Payget review & 3 testimonials for payget.pro (07.2024)

- Overview: is Payget safe?

- Pros & Cons of Payget

- Services, Payget Provides

- Currencies & Payment Systems

- Payget fees

- Buying and selling limits

- Supported countries

- Customer service

- Verification at Payget

- Deposit/withdrawal speed

- Customers' testimonials

- FAQ about Payget

- Payget vs other exchanges

- Conclusion: is Payget legit or scam?

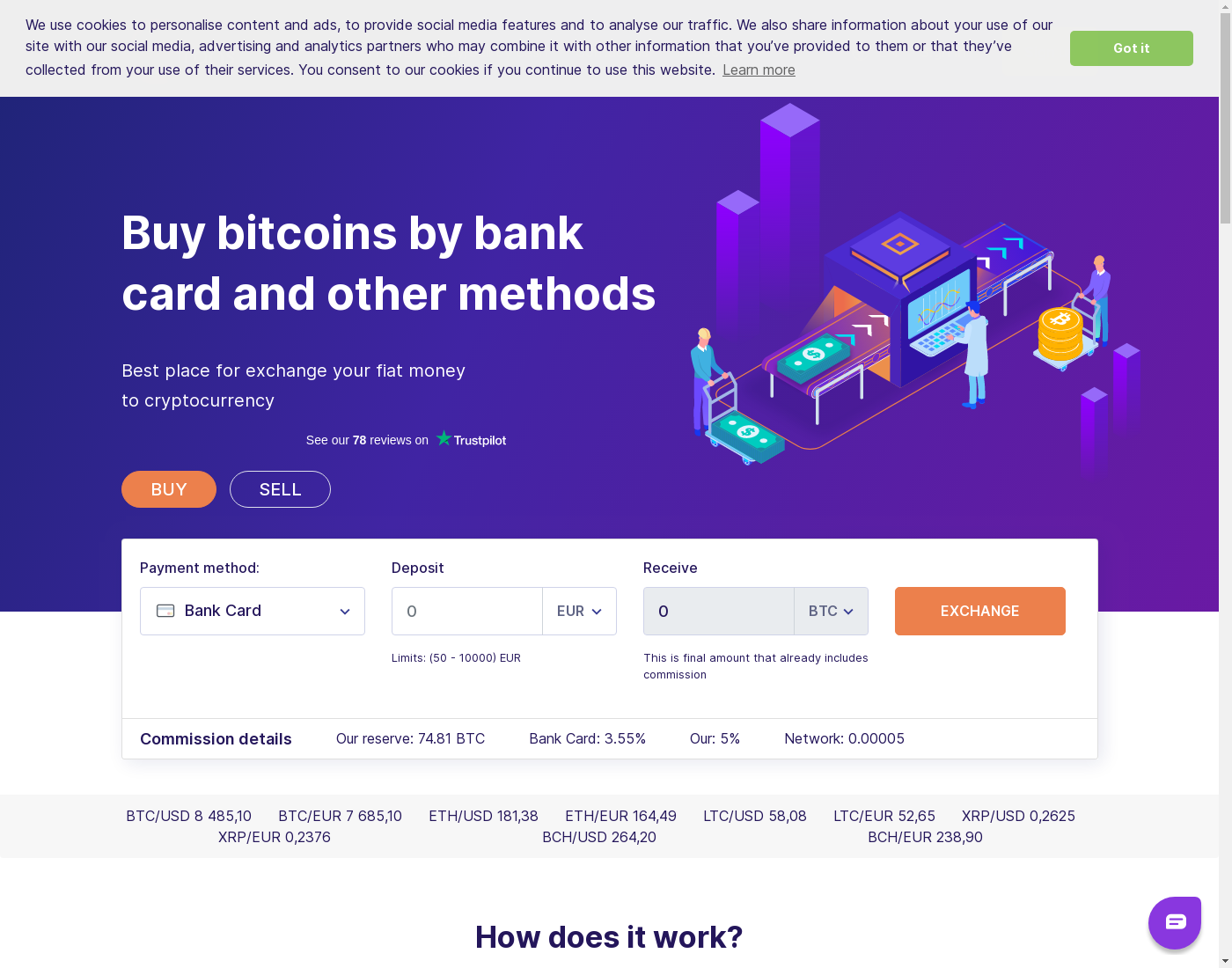

What is Payget in a nutshell? It's a rather popular, well established, fairly promising dealer aka exchanger (broker) working with some popular crypto: you can exchange these using the website. An exchanger started the business Jan 2018, it serves the clients for a few years.

This Broker

welcomes customers from

255

countries

(including your country: United States!).

It serves the US and allows registrations from

all the

56

states and territories.

On the report of the actual users, customer service is

exceptional, 5 stars quality;

the exchange is always instant!

(or close).

Depending on the order details, you may need to verify your account

Based on all these facts, our verdict is the following: Payget is a not bad place to exchange Bitcoins, an exchange that should do the job rather well.

Overview: is Payget safe?

Payget is the Broker; exchange started the business January 2018. Unfortunately, there is not much information available about the company doing business as Payget, etc.

Pros & Cons of Payget

Since Payget is rated rather good by our visitors, there should be some strong sides and some downsides as well. Let's check it out:

- Payget earned perfect testimonials from the clientele.

