payment system. The most popular domestic options for purchasing BTC @ US:

- Barter from Flutterwave | 50 ads

- GoBank Card | 34 ads

- MyVanilla Reloadable | 22 ads

- JCPenney | 13 ads

- Cash in Person | 5 ads

- Nike | 4 ads

- Cash App (Square) | 4 ads

- Other Gift Cards | 4 ads

- Visa & Mastercard | 3 ads

- Netspend Prepaid | 3 ads

Although there's no data left, what was available at dsx.uk for the clients from United States, we are sure that you'll find a worthy alternative on one of 36 exchange websites we compare the rates at! Check out what the local dealers and platforms are offering: currently there are 19 domestic banks supported. Besides, you may find something interesting browsing 9,498 offers available with 19 ways to pay internationally, either to neighboring countries in North America or to any other part of the world.