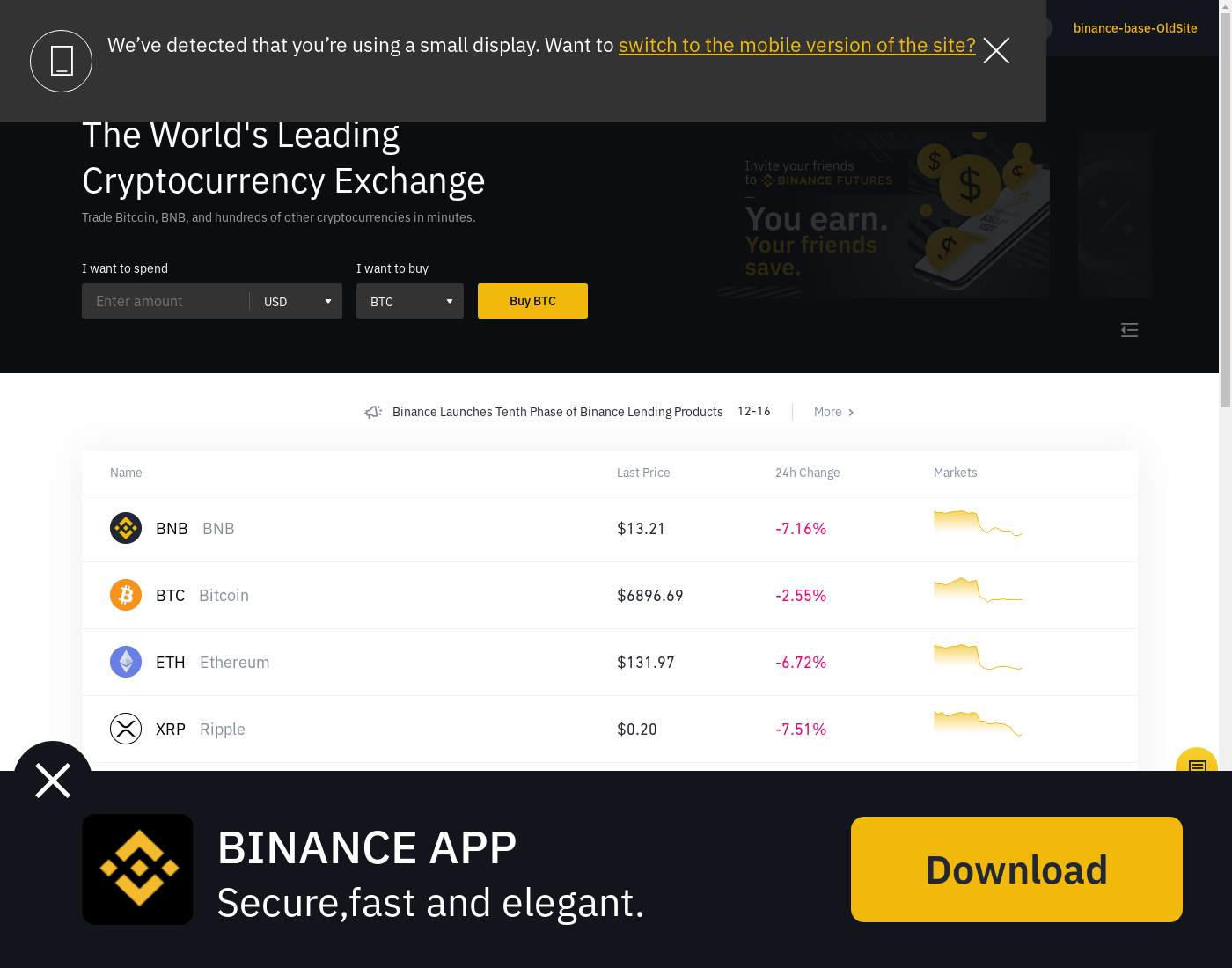

Binance review & 18 testimonials for binance.com (09.2021)

- Overview: is Binance safe?

- Pros & Cons of Binance

- Services, Binance Provides

- Currencies & Payment Systems

- Binance fees

- Buying and selling limits

- Supported countries

- Customer service

- Verification at Binance

- Deposit/withdrawal speed

- Customers' testimonials

- FAQ about Binance

- Binance vs other exchanges

- Conclusion: is Binance legit or scam?

What is Binance in a nutshell? It's a trusted, respectable, well established, promising exchange service (trading platform) working with 42 cryptocurrencies: you can buy and sell coins using 45 fiat currencies (9 banks & payment systems are supported) or exchange one crypto into another here. Exchange service started the business Apr 2017, it's a fully compliant, licensed financial company. Besides the cryptocurrencies exchange, Binance also provides other services, for example, Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace, NFT Marketplace.

This service integrated with a number of currencies, banks, and payment systems.

Hence to estimate the fees level we calculated an average fee you'll spend for an exchange here.

Based on this number

(2.42%)

we may say that Binance

charges

low fees:

0.1% — 4.0%

(in line with our statistics,

92%

exchanges offer lower average fee)

Binance has being assigned the special status: The third best Trading Platform worldwide! What does that mean? Our platform ranks all the exchanges basing on a number of factors: business model, licenses, time in the business, customers' testimonials, complaints (if any), etc. Then we compare all the leaders in each category (like trading platform) to determine who's the best-of-the-best. Hence, we are pleased to say that Binance is among those ones!

Based on all these facts, our verdict is the following: Binance is a 100% legit and perfectly safe place to buy and sell cryptocurrencies, almost an ideal exchange with great feedback we can recommend to our dear visitors!

Overview: is Binance safe?

Binance is the Trading Platform; Binance Europe Services (dba Binance) started the business in April 2017. The company is based in the Malta with the headquarters located in the Ta’Xbiex. Official Binance address is Melita Court, Level 3, Triq Giuseppe Cali, Ta’Xbiex.

Binance was founded by Changpeng Zhao, Yi He. Vertex Ventures and some others are among the lead investors. Binance CEO is Changpeng Zhao.

Although Binance was originally based in China, it moved to Japan when the Chinese government started an infamous "crackdown on crypto exchanges" and then, to Malta.

Binance had started the business not so long time ago, but it gained popularity super fast. It took less than half of a year to the platform to became exchange #3 (rank based on trading volume)! Binance is one of the most popular trading platforms and probably the most famous "crypto to crypto" exchange.

Pros & Cons of Binance

Since Binance is rated as one of the best exchanges in the world by our visitors, there should be many strong sides clients admire and probably some downsides anyway. Let's check it out:

- It's very stable and reliable exchange service operating from 2017.04. Fully compliant and regulated business, service provided by licensed financial company.

- Binance earned perfect testimonials from the clientele.

- 42 digital currencies and 45 fiat ones are supported: definitely a good choice! 9 payment systems and banks are supported, both international and national ones: Visa & Mastercard, Any Local Bank, SEPA Transfer, etc.

- Fees are relatively low.

- High purchase and withdrawal limits.

- Trading platform utilizes a business model based on holding the clients funds at the online wallet; such approach has some risks.

Seems that there are not so many cons, but a lot of pros. We hope you will enjoy your experience exchanging at Binance! Try Binance today and let us know how you like it!

Services, Binance Provides

The platform provides the following cryptocurrency exchange-related services:

- Allows the customers to buy cryptocurrencies with fiat currencies

- Provides the clients with ways to "cash out" the crypto to fiat currency

- Helps you to exchange one crypto to another

- Provides mobile wallet software for iPhone, Android and other phones

- Issues ATM cards (debit cards) you can load with coins to shop with cryptocurrency, etc.

- Allows the clients to issue/redeem so called cash codes; the combination of characters that can be sent to other person and used by him/her to add fiat balance at the exchange. It's something similar to prepaid cards like Paysafecard, etc..

- Cryptocurrency/token lending; it allows the traders earning a passive income — think of saving accounts with yearly interest, paid in crypto

- Margin (leveraged) trading; traders can access greater sums of capital than they possess by borrowing it from the exchange

- And other ones! The full list: Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace and NFT Marketplace.

- And other ones! The full list: Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace and NFT Marketplace.

- And other ones! The full list: Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace and NFT Marketplace.

- And other ones! The full list: Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace and NFT Marketplace.

That's impressive number of features! According to our statistics, 100% of the competition provide less services, many just allow the buying and selling, so this trading platform is among the champions in this field!

Currencies & Payment Systems

Binance provides the service of buying and selling and exchanging 42 digital currencies using fiat currencies and crypto. Besides the fiat-to-crypto conversion and vice versa, it also allows to exchange one cryptocurrency to another. The following cryptocurrencies are available to buy-sell-swap: Aave (AAVE), Cardano (ADA), Bitcoin Cash (BCHABC), Binance Coin (BNB), Bitcoin (BTC), BitTorrent (BTT), Binance USD (BUSD), MakerDAO (DAI), Dash (DASH), Dogecoin (DOGE), Polkadot (DOT), EOS (EOS), Ether Classic (ETC), Ether (ETH), Filecoin (FIL), Internet Computer (ICP), ICON (ICX), Komodo (KMD), Kusama (KSM), Chainlink (LINK), Lisk (LSK), Litecoin (LTC), Polygon (MATIC), IOTA (MIOTA), NEO (NEO), SKALE (SKL), Solana (SOL), SushiSwap (SUSHI), Theta Network (THETA), The Open Network (TON), TRON (TRX), TrueUSD (TUSD), Uniswap (UNI), USD Coin (USDC), Tether (USDT), VeChain (VET), Wrapped Bitcoin (WBTC), Stellar (XLM), Ripple (XRP), Verge (XVG), Zcash (ZEC), 0x (ZRX).