- Almost all the countries in the world are welcomed here! Feel free to check if your country is allowed to register an account.

- Lightning-fast orders processing, according to customers feedback.

- Perfect customer care quality; customers admire it!

- Seems that the exchange operates without any business licenses, etc. Although since it's in the business for over 6 years, it definitely gained trust in the community.

- Brokers are less regulated exchanges, you are basically on your own if you have problems with such a service.

Seems that there are not so many cons, but a lot of pros. We hope you will enjoy your experience exchanging at Payget! Try Payget today and let us know how you like it!

Services, Payget Provides

The platform provides the following cryptocurrency exchange-related services:

- Helps the visitors to exchange the electronic currencies.

As we can see, Payget doesn't provide any services besides the cryptocurrency exchange, althought it's definitely not a bad thing; after all, we came here for the crypto exchange, right?

Currencies & Payment Systems

Payget provides the service of various cryptocurrencies exchange.

If you are not sure, which one of these electronic currencies you are most interested in, you are welcome to read our guides. For example, these: Most scalable cryptocurrencies to invest in 2024.

Payget fees

Unfortunately, the integration data from PAYGET is missing, seems that there are some technical issues preventing our bot to crawl the information. We are sorry, but we can't analyze the fees without an access to the XML data feed, although you can check everything by yourself at the exchange website. We'll try to fix that soon!!

Buying and selling limits

We are sorry, but at the moment the XML data feed from Payget is missing or incorrect, so we can't provide you with this information. Please don't hesitate to either check by yourself at their website or just come back later!

Supported countries

Platform allows the users from 255 countries to use the exchange. The following countries are supported by the broker:

- Afghanistan (AF)

- Aland Islands (AX)

- Albania (AL)

- Algeria (DZ)

- American Samoa (AS)

- Andorra (AD)

- Angola (AO)

- Anguilla (AI)

- Antarctica (AQ)

- Antigua & Barbuda (AG)

- Argentina (AR)

- Armenia (AM)

- Aruba (AW)

- Ascension Island (AC)

- Australia (AU)

- Austria (AT)

- Azerbaijan (AZ)

- Bahamas (BS)

- Bahrain (BH)

- Bangladesh (BD)

- Barbados (BB)

- Belarus (BY)

- Belgium (BE)

- Belize (BZ)

- Benin (BJ)

- Bermuda (BM)

- Bhutan (BT)

- Bolivia (BO)

- Bosnia & Herzegovina (BA)

- Botswana (BW)

- Bouvet Island (BV)

- Brazil (BR)

- British Indian Ocean Territory (IO)

- British Virgin Islands (VG)

- Brunei (BN)

- Bulgaria (BG)

- Burkina Faso (BF)

- Burundi (BI)

- Cambodia (KH)

- Cameroon (CM)

- Canada (CA)

- Canary Islands (IC)

- Cape Verde (CV)

- Caribbean Netherlands (BQ)

- Cayman Islands (KY)

- Central African Republic (CF)

- Ceuta & Melilla (EA)

- Chad (TD)

- Chile (CL)

- China (CN)

- Christmas Island (CX)

- Cocos (Keeling) Islands (CC)

- Colombia (CO)

- Comoros (KM)

- Congo - Brazzaville (CG)

- Congo - Kinshasa (CD)

- Cook Islands (CK)

- Costa Rica (CR)

- Côte d’Ivoire (CI)

- Croatia (HR)

- Cuba (CU)

- Curaçao (CW)

- Cyprus (CY)

- Czech Republic (CZ)

- Denmark (DK)

- Diego Garcia (DG)

- Djibouti (DJ)

- Dominica (DM)

- Dominican Republic (DO)

- Ecuador (EC)

- Egypt (EG)

- El Salvador (SV)

- Equatorial Guinea (GQ)

- Eritrea (ER)

- Estonia (EE)

- Ethiopia (ET)

- Falkland Islands (FK)

- Faroe Islands (FO)

- Fiji (FJ)

- Finland (FI)

- France (FR)

- French Guiana (GF)

- French Polynesia (PF)

- French Southern Territories (TF)

- Gabon (GA)

- Gambia (GM)

- Georgia (GE)

- Germany (DE)

- Ghana (GH)

- Gibraltar (GI)

- Greece (GR)

- Greenland (GL)

- Grenada (GD)

- Guadeloupe (GP)

- Guam (GU)

- Guatemala (GT)

- Guernsey (GG)

- Guinea (GN)

- Guinea-Bissau (GW)

- Guyana (GY)

- Haiti (HT)

- Heard Island and McDonald Islands (HM)

- Honduras (HN)

- Hong Kong SAR China (HK)

- Hungary (HU)

- Iceland (IS)

- India (IN)

- Indonesia (ID)

- Iran (IR)

- Iraq (IQ)

- Ireland (IE)

- Isle of Man (IM)

- Israel (IL)

- Italy (IT)

- Jamaica (JM)

- Japan (JP)

- Jersey (JE)

- Jordan (JO)

- Kazakhstan (KZ)

- Kenya (KE)

- Kiribati (KI)

- Kosovo (XK)

- Kuwait (KW)

- Kyrgyzstan (KG)

- Laos (LA)

- Latvia (LV)

- Lebanon (LB)

- Lesotho (LS)

- Liberia (LR)

- Libya (LY)

- Liechtenstein (LI)

- Lithuania (LT)

- Luxembourg (LU)

- Macau SAR China (MO)

- Macedonia (MK)

- Madagascar (MG)

- Malawi (MW)

- Malaysia (MY)

- Maldives (MV)

- Mali (ML)

- Malta (MT)

- Marshall Islands (MH)

- Martinique (MQ)

- Mauritania (MR)

- Mauritius (MU)

- Mayotte (YT)

- Mexico (MX)

- Micronesia (FM)

- Moldova (MD)

- Monaco (MC)

- Mongolia (MN)

- Montenegro (ME)

- Montserrat (MS)

- Morocco (MA)

- Mozambique (MZ)

- Myanmar (Burma) (MM)

- Namibia (NA)

- Nauru (NR)

- Nepal (NP)

- Netherlands (NL)

- New Caledonia (NC)

- New Zealand (NZ)

- Nicaragua (NI)

- Niger (NE)

- Nigeria (NG)

- Niue (NU)

- Norfolk Island (NF)

- Northern Mariana Islands (MP)

- North Korea (KP)

- Norway (NO)

- Oman (OM)

- Pakistan (PK)

- Palau (PW)

- Palestinian Territories (PS)

- Panama (PA)

- Papua New Guinea (PG)

- Paraguay (PY)

- Peru (PE)

- Philippines (PH)

- Pitcairn Islands (PN)

- Poland (PL)

- Portugal (PT)

- Puerto Rico (PR)

- Qatar (QA)

- Réunion (RE)

- Romania (RO)

- Russia (RU)

- Rwanda (RW)

- Samoa (WS)

- San Marino (SM)

- São Tomé & Príncipe (ST)

- Saudi Arabia (SA)

- Senegal (SN)

- Serbia (RS)

- Seychelles (SC)

- Sierra Leone (SL)

- Singapore (SG)

- Sint Maarten (SX)

- Slovakia (SK)

- Slovenia (SI)

- Solomon Islands (SB)

- Somalia (SO)

- South Africa (ZA)

- South Georgia & South Sandwich Islands (GS)

- South Korea (KR)

- South Sudan (SS)

- Spain (ES)

- Sri Lanka (LK)

- St. Barthélemy (BL)

- St. Helena (SH)

- St. Kitts & Nevis (KN)

- St. Lucia (LC)

- St. Martin (MF)

- St. Pierre & Miquelon (PM)

- St. Vincent & Grenadines (VC)

- Sudan (SD)

- Suriname (SR)

- Svalbard & Jan Mayen (SJ)

- Swaziland (SZ)

- Sweden (SE)

- Switzerland (CH)

- Syria (SY)

- Taiwan (TW)

- Tajikistan (TJ)

- Tanzania (TZ)

- Thailand (TH)

- Timor-Leste (TL)

- Togo (TG)

- Tokelau (TK)

- Tonga (TO)

- Trinidad & Tobago (TT)

- Tristan da Cunha (TA)

- Tunisia (TN)

- Turkey (TR)

- Turkmenistan (TM)

- Turks & Caicos Islands (TC)

- Tuvalu (TV)

- Uganda (UG)

- Ukraine (UA)

- United Arab Emirates (AE)

- United Kingdom (GB)

- United States (US)

- Uruguay (UY)

- U.S. Outlying Islands (UM)

- U.S. Virgin Islands (VI)

- Uzbekistan (UZ)

- Vanuatu (VU)

- Vatican City (VA)

- Venezuela (VE)

- Vietnam (VN)

- Wallis & Futuna (WF)

- Western Sahara (EH)

- Yemen (YE)

- Zambia (ZM)

- Zimbabwe (ZW)

Does Payget allow the users from United States (US)?

Yes, payget.pro allows the registrations from the United States! Broker permits the users from 56 states and territories to register at and use the services exchange provides:

- Alabama (AL)

- Alaska (AK)

- American Samoa (AS)

- Arizona (AZ)

- Arkansas (AR)

- California (CA)

- Colorado (CO)

- Connecticut (CT)

- Delaware (DE)

- District of Columbia (DC)

- Florida (FL)

- Georgia (GA)

- Guam (GU)

- Hawaii (HI)

- Idaho (ID)

- Illinois (IL)

- Indiana (IN)

- Iowa (IA)

- Kansas (KS)

- Kentucky (KY)

- Louisiana (LA)

- Maine (ME)

- Maryland (MD)

- Massachusetts (MA)

- Michigan (MI)

- Minnesota (MN)

- Mississippi (MS)

- Missouri (MO)

- Montana (MT)

- Nebraska (NE)

- Nevada (NV)

- New Hampshire (NH)

- New Jersey (NJ)

- New Mexico (NM)

- New York (NY)

- North Carolina (NC)

- North Dakota (ND)

- Northern Mariana Islands (MP)

- Ohio (OH)

- Oklahoma (OK)

- Oregon (OR)

- Pennsylvania (PA)

- Puerto Rico (PR)

- Rhode Island (RI)

- South Carolina (SC)

- South Dakota (SD)

- Tennessee (TN)

- Texas (TX)

- U.S. Virgin Islands (VI)

- Utah (UT)

- Vermont (VT)

- Virginia (VA)

- Washington (WA)

- West Virginia (WV)

- Wisconsin (WI)

- Wyoming (WY)

Americans are welcome to exchange various cryptos that are supported by the broker.