There are not much exchanges with so many cryptos supported! If you are not sure, which one of these electronic currencies you are most interested in, you are welcome to read our guides. For example, these: Top 10 cryptocurrencies to buy to invest in 2024.

45 fiat currencies are supported to provide crypto purchase and selling: United Arab Emirates Dirham (AED), Australian Dollar (AUD), Azerbaijani Manat (AZN), Bulgarian Lev (BGN), Brazilian Real (BRL), Canadian Dollar (CAD), Swiss Franc (CHF), Chilean Peso (CLP), Colombian Peso (COP), Czech Republic Koruna (CZK), Danish Krone (DKK), Euro (EUR), Pound Sterling (GBP), Ghanaian Cedi (GHS), Hong Kong Dollar (HKD), Croatian Kuna (HRK), Hungarian Forint (HUF), Indonesian Rupiah (IDR), Israeli New Sheqel (ILS), Icelandic Króna (ISK), Japanese Yen (JPY), Kenyan Shilling (KES), South Korean Won (KRW), Kazakhstani Tenge (KZT), Mexican Peso (MXN), Nigerian Naira (NGN), Norwegian Krone (NOK), New Zealand Dollar (NZD), Peruvian Nuevo Sol (PEN), Philippine Peso (PHP), Polish Zloty (PLN), Romanian Leu (RON), Russian Ruble (RUB), Saudi Riyal (SAR), Swedish Krona (SEK), Singapore Dollar (SGD), Thai Baht (THB), Turkish Lira (TRY), New Taiwan Dollar (TWD), Ukrainian Hryvna (UAH), Ugandan Shilling (UGX), US Dollar (USD), Uruguayan Peso (UYU), Vietnamese Dong (VND), South African Rand (ZAR). The Trading Platform will let you buy and sell Bitcoins and 41 other cryptos using the following payment systems:

- Visa & Mastercard. An international payment system (available worldwide) allowing credit/debit cards payments in various currencies. AED, AZN, BGN, CAD, CHF, CLP, COP, CZK, DKK, EUR, GBP, GHS, HKD, HRK, HUF, IDR, ILS, ISK, JPY, KES, KRW, KZT, MXN, NGN, NOK, NZD, PEN, PHP, PLN, RON, SAR, SEK, SGD, THB, TWD, UAH, USD, UYU, VND and ZAR payments are available for both buying and selling cryptocurrencies at this exchange. Visa & Mastercard is a popular way to buy BTC and other cryptocurrencies available at 7 exchanges of various types. You are welcome to find the best rate for buying bitcoin with visa & mastercard at our home page!

- Any Local Bank. An universal payment method, allowing payments from/to all the banks in various currencies. binance.com has options to use local bank transfers in the Turkey, Uganda, Brazil and Australia. AUD, BRL, TRY and UGX payments are available for both buying and selling cryptocurrencies at this exchange.

- SEPA Transfer. An international payment system (it's available in 46 countries) allowing international bank transfers payments in Euro currency. Just the EUR payments are available for selling cryptocurrency to fiat solely; at the time you can't buy crypto using this payment method here.

- Payeer. An international payment system (available worldwide) allowing other payments in various currencies. Just the RUB payments are available for both buying and selling cryptocurrencies at this exchange.

- Advanced Cash. An international payment system (available worldwide) allowing other payments in various currencies. EUR, RUB, TRY and UAH payments are available for both buying and selling cryptocurrencies at this exchange.

- PayID. A local bank (serving Australia) in Australian Dollar currency. Just the AUD payments are available for purchasing cryptos at the exchange.

- MTN Mobile Money (MoMo). An international payment system (it's available in 10 countries) allowing mobile payments payments in various currencies. Just the UGX payments are available for both buying and selling cryptocurrencies at this exchange.

- GEO Pay. A local payment system (serving Ukraine) allowing mobile payments payments in Ukrainian Hryvna currency. Just the UAH payments are available for both buying and selling cryptocurrencies at this exchange.

- Etana. An international payment system (it's available in 217 countries) allowing other payments in various currencies. Just the EUR payments are available for both buying and selling cryptocurrencies at this exchange.

Binance fees

The fees you need to pay at this trading platform during the process of buying and selling cryptocurrencies are easier to understand if you break it down like that (note that you can skip the details, jumping to the conclusion):

-

Deposit/withdrawal fee.

Depending on the fiat payment system and currency, it's as follows:

- 0% to deposit funds by Advanced Cash in Russian Ruble.

- 0% to deposit funds by Advanced Cash in Euro.

- Commission for the money withdrawal to Advanced Cash in Turkish Lira: 1.5%

- 1.5% to deposit funds by Advanced Cash in Turkish Lira.

- 0% to deposit funds by Advanced Cash in Ukrainian Hryvna.

- Commission for the money withdrawal to Advanced Cash in Euro: 0%

- Commission for the money withdrawal to Advanced Cash in Russian Ruble: 0%

- Commission for the money withdrawal to Advanced Cash in Ukrainian Hryvna: 0%

- 0% to deposit funds by Any Local Bank in Turkish Lira.

- 0% to deposit funds by Any Local Bank in Brazilian Real.

- Commission for the money withdrawal to Any Local Bank in Ugandan Shilling: 8000 flat fee

- Commission for the money withdrawal to Any Local Bank in Brazilian Real: 0%

- Commission for the money withdrawal to Any Local Bank in Australian Dollar: 0%

- 0.1% to deposit funds by Etana in Euro.

- Commission for the money withdrawal to Etana in Euro: 0.1%

- Commission for the money withdrawal to GEO Pay in Ukrainian Hryvna: 0%

- 0.65% to deposit funds by GEO Pay in Ukrainian Hryvna.

- Commission for the money withdrawal to MTN Mobile Money (MoMo) in Ugandan Shilling: 1.5%

- 3.5% to deposit funds by MTN Mobile Money (MoMo) in Ugandan Shilling.

- 0% to deposit funds by Payeer in Russian Ruble.

- Commission for the money withdrawal to Payeer in Russian Ruble: 1.0%

- 0% to deposit funds by PayID in Australian Dollar.

- Commission for the money withdrawal to SEPA Transfer in Euro: €0.8 flat fee

- 4.0% to deposit funds by Visa & Mastercard in Indonesian Rupiah.

- 4.0% to deposit funds by Visa & Mastercard in Israeli New Sheqel.

- 4.0% to deposit funds by Visa & Mastercard in Icelandic Króna.

- 4.0% to deposit funds by Visa & Mastercard in Japanese Yen.

- 4.0% to deposit funds by Visa & Mastercard in Kenyan Shilling.

- 4.0% to deposit funds by Visa & Mastercard in South Korean Won.

- 4.0% to deposit funds by Visa & Mastercard in Nigerian Naira.

- 4.0% to deposit funds by Visa & Mastercard in New Zealand Dollar.

- 4.0% to deposit funds by Visa & Mastercard in Philippine Peso.

- 4.0% to deposit funds by Visa & Mastercard in Polish Zloty.

- 4.0% to deposit funds by Visa & Mastercard in Romanian Leu.

- 4.0% to deposit funds by Visa & Mastercard in Saudi Riyal.

- 4.0% to deposit funds by Visa & Mastercard in Swedish Krona.

- 4.0% to deposit funds by Visa & Mastercard in Singapore Dollar.

- 4.0% to deposit funds by Visa & Mastercard in Thai Baht.

- 4.0% to deposit funds by Visa & Mastercard in New Taiwan Dollar.

- 4.0% to deposit funds by Visa & Mastercard in Uruguayan Peso.

- 4.0% to deposit funds by Visa & Mastercard in Vietnamese Dong.

- 4.0% to deposit funds by Visa & Mastercard in South African Rand.

- 3.5% to deposit funds by Visa & Mastercard in US Dollar.

- 4.0% to deposit funds by Visa & Mastercard in Mexican Peso.

- 2.0% to deposit funds by Visa & Mastercard in Euro.

- Commission for the money withdrawal to Visa & Mastercard in Euro: 1.0%

- 4.0% to deposit funds by Visa & Mastercard in Hong Kong Dollar.

- 4.0% to deposit funds by Visa & Mastercard in Norwegian Krone.

- 4.0% to deposit funds by Visa & Mastercard in Peruvian Nuevo Sol.

- 0% to deposit funds by Visa & Mastercard in Kazakhstani Tenge.

- Commission for the money withdrawal to Visa & Mastercard in Kazakhstani Tenge: 0%

- 4.0% to deposit funds by Visa & Mastercard in Ukrainian Hryvna.