Please visit the exchange's website to check the offers that are currently active!

Customer service

According to the community and the exchange users' testimonials, Payget provides an excellent, exceptional quality customers support! The analysis of reviews is the following:

Verification at Payget

The payget.pro may require the customers to pass through the user identification (account verification) process. An exchanger may require you to verify some information about your identity; the details depend on order amount, exchange direction, payment systems used, etc.

You'll see all the details during an order creation.

According to the customers surveys results, the average time to verify an account at Payget is the following:

Deposit/withdrawal speed

Payget processes orders (at least, some of them) "manually" i.e. with the participation of a human operator. Hence it's critically important to know how fast the staff operates, let us show you what statistics we collected about the speed of this exchange service!

Is Payget instant?

So, what can we see? According to the feedback we got from other users of this broker worldwide, Payget is instant: money arrives right after you order it all the time. That's great to know!

Customers' testimonials

Our users left 3 testimonials about their experience dealing with Payget, 100% of the testimonials are positive, 0% are neutral and there are 0 negative ones. Feel free to read as many of these as you like!

Покупал здесь крипту через рокетбанк. По скорости - ракета!! Все оч понравилось, вернусь еще!

Like many other exchange brokers in Russia, this one supports several popular digital currencies, local banks (including less presented ones like Rocketbank), electronic wallets, cards (including Mir) and fiat payment systems. What I like in this one is that unlike many other similar websites, this is well optimized for all the devices and can be used at tablets and phones without problems. Service is good, exchange is fast - operators work 24/7. Nice exchange if you have (or need) Rubles for your crypto!

Overall result if great! 100% positive testimonials is something the business owners are very proud of, such a rating is hard to get and even harder to maintain! It means the community really trusts and likes the Payget services, so most likely, you'd enjoy it too!

FAQ about Payget

Does Payget holds my funds?

It does not! One of the best things dealing with the brokers is that unlike most of other exchanges, such businesses instantly deliver your funds to your own wallet after the payment clearance.

Is Payget a good broker?

The testimonials are not bad, it seems to be OK exchange: not the best, not the worst. Feel free to get acquainted with the details reading this review or just jump to the conclusion!

Is Payget licensed? Does it hold e-money license?

It is not. We even could not find any information about the business entity operating the exchange, etc.

Is Payget a ripoff?

It is not. Feel free to read the whole this review to understand why or check our conclusion: is Payget legit or scam.

Payget vs other exchanges

Let's compare payget.pro to other similar exchange services with more or less the same features: others of broker type mostly. Besides, seems reasonable to compare the platform with the exchanges having similar rating and serving (mostly) the same geographic, etc. Remember that if you wish to find the exchange offering the best price to buy/sell Bitcoin and 50 other cryptos, check the best rates to buy bitcoin and crypto in United States!

Payget vs TransCoin

Let's compare the key features of these two platforms to see which one suits you best:

- TransCoin is a broker Payget is a broker, both are using the same business model.

- TransCoin had started the business May 2018 Payget started the business January 2018 (Payget operates 4 months longer).

- transcoin.me has all the required business licenses and permissions Payget operates without a business registration or there is no information available about it (TransCoin's business model is more stable and safer for clients).

- TransCoin allows registrations from 255 countries; United States is among the supported ones You may register at Payget if you reside in one of 255 countries; it serves United States among others (Payget & TransCoin support the same number of countries and territories).

- During the account verification TransCoin usually asks for some (it depends) documents and/or procedures User identification at Payget usually consists of some (it depends) different procedures (Payget & TransCoin require the client to pass through the — more or less — the same process during the verification).

- Our users left 5 testimonials about TransCoin, 100% of which are positive We've collected 3 users testimonials about Payget, 100% are positive (Payget & TransCoin share the same percentage of positive user reviews).

Although the final decision, which exchange — TransCoin or Payget — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although Payget has a lower total rating 62 vs TransCoin with 100, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

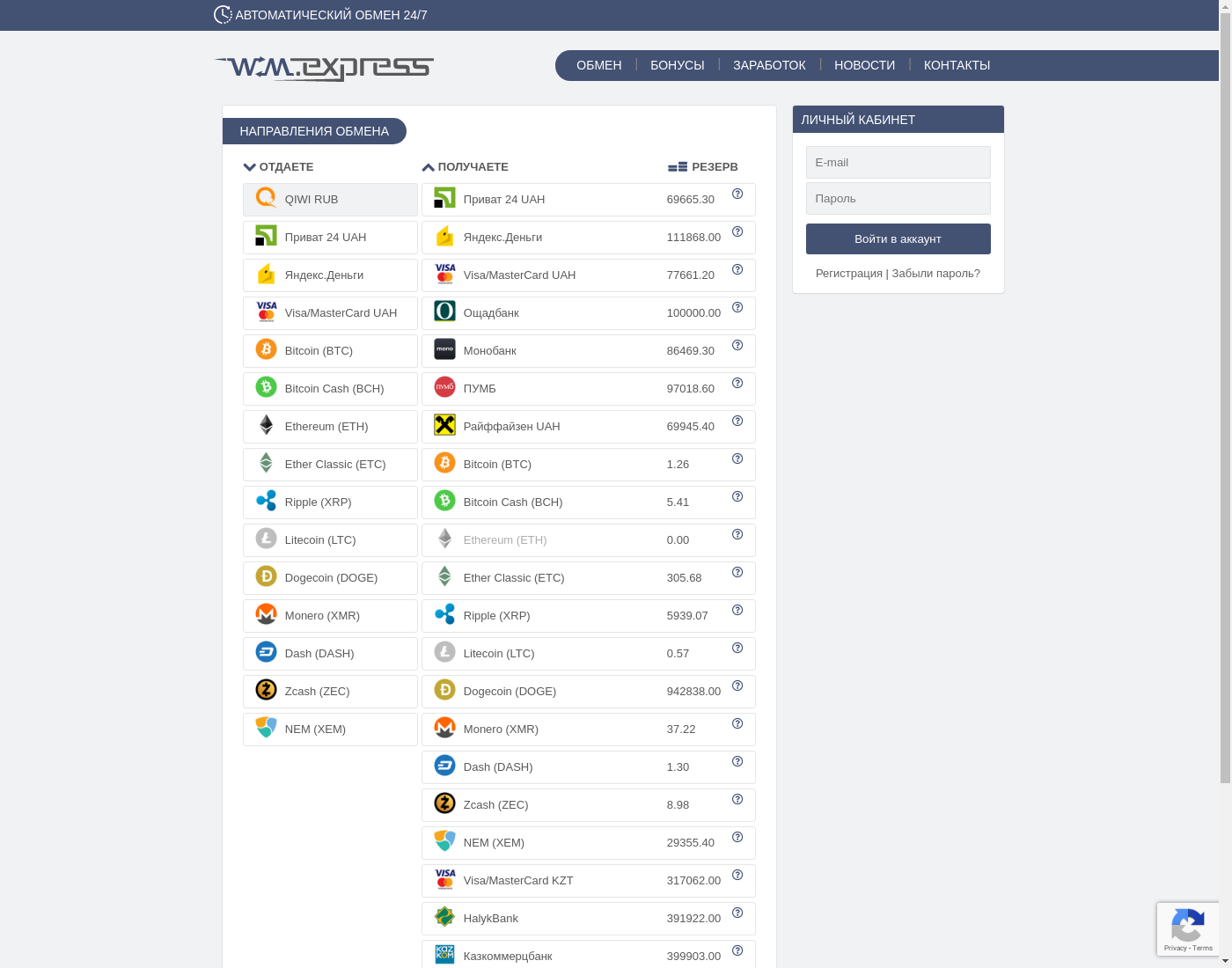

Payget vs WMexpress

Let's compare the key features of these two platforms to see which one suits you best:

- WMexpress is a broker Payget is a broker, both are using the same business model.

- WMexpress had started the business August 2015 Payget started the business January 2018 (wm.express is working for 2 years and 4 months longer time).

- wm.express operates without a business registration or there is no information available about it Payget operates without a business registration or there is no information available about it (both exchange services operate using the same approach to the business, utilizing a same legal model).

- WMexpress allows registrations from 255 countries; United States is among the supported ones You may register at Payget if you reside in one of 255 countries; it serves United States among others (Payget & WMexpress support the same number of countries and territories).

- Our visitors rated customer care at the WMexpress 5.0 / 5.0 Customers' service at Payget exchange was rated 5.0 / 5.0 by our visitors (Payget & WMexpress provide the equal quality of customer support).

- During the account verification WMexpress usually asks for some (it depends) documents and/or procedures and it takes a day or two in most of the cases User identification at Payget usually consists of some (it depends) different procedures (Payget & WMexpress require the client to pass through the — more or less — the same process during the verification).

- Due to results of community feedback, WMexpress process deposit/withdrawal orders in about in couple of minutes Due to results of community feedback, Payget process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay (Payget processes deposits and withdrawals faster

- Our users left 7 testimonials about WMexpress, 100% of which are positive We've collected 3 users testimonials about Payget, 100% are positive (Payget & WMexpress share the same percentage of positive user reviews).

Although the final decision, which exchange — WMexpress or Payget — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although Payget has a lower total rating 62 vs WMexpress with 71, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