- Commission for the money withdrawal to Visa & Mastercard in Ukrainian Hryvna: 1.0%

- 4.0% to deposit funds by Visa & Mastercard in United Arab Emirates Dirham.

- 4.0% to deposit funds by Visa & Mastercard in Azerbaijani Manat.

- 4.0% to deposit funds by Visa & Mastercard in Bulgarian Lev.

- 4.0% to deposit funds by Visa & Mastercard in Canadian Dollar.

- 4.0% to deposit funds by Visa & Mastercard in Swiss Franc.

- 4.0% to deposit funds by Visa & Mastercard in Chilean Peso.

- 4.0% to deposit funds by Visa & Mastercard in Colombian Peso.

- 4.0% to deposit funds by Visa & Mastercard in Czech Republic Koruna.

- 4.0% to deposit funds by Visa & Mastercard in Danish Krone.

- 3.0% to deposit funds by Visa & Mastercard in Pound Sterling.

- 4.0% to deposit funds by Visa & Mastercard in Ghanaian Cedi.

- 4.0% to deposit funds by Visa & Mastercard in Croatian Kuna.

- 4.0% to deposit funds by Visa & Mastercard in Hungarian Forint.

-

Trading fee.

This trading platform charges the following when your trade order matches and executes:

- 0.1% of the order amount, whatever fiat or crypto currency you trade.

-

Cryptocurrency withdrawal fee.

Please note that this fee applies only when you

transfer the crypto 'out': to your own wallet, to someone else, etc.!

- 0.000500 BTC when you purchase Bitcoins

- the usual transaction fee in the according crypto, when you are buying: AAVE, ADA, BCHABC, BNB, BTT, BUSD, DAI, DASH, DOGE, DOT, EOS, ETC, ETH, FIL, ICP, ICX, KMD, KSM, LINK, LSK, LTC, MATIC, MIOTA, NEO, SKL, SOL, SUSHI, THETA, TON, TRX, TUSD, UNI, USDC, USDT, VET, WBTC, XLM, XRP, XVG, ZEC, ZRX.

Are Binance fees high or low?

Now it's time to draw a conclusion: considering the average fee the exchange charges for an operation we can state that Binance takes rather low fees! According to our statistics, most of the exchanges charges about the same fees Binance does. For example, an average fee you pay to buy Bitcoin with Visa & Mastercard in EUR across various exchange brokers, trading platforms, p2p marketplaces and e-wallets is -9%, binance.com charges 2.0% for this. Seems fair.

Buying and selling limits

This Trading Platform has the following limits, applicable when you buy or sell cryptocurrencies (there are no limits on crypto-to-crypto swaps):

-

Purchase limits (when you buy crypto).

- ₽100 minimal buy and ₽70,000,000 max purchase when using Advanced Cash in Russian Ruble.

- €1 minimal buy and €800,000 max purchase when using Advanced Cash in Euro.

- ₺10 minimal buy and ₺6,500,000 max purchase when using Advanced Cash in Turkish Lira.

- ₴50 minimal buy and ₴25,000,000 max purchase when using Advanced Cash in Ukrainian Hryvna.

- ₺1 minimal buy and ₺1,000,000 max purchase when using Any Local Bank in Turkish Lira.

- BRL 1 minimal buy and BRL 600,000 max purchase when using Any Local Bank in Brazilian Real.

- €10 minimal buy and €200,000 max purchase when using Etana in Euro.

- ₴50 minimal buy and ₴1,365,840 max purchase when using GEO Pay in Ukrainian Hryvna.

- UGX 5,000 minimal buy and UGX 5,000,000 max purchase when using MTN Mobile Money (MoMo) in Ugandan Shilling.

- ₽1 minimal buy and ₽70,000,000 max purchase when using Payeer in Russian Ruble.

- AUD 1 minimal buy and AUD 25,000 max purchase when using PayID in Australian Dollar.

- IDR 220,000 minimal buy and IDR 71,000,000 max purchase when using Visa & Mastercard in Indonesian Rupiah.

- ILS 60 minimal buy and ILS 20,000 max purchase when using Visa & Mastercard in Israeli New Sheqel.

- ISK 2,100 minimal buy and ISK 210,000 max purchase when using Visa & Mastercard in Icelandic Króna.

- ¥1,700 minimal buy and ¥530,000 max purchase when using Visa & Mastercard in Japanese Yen.

- KES 1,600 minimal buy and KES 520,000 max purchase when using Visa & Mastercard in Kenyan Shilling.

- KRW 20,000 minimal buy and KRW 6,150,000 max purchase when using Visa & Mastercard in South Korean Won.

- NGN 3,500 minimal buy and NGN 1,800,000 max purchase when using Visa & Mastercard in Nigerian Naira.

- NZD 25 minimal buy and NZD 8,200 max purchase when using Visa & Mastercard in New Zealand Dollar.

- PHP 780 minimal buy and PHP 250,000 max purchase when using Visa & Mastercard in Philippine Peso.

- PLN 100 minimal buy and PLN 18,000 max purchase when using Visa & Mastercard in Polish Zloty.

- RON 65 minimal buy and RON 21,000 max purchase when using Visa & Mastercard in Romanian Leu.

- SAR 60 minimal buy and SAR 18,000 max purchase when using Visa & Mastercard in Saudi Riyal.

- SEK 150 minimal buy and SEK 46,000 max purchase when using Visa & Mastercard in Swedish Krona.

- SGD 30 minimal buy and SGD 7,200 max purchase when using Visa & Mastercard in Singapore Dollar.

- ฿500 minimal buy and ฿160,000 max purchase when using Visa & Mastercard in Thai Baht.

- TWD 500 minimal buy and TWD 160,000 max purchase when using Visa & Mastercard in New Taiwan Dollar.

- UYU 650 minimal buy and UYU 65,000 max purchase when using Visa & Mastercard in Uruguayan Peso.

- VND 360,000 minimal buy and VND 118,000,000 max purchase when using Visa & Mastercard in Vietnamese Dong.

- ZAR 300 minimal buy and ZAR 130,000 max purchase when using Visa & Mastercard in South African Rand.

- $15 minimal buy and $15,000 max purchase when using Visa & Mastercard in US Dollar.

- MXN 360 minimal buy and MXN 999,230 max purchase when using Visa & Mastercard in Mexican Peso.

- €15 minimal buy and €42,150 max purchase when using Visa & Mastercard in Euro.

- HK$120 minimal buy and HK$100,000 max purchase when using Visa & Mastercard in Hong Kong Dollar.

- NOK 150 minimal buy and NOK 44,000 max purchase when using Visa & Mastercard in Norwegian Krone.

- PEN 55 minimal buy and PEN 16,000 max purchase when using Visa & Mastercard in Peruvian Nuevo Sol.

- ₸1,000 minimal buy and ₸400,000,000 max purchase when using Visa & Mastercard in Kazakhstani Tenge.

- ₴5 minimal buy and ₴29,999 max purchase when using Visa & Mastercard in Ukrainian Hryvna.

- AED 70 minimal buy and AED 55,000 max purchase when using Visa & Mastercard in United Arab Emirates Dirham.

- AZN 25 minimal buy and AZN 2,500 max purchase when using Visa & Mastercard in Azerbaijani Manat.

- BGN 30 minimal buy and BGN 8,800 max purchase when using Visa & Mastercard in Bulgarian Lev.

- CAD 20 minimal buy and CAD 6,700 max purchase when using Visa & Mastercard in Canadian Dollar.

- CHF 15 minimal buy and CHF 5,000 max purchase when using Visa & Mastercard in Swiss Franc.

- CLP 12,000 minimal buy and CLP 3,800,000 max purchase when using Visa & Mastercard in Chilean Peso.

- COP 62,000 minimal buy and COP 20,000,000 max purchase when using Visa & Mastercard in Colombian Peso.

- CZK 350 minimal buy and CZK 110,000 max purchase when using Visa & Mastercard in Czech Republic Koruna.

- DKK 100 minimal buy and DKK 35,000 max purchase when using Visa & Mastercard in Danish Krone.

- £15 minimal buy and £5,000 max purchase when using Visa & Mastercard in Pound Sterling.

- GHS 100 minimal buy and GHS 50,000 max purchase when using Visa & Mastercard in Ghanaian Cedi.

- HRK 100 minimal buy and HRK 33,500 max purchase when using Visa & Mastercard in Croatian Kuna.

- HUF 4,600 minimal buy and HUF 1,550,000 max purchase when using Visa & Mastercard in Hungarian Forint.

-

Withdrawal limits (when you out-exchange crypto to the fiat money).

- ₺10 min and ₺800,000 maximal withdrawal when receiving money to Advanced Cash in Turkish Lira.

- €1 min and €800,000 maximal withdrawal when receiving money to Advanced Cash in Euro.

- ₽100 min and ₽70,000,000 maximal withdrawal when receiving money to Advanced Cash in Russian Ruble.

- ₴5 min and ₴2,500,000 maximal withdrawal when receiving money to Advanced Cash in Ukrainian Hryvna.

- UGX 8,000 min and UGX 5,000,000 maximal withdrawal when receiving money to Any Local Bank in Ugandan Shilling.