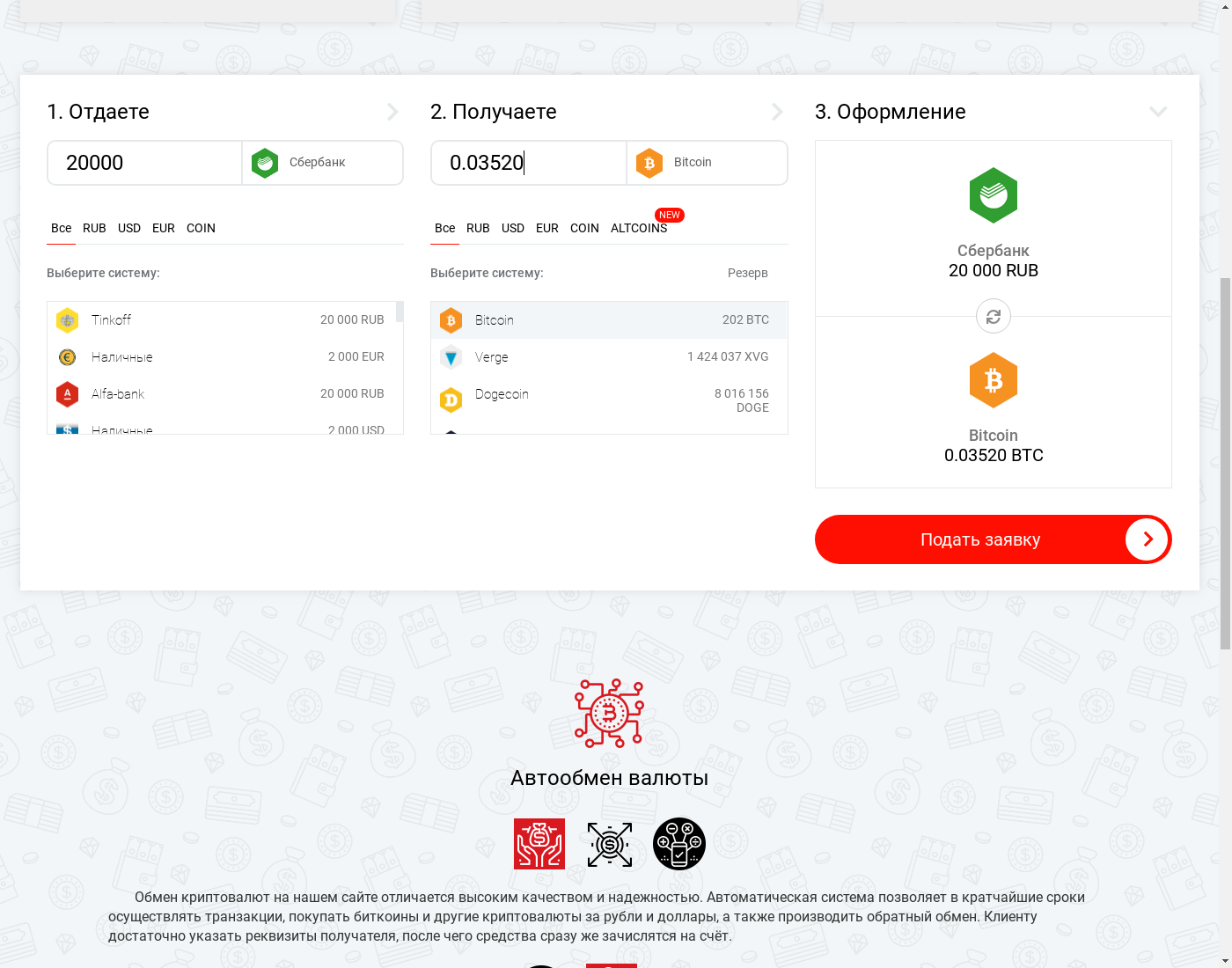

Payget vs chby

Let's compare the key features of these two platforms to see which one suits you best:

- chby is a broker Payget is a broker, both are using the same business model.

- chby had started the business July 2018 Payget started the business January 2018 (Payget operates 6 months longer).

- chby.io operates without a business registration or there is no information available about it Payget operates without a business registration or there is no information available about it (both exchange services operate using the same approach to the business, utilizing a same legal model).

- chby allows registrations from 255 countries; United States is among the supported ones You may register at Payget if you reside in one of 255 countries; it serves United States among others (Payget & chby support the same number of countries and territories).

- Our visitors rated customer care at the chby 5.0 / 5.0 Customers' service at Payget exchange was rated 5.0 / 5.0 by our visitors (Payget & chby provide the equal quality of customer support).

- During the account verification chby usually asks for some (it depends) documents and/or procedures and it takes a day or two in most of the cases User identification at Payget usually consists of some (it depends) different procedures (Payget & chby require the client to pass through the — more or less — the same process during the verification).

- Due to results of community feedback, chby process deposit/withdrawal orders in about in couple of minutes Due to results of community feedback, Payget process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay (Payget processes deposits and withdrawals faster

- Our users left 6 testimonials about chby, 100% of which are positive We've collected 3 users testimonials about Payget, 100% are positive (Payget & chby share the same percentage of positive user reviews).

Although the final decision, which exchange — chby or Payget — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although Payget has a lower total rating 62 vs chby with 70, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