- BRL 10 min and BRL 600,000 maximal withdrawal when receiving money to Any Local Bank in Brazilian Real.

- AUD 50 min and AUD 20,000 maximal withdrawal when receiving money to Any Local Bank in Australian Dollar.

- €1 min and €50,000 maximal withdrawal when receiving money to Etana in Euro.

- ₴50 min and ₴1,365,780 maximal withdrawal when receiving money to GEO Pay in Ukrainian Hryvna.

- UGX 8,000 min and UGX 5,000,000 maximal withdrawal when receiving money to MTN Mobile Money (MoMo) in Ugandan Shilling.

- ₽200 min and ₽8,000,000 maximal withdrawal when receiving money to Payeer in Russian Ruble.

- €3 min and €42,150 maximal withdrawal when receiving money to SEPA Transfer in Euro.

- €10 min and €5,000 maximal withdrawal when receiving money to Visa & Mastercard in Euro.

- ₸1,000 min and ₸45,000,000 maximal withdrawal when receiving money to Visa & Mastercard in Kazakhstani Tenge.

- ₴5 min and ₴29,999 maximal withdrawal when receiving money to Visa & Mastercard in Ukrainian Hryvna.

And the good news: there are no limits on other payment systems (the limitations the payment system has aside) Binance supports! Comparing to other exchanges, Binance has one of highest buying and selling limits on the whole exchange market!

Supported countries

Platform allows the users from 250 countries to use the exchange. The following countries are supported by the trading platform:

- Afghanistan (AF)

- Aland Islands (AX)

- Albania (AL)

- Algeria (DZ)

- American Samoa (AS)

- Andorra (AD)

- Angola (AO)

- Anguilla (AI)

- Antarctica (AQ)

- Antigua & Barbuda (AG)

- Argentina (AR)

- Armenia (AM)

- Aruba (AW)

- Ascension Island (AC)

- Australia (AU)

- Austria (AT)

- Azerbaijan (AZ)

- Bahamas (BS)

- Bahrain (BH)

- Bangladesh (BD)

- Barbados (BB)

- Belarus (BY)

- Belgium (BE)

- Belize (BZ)

- Benin (BJ)

- Bermuda (BM)

- Bhutan (BT)

- Bolivia (BO)

- Bosnia & Herzegovina (BA)

- Botswana (BW)

- Bouvet Island (BV)

- Brazil (BR)

- British Indian Ocean Territory (IO)

- British Virgin Islands (VG)

- Brunei (BN)

- Bulgaria (BG)

- Burkina Faso (BF)

- Burundi (BI)

- Cambodia (KH)

- Cameroon (CM)

- Canary Islands (IC)

- Cape Verde (CV)

- Caribbean Netherlands (BQ)

- Cayman Islands (KY)

- Central African Republic (CF)

- Ceuta & Melilla (EA)

- Chad (TD)

- Chile (CL)

- China (CN)

- Christmas Island (CX)

- Cocos (Keeling) Islands (CC)

- Colombia (CO)

- Comoros (KM)

- Congo - Brazzaville (CG)

- Congo - Kinshasa (CD)

- Cook Islands (CK)

- Costa Rica (CR)

- Côte d’Ivoire (CI)

- Croatia (HR)

- Cuba (CU)

- Curaçao (CW)

- Cyprus (CY)

- Czech Republic (CZ)

- Denmark (DK)

- Diego Garcia (DG)

- Djibouti (DJ)

- Dominica (DM)

- Dominican Republic (DO)

- Ecuador (EC)

- Egypt (EG)

- El Salvador (SV)

- Equatorial Guinea (GQ)

- Eritrea (ER)

- Estonia (EE)

- Ethiopia (ET)

- Falkland Islands (FK)

- Faroe Islands (FO)

- Fiji (FJ)

- Finland (FI)

- France (FR)

- French Guiana (GF)

- French Polynesia (PF)

- French Southern Territories (TF)

- Gabon (GA)

- Gambia (GM)

- Georgia (GE)

- Germany (DE)

- Ghana (GH)

- Gibraltar (GI)

- Greece (GR)

- Greenland (GL)

- Grenada (GD)

- Guadeloupe (GP)

- Guam (GU)

- Guatemala (GT)

- Guernsey (GG)

- Guinea (GN)

- Guinea-Bissau (GW)

- Guyana (GY)

- Haiti (HT)

- Heard Island and McDonald Islands (HM)

- Honduras (HN)

- Hong Kong SAR China (HK)

- Hungary (HU)

- Iceland (IS)

- India (IN)

- Indonesia (ID)

- Ireland (IE)

- Isle of Man (IM)

- Israel (IL)

- Italy (IT)

- Jamaica (JM)

- Japan (JP)

- Jersey (JE)

- Jordan (JO)

- Kazakhstan (KZ)

- Kenya (KE)

- Kiribati (KI)

- Kosovo (XK)

- Kuwait (KW)

- Kyrgyzstan (KG)

- Laos (LA)

- Latvia (LV)

- Lebanon (LB)

- Lesotho (LS)

- Liberia (LR)

- Libya (LY)

- Liechtenstein (LI)

- Lithuania (LT)

- Luxembourg (LU)

- Macau SAR China (MO)

- Macedonia (MK)

- Madagascar (MG)

- Malawi (MW)

- Malaysia (MY)

- Maldives (MV)

- Mali (ML)

- Malta (MT)

- Marshall Islands (MH)

- Martinique (MQ)

- Mauritania (MR)

- Mauritius (MU)

- Mayotte (YT)

- Mexico (MX)

- Micronesia (FM)

- Moldova (MD)

- Monaco (MC)

- Mongolia (MN)

- Montenegro (ME)

- Montserrat (MS)

- Morocco (MA)

- Mozambique (MZ)

- Myanmar (Burma) (MM)

- Namibia (NA)

- Nauru (NR)

- Nepal (NP)

- Netherlands (NL)

- New Caledonia (NC)

- New Zealand (NZ)

- Nicaragua (NI)

- Niger (NE)

- Nigeria (NG)

- Niue (NU)

- Norfolk Island (NF)

- Northern Mariana Islands (MP)

- Norway (NO)

- Oman (OM)

- Pakistan (PK)

- Palau (PW)

- Palestinian Territories (PS)

- Panama (PA)

- Papua New Guinea (PG)

- Paraguay (PY)

- Peru (PE)

- Philippines (PH)

- Pitcairn Islands (PN)

- Poland (PL)

- Portugal (PT)

- Puerto Rico (PR)

- Qatar (QA)

- Réunion (RE)

- Romania (RO)

- Russia (RU)

- Rwanda (RW)

- Samoa (WS)

- San Marino (SM)

- São Tomé & Príncipe (ST)

- Saudi Arabia (SA)

- Senegal (SN)

- Serbia (RS)

- Seychelles (SC)

- Sierra Leone (SL)

- Singapore (SG)

- Sint Maarten (SX)

- Slovakia (SK)

- Slovenia (SI)

- Solomon Islands (SB)

- Somalia (SO)

- South Africa (ZA)

- South Georgia & South Sandwich Islands (GS)

- South Korea (KR)

- South Sudan (SS)

- Spain (ES)

- Sri Lanka (LK)

- St. Barthélemy (BL)

- St. Helena (SH)

- St. Kitts & Nevis (KN)

- St. Lucia (LC)

- St. Martin (MF)

- St. Pierre & Miquelon (PM)

- St. Vincent & Grenadines (VC)

- Sudan (SD)

- Suriname (SR)

- Svalbard & Jan Mayen (SJ)

- Swaziland (SZ)

- Sweden (SE)

- Switzerland (CH)

- Syria (SY)

- Taiwan (TW)

- Tajikistan (TJ)

- Tanzania (TZ)

- Thailand (TH)

- Timor-Leste (TL)

- Togo (TG)

- Tokelau (TK)

- Tonga (TO)

- Trinidad & Tobago (TT)

- Tristan da Cunha (TA)

- Tunisia (TN)

- Turkey (TR)

- Turkmenistan (TM)

- Turks & Caicos Islands (TC)

- Tuvalu (TV)

- Uganda (UG)

- Ukraine (UA)

- United Arab Emirates (AE)

- United Kingdom (GB)

- Uruguay (UY)

- U.S. Outlying Islands (UM)

- U.S. Virgin Islands (VI)

- Uzbekistan (UZ)

- Vanuatu (VU)

- Vatican City (VA)

- Venezuela (VE)

- Vietnam (VN)

- Wallis & Futuna (WF)

- Western Sahara (EH)

- Yemen (YE)

- Zambia (ZM)

- Zimbabwe (ZW)

Does Binance allow the users from United States (US)?

Sorry, but the binance.com can't provide the services to the citizens and residents of the United States of America at this time, due to the local regulations and licensing matters, etc. But there are no reasons to get disappointed because of that, there are plenty of great exchanges as well as the ones of Trading Platform type, who warmly welcomes the American people! We can recommend you look at these:

Customer service

According to the community and the exchange users' testimonials, Binance provides an excellent, exceptional quality customers support! The analysis of reviews is the following:

Verification at Binance

The trading platform requires it's clients to pass through obligatory user identification (account verification). The following procedures should be completed before the client will be able to buy and sell on the exchange:

- Selfie

According to the data submitted by the customers with the reviews and testimonials, the average time the account verification takes is up to 5 minutes! The feedback is the following:

An excellent result! Verification just takes a little bit of your time and the best thing is that you do it only once.

Deposit/withdrawal speed

Although the exchange process is fully automated on any e-wallet or trading platform, you may face some delay when you send the money "outside", i.e. say you are withdrawing the BTC you purchased to your personal wallet. Let's see what other cryptocurrency enthusiasts say about how fast is binance.com!

Is Binance instant?

So, what can we see? According to the feedback we got from other users of this trading platform worldwide, Binance is instant: money arrives right after you order it all the time. That's great to know!

Customers' testimonials

Our users left 18 testimonials about their experience dealing with Binance, 94% of the testimonials are positive, 6% are neutral and there are 0 negative ones. Feel free to read as many of these as you like!

Online trading and investing has been my main source of income for a while. All you need is the right exchange and Binance is just the one!

I trade some tokens and rare coins here. It's all good and exchange is very trusted, definitely a great choice!

Nice user interface, many coins supported and you can withdraw up to 2 BTC daily without KYC. Nice!

It was always a great experience, very friendly and fast support as well. Use it for like two years and it was being #1 crypto experience for me forever !

Best trading platform ever!! Limits are also very good even when no KYC

A very good exchange with an excellent customer service. Really a lot of various cryptocurrency supported! Tokens too. I also hope they add USD bank tranfers and like, now you only can buy crypto with a card and the price is now very attractive. Other than that everything is super good

Very good if you want to especulate. Like buy low, sell high. Not the other way )) Many tools, margin trading, etc etc. I like it! ✌

Trade alts here all the time. I used polo before and sometimes bittrex, but now binance is my fav! What else can I say?

One of the best alt coin exchanges, period. But sometimes support works very slow. This is my only complain, everything else is great

My favourite exchange when I want to trade some cryptocurrencies and earn money (hopefully 👌😅👍) buying low, selling high. It supports HUGE number of cryptocurrencies and the liquidity is very good. It's not very good for instant conversions (say you hold some LTC and want to get ETH instead), brokers do such exchanges better. But for trading, it's definitely my choice! ⭐⭐⭐⭐⭐

Overall result if great! 100% positive testimonials is something the business owners are very proud of, such a rating is hard to get and even harder to maintain! It means the community really trusts and likes the Binance services, so most likely, you'd enjoy it too!

FAQ about Binance

Does Binance holds my funds?

Yes, it does. Although you can always withdraw the funds to your e-currency wallet "by default" Binance holds your balance at it's own hot storage wallet. This is the standard practice for all the trading platforms, although we recommend to keep only the funds you need for the trading at the exchange.

Is Binance a good trading platform?

According to our rating and the clients' testimonials, it is! Feel free to get acquainted with the details reading this review or just jump to the conclusion!

Is Binance licensed? Does it hold e-money license?

Although Binance Europe Services (registered name of company operating Binance exchange) holds no special licenses, it fully complies with the regulation in Malta; no license is required there to run such a business.

Does Binance provide the mobile wallet apps?

It does! There are a mobile apps for popular mobile platforms available.

Does Binance provide a debit card (ATM card)?

Yes, Binance provides such a card, you can get one if you are residing in any of the supported countries.

Does Binance issue redeemable cash codes?

It does. All the users of trading platform may issue/redeem such codes and send/receive such ones from/to others. It works like the prepaid gift cards, e-vouchers, etc.

Does Binance have any features like lending, deposits with interest, etc.?

It does! Feel free to check the exchange website to know the details.

Does Binance provides Margin Trading?

It does. Margin trading is possible at Binance; if you wish to, you may trade with leverage here!

Is Binance a ripoff?

It definitely isn't! Feel free to read the whole this review to understand why or check our conclusion: is Binance legit or scam.

Binance vs other exchanges

Let's compare binance.com to other similar exchange services with more or less the same features: others of trading platform type mostly. Besides, seems reasonable to compare the platform with the exchanges having similar rating and serving (mostly) the same geographic, etc. Remember that if you wish to find the exchange offering the best price to buy/sell Bitcoin and 50 other cryptos, check the best rates to buy bitcoin and crypto in United States!

Binance vs CEX

Let's compare the key features of these two platforms to see which one suits you best:

- CEX is a trading platform Binance is a trading platform, both are using the same business model.

- CEX had started the business July 2014 Binance started the business April 2017 (cex.io is working for 2 years and 9 months longer time).

- cex.io has all the required business licenses and permissions Binance has all the required business licenses and permissions (both exchange services operate using the same approach to the business, utilizing a same legal model).

- Besides buying, selling and exchanging cryptocurrencies, cex.io provides the following extra services: Lending, Margin Trading, Faucets (small amounts of cryptos for free) and the Staking, MasterNodes, etc. (passive income opportunity) Binance provides more exchange-related services: it allows us to purchase and sell digital currencies, swap cryptocoins and tokens, and besides that: Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace and the NFT Marketplace.

- CEX supports 29 cryptocurrencies and tokens Binance allows to swap 42 cryptos (Binance additionally works with 13 added cryptocurrencies/tokens).

- 3 fiat currencies are available on cex.io website You'll be able to use 45 national currencies to swap with digital ones at Binance (Binance supports 42 fiat currencies more).

- CEX accepts deposits from and allows withdrawals to 8 fiat payment systems / banks Binance allows the user to utilize 9 various fiat payment systems and/or banks (Binance supports 1 fiat payment systems and banks more).

- CEX charges 0.3% — 3.99% fee Binance charges the client 0.1% — 4.0% fee, depending on the currency, payment system, etc. (Binance has higher fees, generally).

- Buying limits at CEX start from $20.00 and are up to $10,000 Deposit/withdraw limits at Binance are $15.00 — $15,000 depending on the payment method (Binance has higher buying/selling limits).

- CEX allows registrations from 224 countries; United States is among the supported ones You may register at Binance if you reside in one of 250 countries; unfortunately, United States is not among the supported ones (Binance supports more countries worldwide).

- Our visitors rated customer care at the CEX 4.55 / 5.0 Customers' service at Binance exchange was rated 5.0 / 5.0 by our visitors (Binance support team got better rating from our customers

- During the account verification CEX usually asks for 3 documents and/or procedures (id verification, phone confirmation, selfie) and it takes up to 5 minutes in most of the cases User identification at Binance usually consists of 1 procedure: selfie and the process usually takes up to 5 minutes (Binance's KYC, AML, etc programs and policies permit a user to finish fewer procedures, to share reduced personal information).

- Due to results of community feedback, CEX process deposit/withdrawal orders in about in couple of minutes (although the exchange is instant) Due to results of community feedback, Binance process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated (Binance processes deposits and withdrawals faster

- Our users left 27 testimonials about CEX, 100% of which are positive We've collected 18 users testimonials about Binance, 94% are positive (Binance & CEX was rated lower by the community).

Although the final decision, which exchange — CEX or Binance — is better is up to you, we'll try to help you with the decision. Both exchanges are great, since both exchanges are equally rated, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