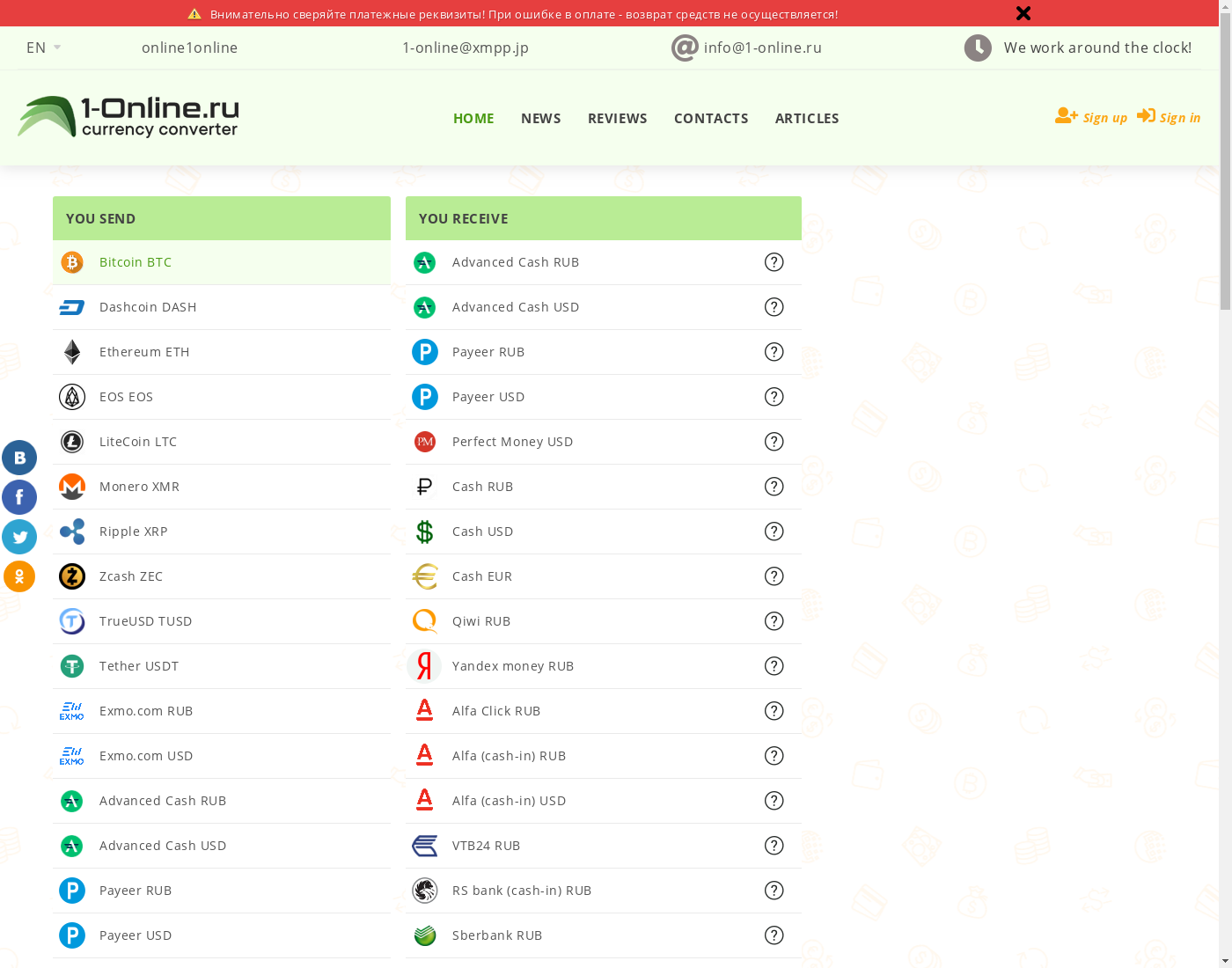

Payget vs 1-online

Let's compare the key features of these two platforms to see which one suits you best:

- 1-online is a broker Payget is a broker, both are using the same business model.

- 1-online had started the business February 2017 Payget started the business January 2018 (1-online.ru is working for 10 months longer time).

- 1-online.ru operates without a business registration or there is no information available about it Payget operates without a business registration or there is no information available about it (both exchange services operate using the same approach to the business, utilizing a same legal model).

- 1-online allows registrations from 255 countries; United States is among the supported ones You may register at Payget if you reside in one of 255 countries; it serves United States among others (Payget & 1-online support the same number of countries and territories).

- Our visitors rated customer care at the 1-online 5.0 / 5.0 Customers' service at Payget exchange was rated 5.0 / 5.0 by our visitors (Payget & 1-online provide the equal quality of customer support).

- During the account verification 1-online usually asks for some (it depends) documents and/or procedures and it takes a day or two in most of the cases User identification at Payget usually consists of some (it depends) different procedures (Payget & 1-online require the client to pass through the — more or less — the same process during the verification).

- Due to results of community feedback, 1-online process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay Due to results of community feedback, Payget process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay (Payget & 1-online process the deposits and withdrawals with equal speed).

- Our users left 5 testimonials about 1-online, 100% of which are positive We've collected 3 users testimonials about Payget, 100% are positive (Payget & 1-online share the same percentage of positive user reviews).