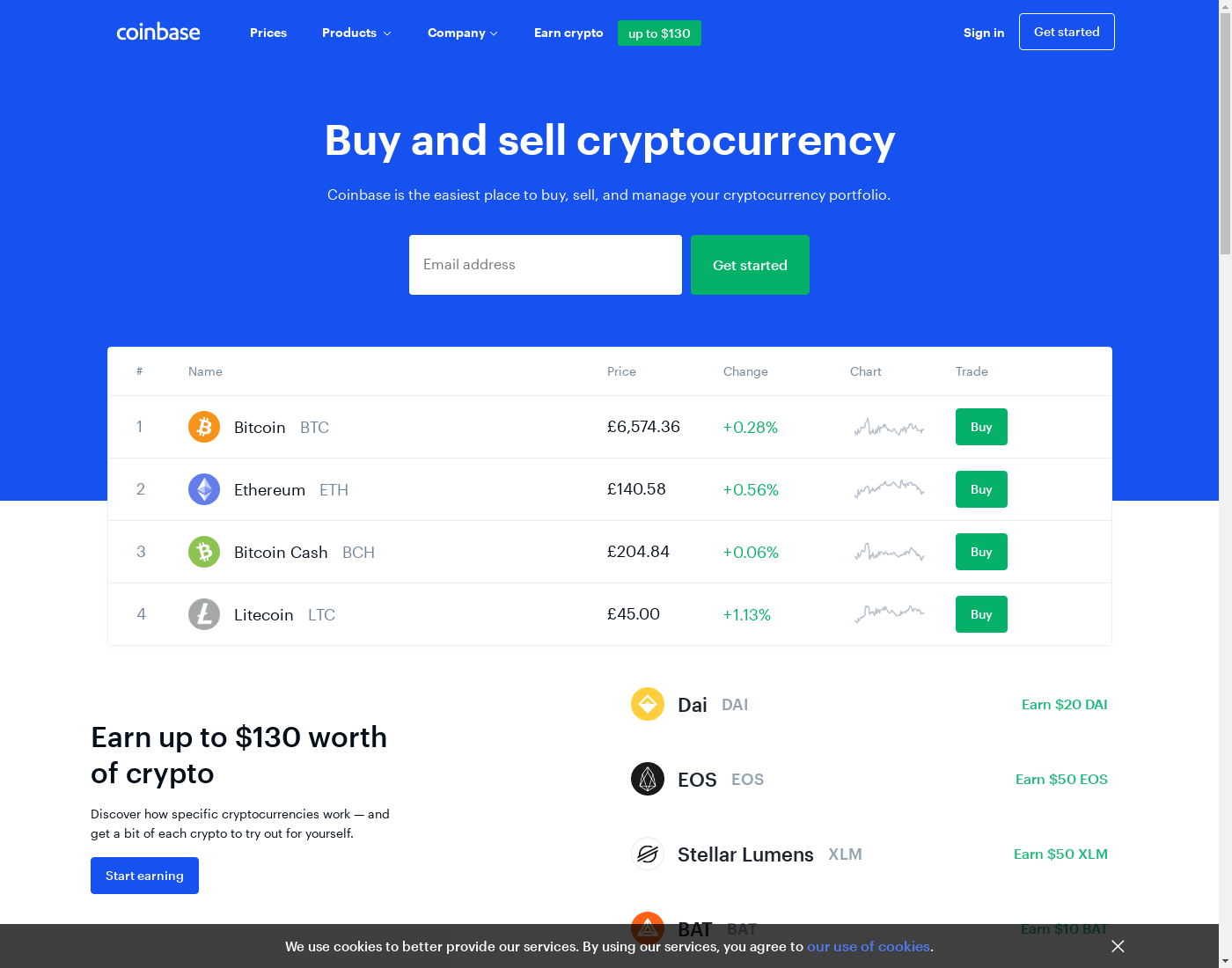

Binance vs Coinbase

Let's compare the key features of these two platforms to see which one suits you best:

- Coinbase is a e-wallet Binance is a trading platform, it has a different business model (feel free to read about the differences between e-wallet and trading platform)

- Coinbase had started the business June 2012 Binance started the business April 2017 (coinbase.com is working for 4 years and 10 months longer time).

- coinbase.com has all the required business licenses and permissions Binance has all the required business licenses and permissions (both exchange services operate using the same approach to the business, utilizing a same legal model).

- Besides buying and selling cryptocurrencies, coinbase.com provides the following extra services: ATM Cards, Merchant Services and the Staking, MasterNodes, etc. (passive income opportunity) Binance provides more exchange-related services: it allows us to purchase and sell digital currencies, swap cryptocoins and tokens, and besides that: Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace and the NFT Marketplace.

- Coinbase supports 21 cryptocurrencies and tokens Binance allows to swap 42 cryptos (Binance additionally works with 21 added cryptocurrencies/tokens).

- 6 fiat currencies are available on coinbase.com website You'll be able to use 45 national currencies to swap with digital ones at Binance (Binance supports 39 fiat currencies more).

- Coinbase accepts deposits from and allows withdrawals to 8 fiat payment systems / banks Binance allows the user to utilize 9 various fiat payment systems and/or banks (Binance supports 1 fiat payment systems and banks more).

- Coinbase charges 1.0% — 3.99% fee Binance charges the client 0.1% — 4.0% fee, depending on the currency, payment system, etc. (Binance & Coinbase charge the customer with the equal fee level, more or less).

- Coinbase gives the gifts to the customers Binance has neither gifts or cashback available (Binance & Coinbase both provide the same bonuses for customers).

- Buying limits at Coinbase start from $2.00 and are up to $5,000 Deposit/withdraw limits at Binance are $15.00 — $15,000 depending on the payment method (Binance has higher buying/selling limits).

- Coinbase allows registrations from 39 countries; United States is among the supported ones You may register at Binance if you reside in one of 250 countries; unfortunately, United States is not among the supported ones (Binance supports more countries worldwide).

- During the account verification Coinbase usually asks for 2 documents and/or procedures (id verification, phone confirmation) and it takes up to 5 minutes in most of the cases User identification at Binance usually consists of 1 procedure: selfie and the process usually takes up to 5 minutes (Binance's KYC, AML, etc programs and policies permit a user to finish fewer procedures, to share reduced personal information).

- Due to results of community feedback, Coinbase process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated Due to results of community feedback, Binance process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated (Binance & Coinbase process the deposits and withdrawals with equal speed).

- Our users left 25 testimonials about Coinbase, 96% of which are positive We've collected 18 users testimonials about Binance, 94% are positive (Binance & Coinbase was rated lower by the community).

Although the final decision, which exchange — Coinbase or Binance — is better is up to you, we'll try to help you with the decision. Both exchanges are great, since both exchanges are equally rated, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

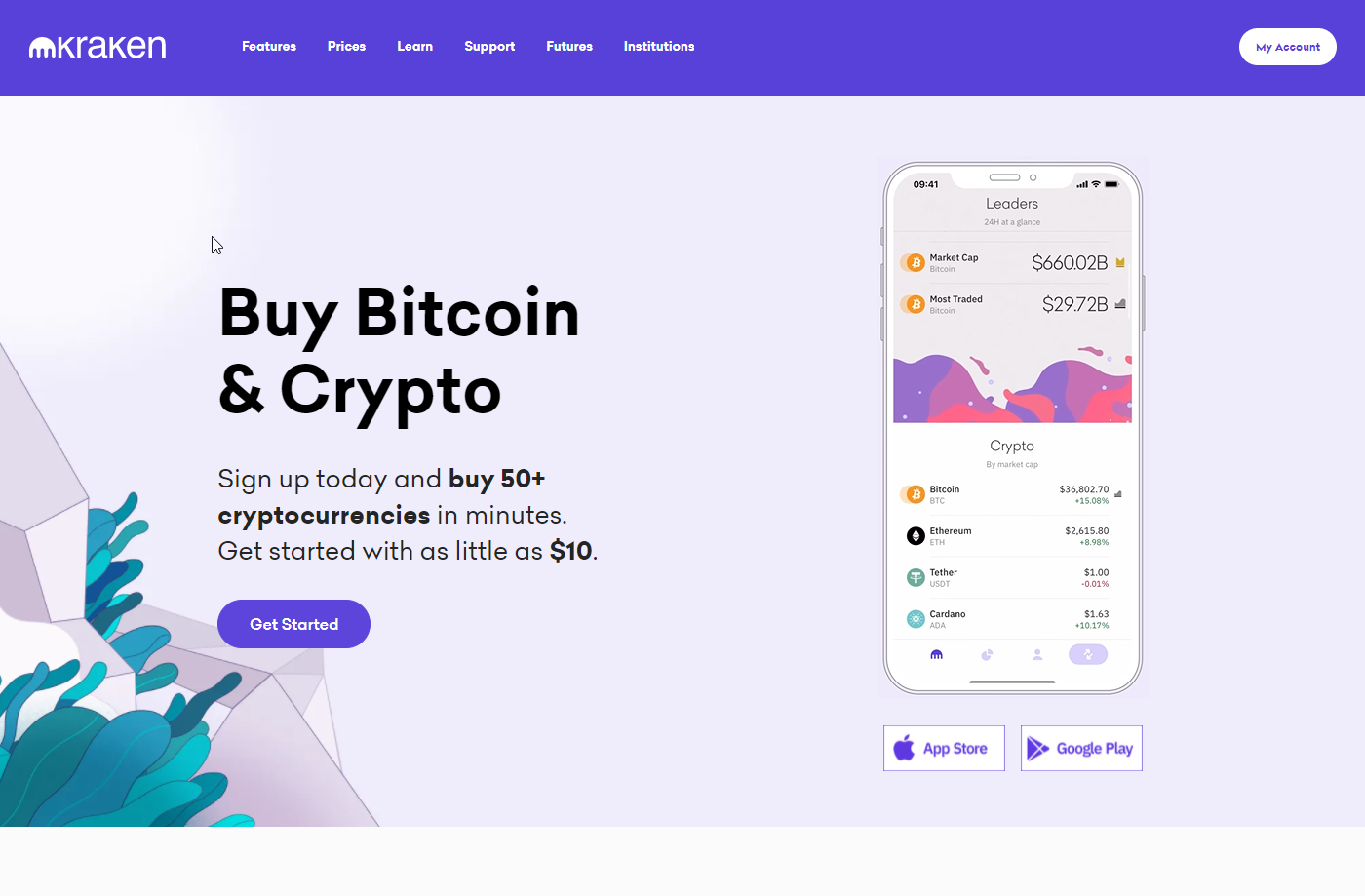

Binance vs Kraken

Let's compare the key features of these two platforms to see which one suits you best:

- Kraken is a trading platform Binance is a trading platform, both are using the same business model.

- Kraken had started the business July 2011 Binance started the business April 2017 (kraken.com is working for 5 years and 8 months longer time).

- kraken.com has all the required business licenses and permissions Binance has all the required business licenses and permissions (both exchange services operate using the same approach to the business, utilizing a same legal model).

- Besides buying, selling and exchanging cryptocurrencies, kraken.com provides the following extra services: Mobile wallet, OTC trading, Margin Trading, Futures Trading and the Staking, MasterNodes, etc. (passive income opportunity) Binance provides more exchange-related services: it allows us to purchase and sell digital currencies, swap cryptocoins and tokens, and besides that: Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace and the NFT Marketplace.

- Kraken supports 34 cryptocurrencies and tokens Binance allows to swap 42 cryptos (Binance additionally works with 8 added cryptocurrencies/tokens).

- 7 fiat currencies are available on kraken.com website You'll be able to use 45 national currencies to swap with digital ones at Binance (Binance supports 38 fiat currencies more).

- Kraken accepts deposits from and allows withdrawals to 10 fiat payment systems / banks Binance allows the user to utilize 9 various fiat payment systems and/or banks (Binance supports 1 banks and fiat payment systems less).

- Kraken charges 0.25% — 3.75% fee Binance charges the client 0.1% — 4.0% fee, depending on the currency, payment system, etc. (Binance has higher fees, generally).

- Buying limits at Kraken start from $14.58 and are up to $365 Deposit/withdraw limits at Binance are $15.00 — $15,000 depending on the payment method (Binance has lower buying/selling limits).

- Kraken allows registrations from 234 countries; United States is among the supported ones You may register at Binance if you reside in one of 250 countries; unfortunately, United States is not among the supported ones (Binance supports more countries worldwide).

- Our visitors rated customer care at the Kraken 5.0 / 5.0 Customers' service at Binance exchange was rated 5.0 / 5.0 by our visitors (Binance & Kraken provide the equal quality of customer support).

- During the account verification Kraken usually asks for 2 documents and/or procedures (id verification, address confirmation) and it takes up to 5 minutes in most of the cases User identification at Binance usually consists of 1 procedure: selfie and the process usually takes up to 5 minutes (Binance's KYC, AML, etc programs and policies permit a user to finish fewer procedures, to share reduced personal information).

- Due to results of community feedback, Kraken process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated Due to results of community feedback, Binance process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated (Binance & Kraken process the deposits and withdrawals with equal speed).

- Our users left 3 testimonials about Kraken, 100% of which are positive We've collected 18 users testimonials about Binance, 94% are positive (Binance & Kraken was rated lower by the community).

Although the final decision, which exchange — Kraken or Binance — is better is up to you, we'll try to help you with the decision. Both exchanges are great, since both exchanges are equally rated, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

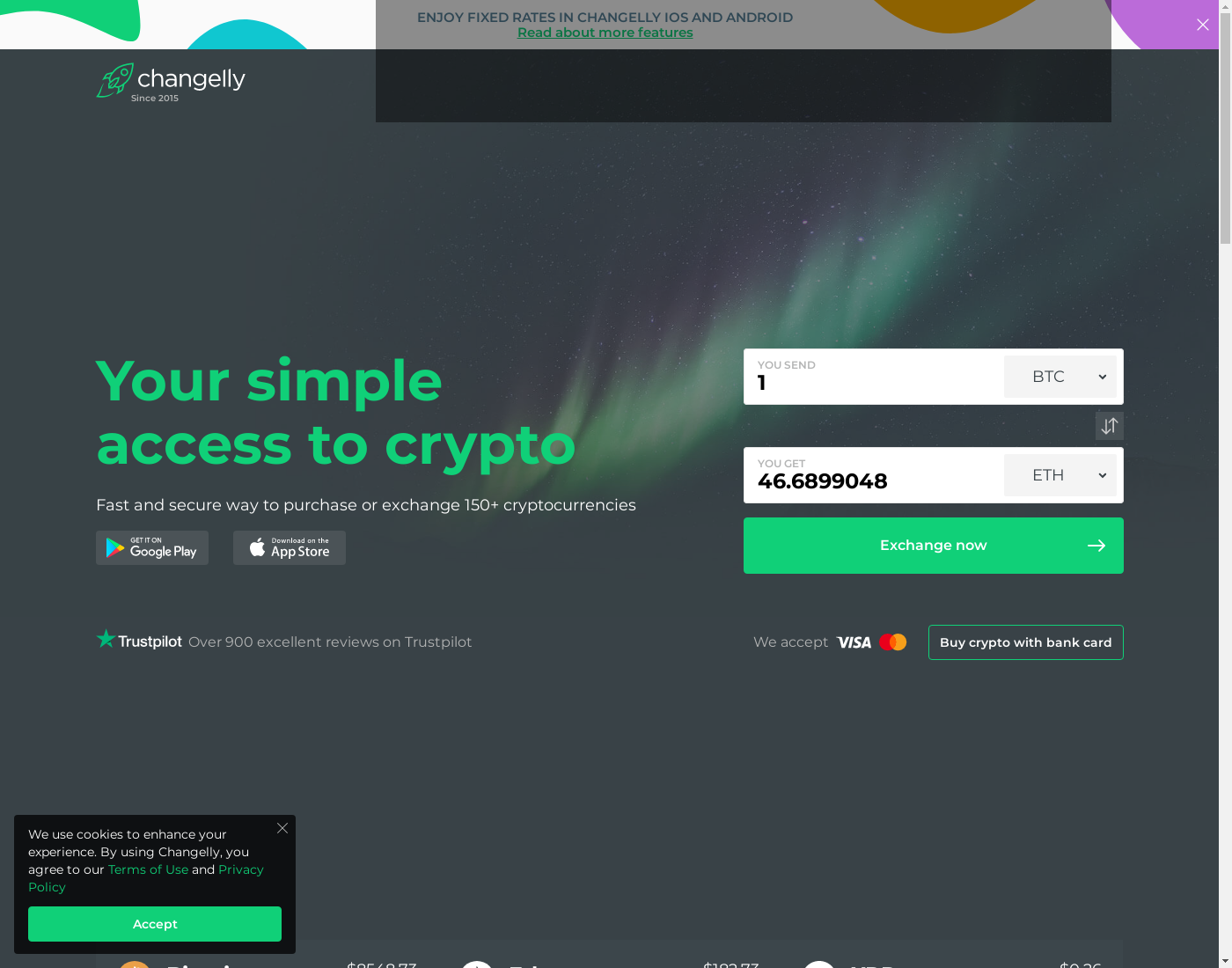

Binance vs Changelly

Let's compare the key features of these two platforms to see which one suits you best:

- Changelly is a broker Binance is a trading platform, it has a different business model (feel free to read about the differences between broker and trading platform)

- Changelly had started the business December 2013 Binance started the business April 2017 (changelly.com is working for 3 years and 4 months longer time).

- Changelly is an ordinary company without licenses, etc. Binance has all the required business licenses and permissions (Binance utilizes a safer and more stable business model).

- Besides buying, selling and exchanging cryptocurrencies, Changelly provides no extra services Binance provides more exchange-related services: it allows us to purchase and sell digital currencies, swap cryptocoins and tokens, and besides that: Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace and the NFT Marketplace.

- Changelly supports 43 cryptocurrencies and tokens Binance allows to swap 42 cryptos (Binance works with one cryptocurrency less).

- 34 fiat currencies are available on changelly.com website You'll be able to use 45 national currencies to swap with digital ones at Binance (Binance supports 11 fiat currencies more).

- Changelly accepts deposits from and allows withdrawals to 1 fiat payment systems / banks Binance allows the user to utilize 9 various fiat payment systems and/or banks (Binance supports 8 fiat payment systems and banks more).

- Changelly charges 7.25% fee Binance charges the client 0.1% — 4.0% fee, depending on the currency, payment system, etc. (Binance & Changelly charge the customer with the equal fee level, more or less).

- Buying limits at Changelly start from $30.00 and are up to $12,000 Deposit/withdraw limits at Binance are $15.00 — $15,000 depending on the payment method (Binance has lower buying/selling limits).

- Changelly allows registrations from 242 countries; we are sorry, but United States is not supported this time You may register at Binance if you reside in one of 250 countries; unfortunately, United States is not among the supported ones (Binance supports more countries worldwide).

- Our visitors rated customer care at the Changelly 5.0 / 5.0 Customers' service at Binance exchange was rated 5.0 / 5.0 by our visitors (Binance & Changelly provide the equal quality of customer support).

- During the account verification Changelly usually asks for 2 documents and/or procedures (id verification, address confirmation) User identification at Binance usually consists of 1 procedure: selfie and the process usually takes up to 5 minutes (While Changelly agrees on certain exceptions granting no verification for specific orders, Binance follows the stricter rules and sets more restrictions).

- Due to results of community feedback, Changelly process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated Due to results of community feedback, Binance process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated (Binance & Changelly process the deposits and withdrawals with equal speed).

- Our users left 17 testimonials about Changelly, 94% of which are positive We've collected 18 users testimonials about Binance, 94% are positive (Binance has better testimonials from the clients).