Although the final decision, which exchange — 1-online or Payget — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although Payget has a lower total rating 62 vs 1-online with 67, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

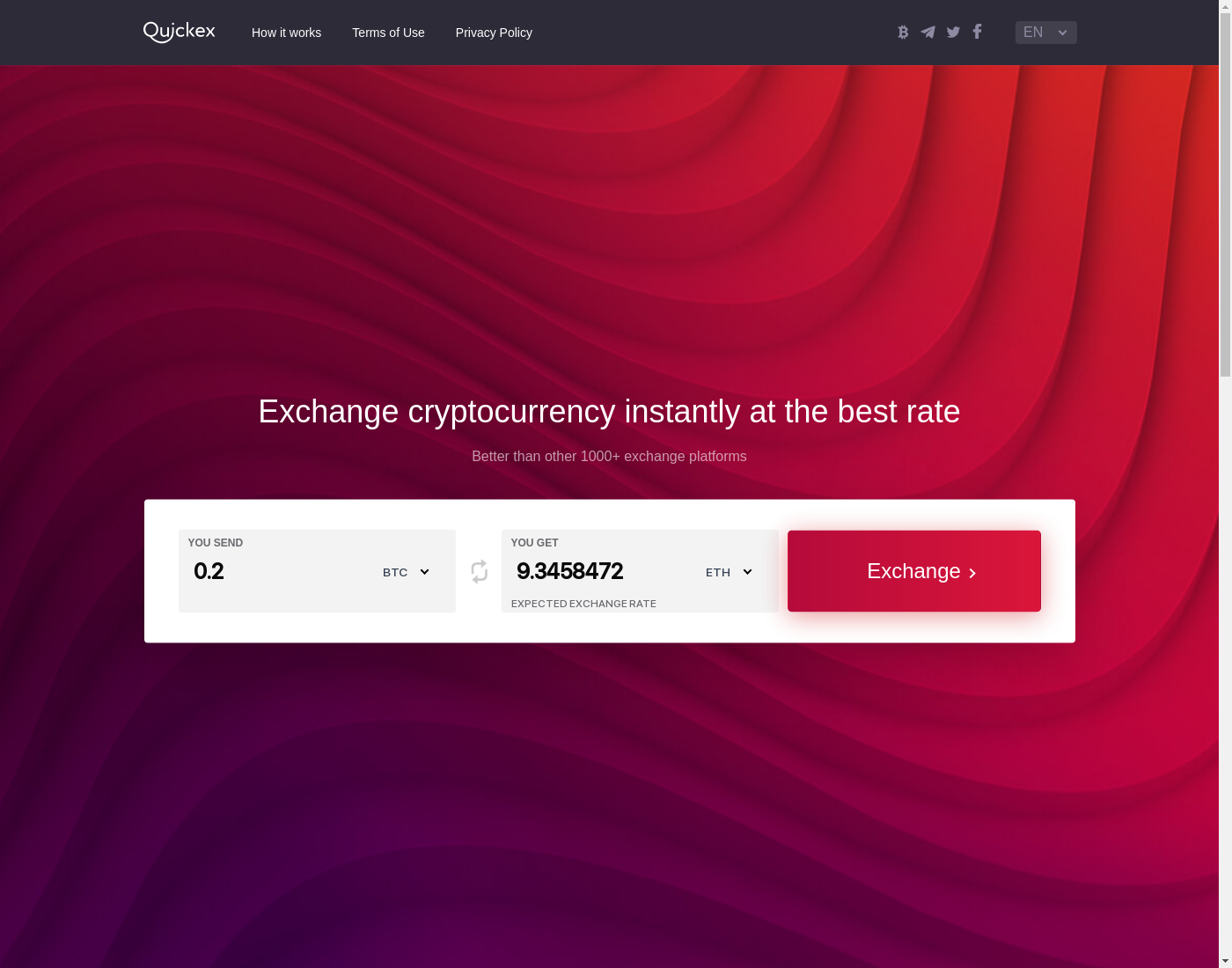

Payget vs Quickex

Let's compare the key features of these two platforms to see which one suits you best:

- Quickex is a broker Payget is a broker, both are using the same business model.

- Quickex had started the business February 2018 Payget started the business January 2018 (Payget operates 1 months longer).

- Quickex is an ordinary company without licenses, etc. Payget operates without a business registration or there is no information available about it (Quickex's business model is more stable and safer for clients).

- Quickex allows registrations from 255 countries; United States is among the supported ones You may register at Payget if you reside in one of 255 countries; it serves United States among others (Payget & Quickex support the same number of countries and territories).

- During the account verification Quickex usually asks for some (it depends) documents and/or procedures User identification at Payget usually consists of some (it depends) different procedures (Payget & Quickex require the client to pass through the — more or less — the same process during the verification).

- Due to results of community feedback, Quickex process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay Due to results of community feedback, Payget process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay (Payget & Quickex process the deposits and withdrawals with equal speed).

- Our users left 3 testimonials about Quickex, 100% of which are positive We've collected 3 users testimonials about Payget, 100% are positive (Payget & Quickex share the same percentage of positive user reviews).

Although the final decision, which exchange — Quickex or Payget — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although Payget has a lower total rating 62 vs Quickex with 64, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

Conclusion: is Payget legit or scam?

Now it's time to draw a conclusion, is payget.pro a scam or is it a legit exchange? Although Payget has some flaws, disadvantages, drawbacks, etc. it should be okay to deal with, we are positive that it's not a scam! Let's summarize what we like most (and what we don't) about the Payget:

- There is no information about the business entity, regulatory compliance, etc.

- The broker doesn't hold customers' funds, instantly delivering monies to your wallet

- This company has being in the business for a long time; exchange was started 6 years and 6 months ago

- Payget allows registrations from 255 countries; people from United States may use the service

- Clients' testimonials are perfect, 100% (3 out of 3) note their positive experience dealing with Payget. According to the customers feedback:

- Customer support is great

- Deposits and withdrawals are instant