Although the final decision, which exchange — Changelly or Binance — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although Binance has a better total rating 100 vs Changelly's 84, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

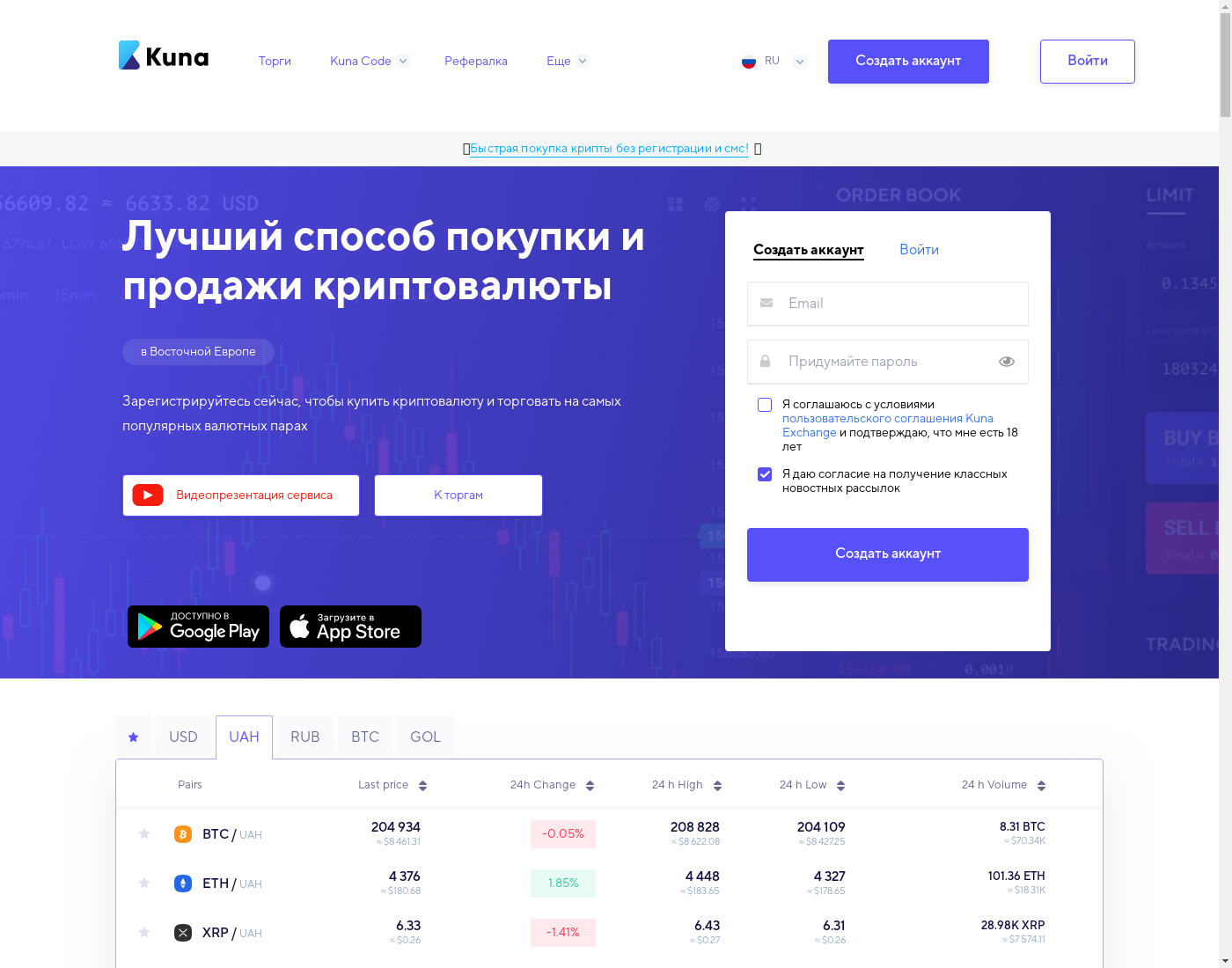

Binance vs Kuna

Let's compare the key features of these two platforms to see which one suits you best:

- Kuna is a trading platform Binance is a trading platform, both are using the same business model.

- Kuna had started the business January 2016 Binance started the business April 2017 (kuna.io is working for 1 years and 3 months longer time).

- Kuna is an ordinary company without licenses, etc. Binance has all the required business licenses and permissions (Binance utilizes a safer and more stable business model).

- Besides buying and selling cryptocurrencies, kuna.io provides the following extra services: Cash codes Binance provides more exchange-related services: it allows us to purchase and sell digital currencies, swap cryptocoins and tokens, and besides that: Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace and the NFT Marketplace.

- Kuna supports 1 cryptocurrency Binance allows to swap 42 cryptos (Binance additionally works with 41 added cryptocurrencies/tokens).

- 3 fiat currencies are available on kuna.io website You'll be able to use 45 national currencies to swap with digital ones at Binance (Binance supports 42 fiat currencies more).

- Kuna accepts deposits from and allows withdrawals to 7 fiat payment systems / banks Binance allows the user to utilize 9 various fiat payment systems and/or banks (Binance supports 2 fiat payment systems and banks more).

- Kuna charges 1.0% — 3.0% fee Binance charges the client 0.1% — 4.0% fee, depending on the currency, payment system, etc. (Binance has higher fees, generally).

- Buying limits at Kuna start from $1.00 and are up to $10,000 Deposit/withdraw limits at Binance are $15.00 — $15,000 depending on the payment method (Binance has higher buying/selling limits).

- Kuna allows registrations from 251 countries; we are sorry, but United States is not supported this time You may register at Binance if you reside in one of 250 countries; unfortunately, United States is not among the supported ones (Binance supports less countries).

- Our visitors rated customer care at the Kuna 5.0 / 5.0 Customers' service at Binance exchange was rated 5.0 / 5.0 by our visitors (Binance & Kuna provide the equal quality of customer support).

- Kuna allows the user to be anonymous, there is no account verification, etc. User identification at Binance usually consists of 1 procedure: selfie and the process usually takes up to 5 minutes (Unlike kuna.io that agrees to serve anonyms, Binance abides certain KYC, AML/CTF policies, there's an account verification)

- Due to results of community feedback, Kuna process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated Due to results of community feedback, Binance process deposit/withdrawal orders in about a couple of seconds, in fact — instantly, without any delay; everything is automated (Binance & Kuna process the deposits and withdrawals with equal speed).

- Our users left 4 testimonials about Kuna, 100% of which are positive We've collected 18 users testimonials about Binance, 94% are positive (Binance & Kuna was rated lower by the community).

Although the final decision, which exchange — Kuna or Binance — is better is up to you, we'll try to help you with the decision. Both exchanges are great, although Binance has a better total rating 100 vs Kuna's 84, we recommend you look at the list above and decide, what is most important for you!

If you feel like need more comparison versus other exchanges, feel free to check these:

Conclusion: is Binance legit or scam?

Now it's time to draw a conclusion, is binance.com a scam or is it a legit exchange? We are 100% sure Binance is the most trusted and absolutely legit exchange platform with an outstanding reputation in the crypto community; one of the industry leaders. There is no way it can be even considered to be called a scam! Let's summarize what we like most (and what we don't) about the Binance:

- It is licensed, regulatory compliant financial company

- The trading platform holds users' funds

- This company has being in the business for a long time; exchange was started 7 years and 5 months ago

- Exchange supports 42 cryptocurrencies and 45 fiat ones (totally 9 payment systems / banks are available). Besides buying, selling and exchanging digital currencies, the following services are available: Mobile wallet, ATM Cards, Cash codes, Lending, Margin Trading, Futures Trading, Staking, MasterNodes, etc. (passive income opportunity), P2P Marketplace and NFT Marketplace

- It charges rather low fees: from 0.1% to 4.0% depending on the payment method; although the exchange of smaller amounts is rather inexpensive

- The purchase and withdrawal limits are among the highest: from $15.00 to $15,000 USD, it depends on a payment system choice

- Binance accepts the clients from 250 countries; unfortunately, users from United States are not permitted to use the service

- Clients' testimonials are perfect, 100% (18 out of 18) note their positive experience dealing with Binance. According to the customers feedback:

- Customer support is great

- Deposits and withdrawals are instant

- Verification is really fast

Besides the exchange, a dedicated mobile wallet (Trust Wallet) and lending ("hodl and earn", sort of savings account with annual interest paid in crypto), Binance provides a large number of services and does a lot more than just an exchange. Academy, Labs, Launchpad, Research... just to name a few. Binance is a whole ecosystem and it's not a surprise that it has its own token: Binance Coin (BNB).

As well as many major bitcoin exchanges, Binance once experienced a major hack: 7th May 2019, 7000 BTC was stolen from the exchange's hot wallets. Although unlike many other major exchanges suffered from such hacks, Binance covered all the loses by its emergency fund (so-called SAFU) and customers never a satoshi. Binance is a serious business for sure! And a nice place to trade cryptocurrencies...

Last but not least, according to our rating and the feedback from the Binance clientele, we consider it as "The third best Trading Platform worldwide!" That means the platform really stands out from the 333 exchange services we monitor; our ranking algorithms and the input we got from the actual exchange customers confirm that. With all the features and positive reviews, it's obvious why Binance has been so successful for 7+ years and we invite you to check out by yourself!